4 Likely Biotech Takeover Targets To Buy

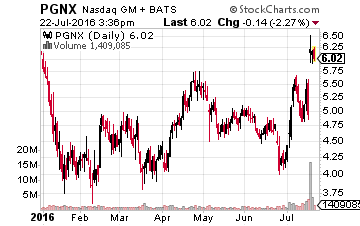

It was a good week for the Biotech Gems portfolio. Progenics Pharmaceuticals (NASDAQ: PGNX) leapt 25% in trading Wednesday after announcing that the oral version of relistor had been approved by the FDA. Then on Thursday, another small cap in the 20 stock portfolio, Relypsa (NASDAQ: RLYP), broke news before the bell that it was being acquired by Swiss based Galencia for $32 a share in cash which represented a 60% premium to where the stock closed at on Wednesday and a 75% total gain from when I first recommended the stock.

My view is that M&A within biotech and biopharma will pick up in the second half of 2016 as major pharma and biotech concerns leverage low interest rates and their cash flow to replenish pipelines. So, what are some my favorite possible buyout targets in the space right now? Here is a short list.

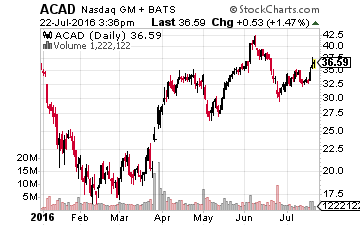

Let’s start with the most logical mid-cap biotech stock other than Medivation (NASDAQ: MDVN), which is already in the midst of trying to fend off a bid from French drug maker Sanofi (NYSE:SNY). That is Acadia Pharmaceuticals (NASDAQ: ACAD).

This stock is already up 80% this year but still could fetch a significant premium. The company currently has a market capitalization of around $4 billion.

The shares’ rally has been powered by the approval of Nuplazid. This is the first approved treatment for the psychosis seen in many Parkinson’s patients. It has billion dollar annual sales potential just for that one approved indication, but Nuplazid is also in mid-stage trials for treating psychosis found in Alzheimers patients as well as individuals that have Schizophrenia. Success here could boost peak revenue potential dramatically.

This is Acadia’s first commercial success and it is building up its salesforce as it rolls out Nuplazid. It has plenty of cash on the balance sheet to do so, but being acquired by a larger player with an established sales force in the neurology space would make strategic sense. Biogen (NASDAQ: BIIB) makes the most sense as a potential suitor. It certainly has the financial flexibility to make this purchase work. It is spinning out its hemophilia business that could be worth $5 billion to $7 billion. The company also recently laid off more than 10% of its workforce and shut down failed trials in areas such as Lupus. Biogen has said it wants to expand its offerings targeting neurological diseases and picking up Acadia could boost its growth prospects in that area.

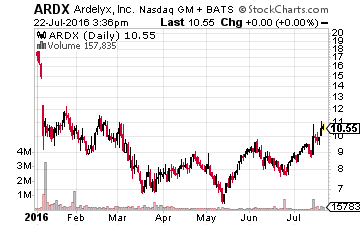

Next up is Ardelyx (NASDAQ: ARDX) which has also seen a nice run up recently. Hyperkalemia concern ZS Pharma (NASDAQ: ZSPH) was snatched up for $2.7 billion in November of last year by AstraZeneca (NYSE: AZN).

Hyperkalemia play Relypsa was acquired this week. Seems that there is a trend here.

Ardelyx has a mid-stage compound aimed at treating hyperkalemia as well as two other late stage compounds. If trials go well it could file up to three separate New Drug Applications (NDAs) by the end of 2017. The company just raised $110 million in a private placement so has funding in place to take all three drugs to approval stage and beyond. Sanofi, which lost out on ZS Pharma and was reportedly interested at one time in Relypsa, would be one possible suitor especially given Ardelyx’s small market capitalization of under $400 million. Actelion is in the same boat as a spurned bidder for ZS Pharma.

The before mentioned Progenics is a more attractive takeout candidate as oral relistor approval triggers a series of positives. First, it should more than triple the amount of revenues coming from the relistor franchise. Approval also triggered a $50 million milestone payment from distribution and marketing partner Valeant Pharmaceuticals (NASDAQ: VRX).

Sales from relistor will also accelerate the timeline of Progenics earning up to $200 million in additional sales milestone in addition to the 15% to 19% of sales it gets in royalties. The first $10 million sales milestone can be earned for overall relistor sales of $100 million in a calendar year which seems a 50/50 possibility in 2016 thanks to oral relistor being approved.

A buyout would be complicated by Progenics’ deal with Valeant. However, given Valeant needs to sell off some assets to pay down its immense $30 billion in debt, a two-step process where a larger player such as Allergan (NYSE: AGN) who has stated interest in expanding its footprint in the gastrointestinal space first buys the rights to relistor from Valeant. Then, they could step in and buy Progenics all together to eliminate the obligation to pay royalties and milestones and to acquire a nice pipeline as well seems. With a market capitalization of $400 million and cash on hand of over $100 million, Progenics is still woefully undervalued despite the nice run up this week.

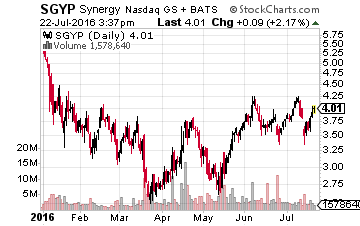

For a more straightforward transaction in the GI space, Synergy Pharmaceuticals (NASDAQ: SGYP) fits the bill. Its compound plecanatide should be approved for both chronic idiopathic constipation and constipation-predominant irritable bowel syndrome (IBS-C) by the end of the first half of the year. It has plenty of cash on hand after a recent secondary offering and with a market capitalization of $600 million it would make a bite sized acquisition for someone.

That is a short list of some biotech stocks that seem undervalued and make logical acquisition targets in the near future. Hopefully, one of them will provide some of that Relypsa magic before the end of the year.

Disclosure: Positions: Long ...

more