4 Bank Stocks With Dividend Hikes This Week To Keep On Your Radar

Image: Shutterstock

Key Takeaways

- Bank7 boosted its dividend by 12.5% to $0.27 per share, marking the sixth raise in five years.

- Unity Bancorp lifted its payout by 7.1% to $0.15, with sales and earnings growth expected in 2025.

- BayCom raised its dividend by 25% to $0.25 per share, its fourth increase in five years.

After almost two months of impressive performance since mid-June, equity markets have been witnessing volatility in August amid tariff policy implementation and inflationary pressure. With volatility returning to the U.S. stock markets, investors must remain cautious and should avoid making hasty investment decisions.

Amid such a challenging operating backdrop, investors may bet on stocks with a track record of steady and incremental dividend payouts to safeguard their portfolio. This is because dividend-paying stocks have a long history of profitability and a robust business model, which helps them endure market volatility.

Hence, this investment strategy can help investors generate steady returns. Today, we are discussing four small- and mid-cap banks – Bank7 Corp. (BSVN - Free Report), Unity Bancorp, Inc. (UNTY - Free Report), Stock Yards Bancorp, Inc. (SYBT - Free Report), and BayCom Corp (BCML - Free Report) – that all recently announced dividend hikes.

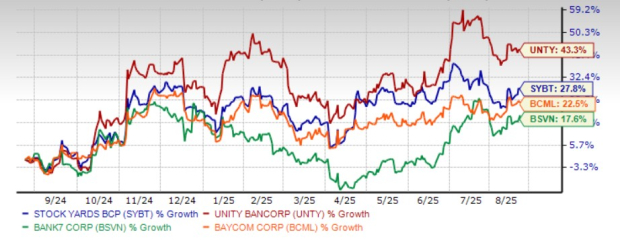

The above-mentioned banks have been increasing quarterly dividends regularly, thus enhancing shareholder value. Additionally, over the past year, these stocks have rallied more than 15%.

Price Performance

Image Source: Zacks Investment Research

4 Bank Stocks to Watch

Presented below is a brief rundown of the previously-mentioned stocks to keep an eye on.

Bank7 Corp.

Bank7 Corp. is a bank holding company that operates through its principal subsidiary, Bank7, which is primarily engaged in providing a broad range of banking and financial services to retail and corporate clients located in Oklahoma, Texas, and Kansas. As of June 30, 2025, it had $1.83 billion in assets.

On Aug. 21, Bank7 Corp. announced a quarterly cash dividend of 27 cents per share, marking an increase of 12.5% from the prior payout. The dividend will be paid out on Oct. 7, 2025 to common stock shareholders of record as of Sept. 19.

The company has increased its dividend six times in the past five years, with an annualized dividend growth rate of 24%. Bank7 Corp. has a forward dividend yield of 2.33% and a dividend payout ratio of 21%.

The Zacks Consensus Estimate for Bank7 Corp.’s 2025 sales indicates a year-over-year decline of 2.4%, while the estimate for earnings suggests a 13.4% decrease. This Zacks Rank #2 (Buy) rated company has a market cap of $462.1 million.

Unity Bancorp

Unity Bancorp is the bank holding company incorporated in New Jersey, offering a full range of commercial and retail banking services through online banking platforms and a robust branch network across New Jersey and Pennsylvania. As of June 30, 2025, the company had $2.93 billion in assets.

On Aug. 21, Unity Bancorp announced a quarterly cash dividend of 15 cents per share, representing a rise of 7.1% from the prior payout. The dividend will be paid out on Sept. 19, 2025 to shareholders of record as of Sept. 5.

The company has increased its dividend six times in the past five years, with an annualized dividend growth rate of 13%. Unity Bancorp has a forward dividend yield of 1.24% and a dividend payout ratio of 12%.

The Zacks Consensus Estimate for 2025 sales indicates a rise of 16.5% year-over-year, while earnings are expected to grow 20.9%. This Zacks Rank #2 (Buy) rated stock has a market cap of $523.8 million.

Stock Yards Bancorp

Stock Yards Bancorp, headquartered in Louisville, KY, offers various financial services to individuals, corporations, and others in Louisville, Kentucky, Indiana, and Ohio.

On Aug. 20, Stock Yards Bancorp announced a dividend of 32 cents per share, representing a hike of 3.2% from the prior payout. The dividend will be paid out on Oct. 1 to stockholders on record as of Sept. 15.

The company has increased its dividend five times in the past five years, with an annualized dividend growth rate of 3.4%. Stock Yards Bancorp has a forward dividend yield of 1.66% and a dividend payout ratio of 29%.

The Zacks Consensus Estimate for 2025 sales suggests an increase of 11.1% year-over-year, while earnings are expected to jump 17.2%. This Zacks Rank #3 (Hold) rated stock has a market cap of $2.40 billion.

BayCom Corp

BayCom, headquartered in Walnut Creek, CA, operates through its wholly-owned subsidiary, United Business Bank, offering a wide range of financial services primarily to local small and mid-sized businesses, service professionals, and individuals. As of June 30, 2025, the company had $2.62 billion of assets and 34 full-service banking branches across California, Nevada, Washington, New Mexico, and Colorado.

On Aug. 21, BayCom announced a quarterly cash dividend of 25 cents per share on its common stock, representing an increase of 25% from the prior payout. The dividend will be paid out Oct. 9 to shareholders of record as of Sept. 11, 2025.

The company has increased its dividend four times in the past five years, with an annualized dividend growth rate of 48.33%. BayCom Corp has a forward dividend yield of 3.53%. Further, it has a dividend payout ratio of 37%.

The Zacks Consensus Estimate for BayCom’s 2025 sales suggests year-over-year growth of 3.6%, while the estimate for earnings indicates a 5.2% increase. This Zacks Rank #3 (Hold) rated company has a market cap of $331.4 million.

More By This Author:

3 Networking Stocks To Consider From A Flourishing Industry

3 Alternative Energy Stocks To Watch Amid Impacts Of Policy Shift

Short-Term Pain, Long-Term Gain? 4 Quantum Stocks To Watch

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any ...

more