4 Mental Health Stocks Got My Mind Made Up

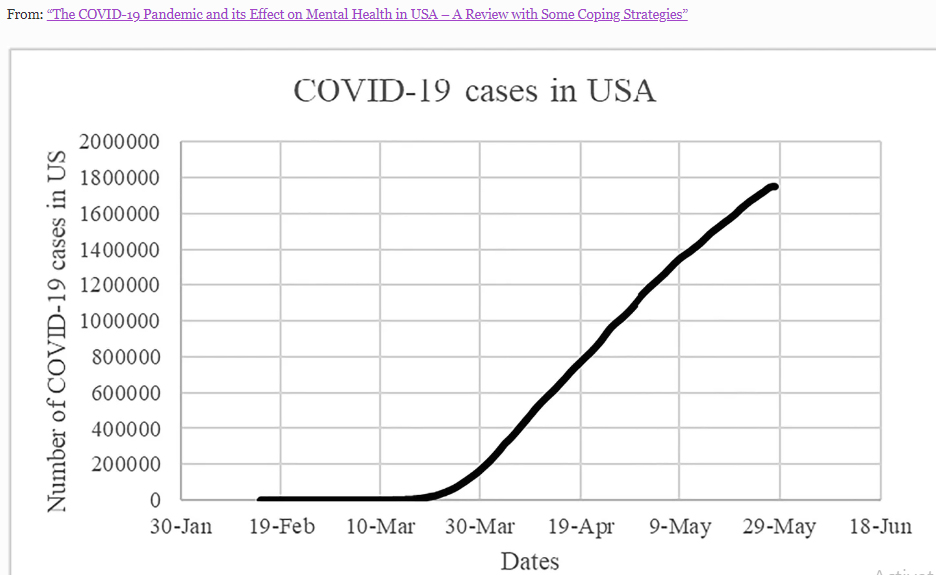

As per the WHO, nations need to substantially increase investments in mental health services or face an upsurge of mental-health-related complications. To get a sense of how rapidly mental health cases multiplied after recent events, check the data mined by Springer (image below). What’s depressing is that the data are up to May 2020. The situation may have worsened since.

Image Source: Springer

Recent data suggests that our younger generation (ages 18-44) is the worst impacted by mental health issues. There’s little doubt that nations will soon start addressing the mental health issue on a war footing.

I’ve drawn up a list of 4 track-worthy biotech companies that help promote mental health. These are not buying recommendations – these are stocks that you can consider tracking. Here’s the list:

1. Intra-Cellular Therapies (ITCI)

Price: $24.46, Market Cap: $1.96B

ITCI currently manufactures Caplyta (lumateperone), a drug used in the treatment of schizophrenia. It won FDA’s approval in December 2019, but its marketing efforts were stalled by COVID-19.

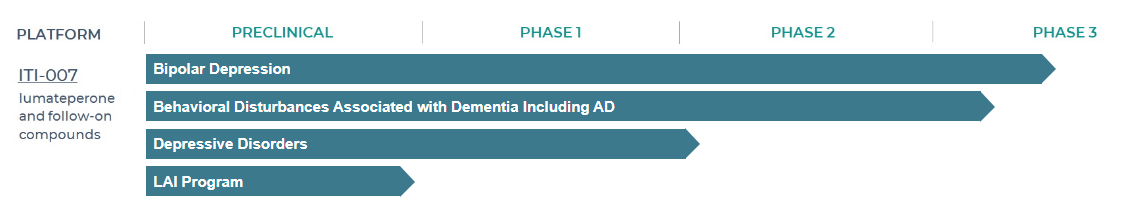

The company is currently developing (pipeline) the following drugs:

(a) ITI-007, which helps treat bipolar depression, behavioral disturbances associated with ADHD or dementia, and depressive disorders.

Image Source: The ITCI Website

(b) PDE Inhibitors that help treat Parkinson’s disease and heart conditions.

As the company’s marketing has not started, analyzing its financials won’t make sense now. Investors can track the progress of Caplyta and other pipeline drugs. Investors are chasing this stock, which is why it is currently quoting at an unattractive high Forward Price-to-Sales multiple of 89.72.

2. Acadia Healthcare (ACHC)

Price: $38.29, Market Cap: $3.43B

ACHC helps treat behavioral health conditions and addiction issues in its facilities in the U.S. and U.K. The company reports positive operating profits and cash flows every quarter. However, its trade receivables work up to about 40%+ of sales per quarter, which is steep. An analyst has opined that the company books all billables as income and then writes off the amount that’s not paid by insurers. However, despite this accounting practice, the company has reported a healthy Levered FCF TTM Margin of 7.27% and Cash from Operations of $591.6 million as of Q3 2020.

Notes:

(a) In 2019, ACHC overbilled Medicaid and had to pay $17 million to settle accusations of fraud.

(b) The stock has appreciated from $12.6 in March 2020 to $36.54 as of November 5, 2020.

2. Supernus Pharmaceuticals (SUPN)

Price: $23.58, Market Cap: $1.2B

SUPN is focused on developing and marketing drugs used in the treatment of CNS (Central Nervous System) diseases. Its commercialized drugs are used in the treatment of partial-onset seizures, migraines, Parkinson’s disease, cervical dystonia, and chronic sialorrhea. Its psychiatry drug pipeline includes SPN-812 (for treating hyperactivity/inattention) and SPN-820 (for treating depression).

On November 3, 2020, SUPN announced terrific Q3 2020 results, which beat revenue estimates by $24.38 million and EPS estimates by $0.47. The stock is available at an attractive Forward Price-To-Earnings (GAAP) ratio of 12.85 as compared to the sector median of 30.82, and a low Forward Price-To-Sales ratio of 1.93 as compared to the sector median of 6.55 (as of November 3, 2020). The company reports positive operating cash flows consistently and has the makings of a winner

4. GW Pharmaceuticals (GWPH)

Price: $114.64, Market Cap: $3.43B

GWPH researches and makes therapeutics out of cannabinoid molecules. Its drugs are used in the treatment of epilepsy, autism, and schizophrenia. The global cannabis pharmaceutical market size is estimated to grow at a phenomenal CAGR of 76.8% between 2020 and 2027 mainly because these drugs focus on value-based outcomes rather than perception-based outcomes.

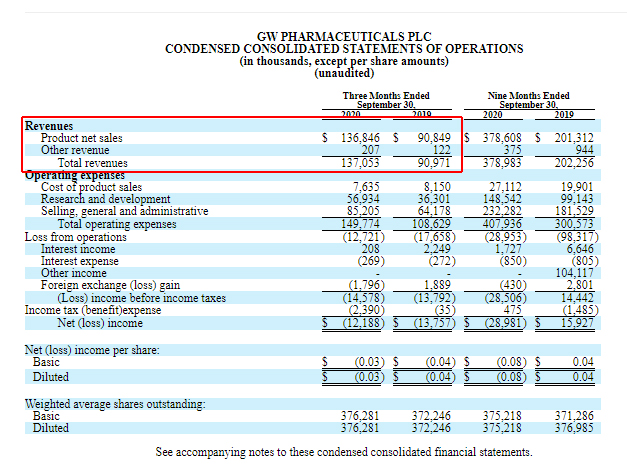

The company reported a 50+% jump in sales in Q3 2020 along with a robust gross profit margin of 94.5% on a year over year basis.

Image Source: GWPH’s SEC Filing

Though GWPH has solid potential in the long run, I believe that its near term growth is priced in and investors need to watch out for triggers that will help boost the company’s revenues. The company has recently launched phase 3 trials of nabiximols (Sativex outside the U.S.), which is meant to be used in the treatment of spasticity in Multiple Sclerosis. Investors can track this bit along with other pipeline-related news.

The stock has delivered −18.26% price growth year over year, and investors can consider buying it on dips.

Summing Up

I believe that mental health biotech and services stocks will do well in the long run and reward their investors. Also, I’ve just fished out 4 stocks – there are many others including big pharma companies that are focused on mental health. Investors can use this post as a starting point for their research, and draw up a bigger list. Drop some off in the comments section.

Disclosure: I have no position in the stocks discussed, and neither do I plan to buy/sell it in the next 72 hours. I researched and wrote this article. I am not being compensated for it (other ...

more