4 Bank Stocks That More Than Doubled In 2021

Image: Bigstock

A recuperating U.S. economy in the post-pandemic era has favored the banking sector so far. Banks such as Signature Bank (SBNY - Free Report), Metropolitan Commercial Bank (MCB - Free Report), Hanmi Financial Corporation (HAFC - Free Report), and PCB Bancorp (PCB - Free Report) could escape the worst on the back of substantial government stimulus, loan-repayment holidays, increasing consumer and business confidence, progress on the vaccination front as well as other federal support programs.

Although continued inflation, disruptions due to Omicron, supply chains, product shortages and labor issues cropped up from time to time, the performance of banks in the United States has remained impressive so far this year. Year to date, the KBW Nasdaq Bank Index has gained 36.9%, while the S&P Banks Select Industry Index has rallied 32.7%. Over the same period, the S&P 500 Index has gained 29.3%.

Like 2020, demand for loans remained soft during the first, second and the third quarter of 2021, while consumer and real estate loan portfolios offered some support. Per the Fed’s latest data, the lending scenario for November was strong in terms of commercial and industrial loans. The real estate, commercial real estate and consumer loan portfolios also offered respite. Continued loan growth in the fourth quarter of 2021 on the back of a growing economy and full-fledged resumption of business activities is expected to drive the banks’ performance.

Banks’ 2021 earnings followed an understandably low-key 2020 as banks had deployed much of last year’s funds to extending loan loss reserves (LLRs) in response to the impact of the COVID-19 pandemic. Nonetheless, owing to the US economy’s road to recovery this year, banks have been able to free up much of those reserves to date. This too played a major role in steering their bottom lines.

This apart, credit and debit card spending propelled the financials for many banks in the third quarter as lenders sought to leverage the recovery in economic conditions by launching card products, flexible payment schemes and various offers.

Record fees were also collected from investment banking. A furor of mergers and acquisitions (M&A) deals with amplified initial public offering (IPO) and private equity activities as well as a fundraising frenzy via special purpose acquisition vehicles and companies (SPACs) certainly added to the banks’ growth trajectory.

Following the nod from the Fed after clearing this year’s stress tests in June, major banks announced robust capital deployments (including dividend hikes and share repurchases) effective third-quarter 2021. This instilled investors’ confidence in the banking industry.

Banks are taking measures to align their businesses with technology by spending substantially on the said area to upgrade and add advanced features plus tap clients accordingly. This is expected to lower costs and improve operating efficiency in the long term.

While near-zero interest rates (the Federal Reserve had reduced benchmark rates to near zero in March 2020) continued to weigh on the net interest margins in 2021, banks’ top lines were boosted by a steeper yield curve. Further, at the last two-day FOMC policy meeting, the Fed signaled that its decision to speed up the pace of winding down the bond-buying program positions it to raise interest rates (probably thrice) in 2022.

Per the latest Summary of Economic Projections, the Fed estimates real GDP growth of 4% for 2022, better than the 3.8% mentioned in September 2021. Also, a PCE inflation rate of 2.6% is projected for next year.

Since banks thrive in a rising rate environment, an increase in interest rates will likely reduce the pressure on banks’ margin as well as support net interest income (NII) growth. A steady fall in the unemployment claims, a solid housing market and soaring consumer confidence are some of the major catalysts for the economy. Moreover, a continued increase in demand for loans and efforts to diversify operations are likely to keep supporting banks’ financial performance in 2022.

The banking system is at least as stable as it was before the pandemic era and much healthier than the post 2008 crisis.

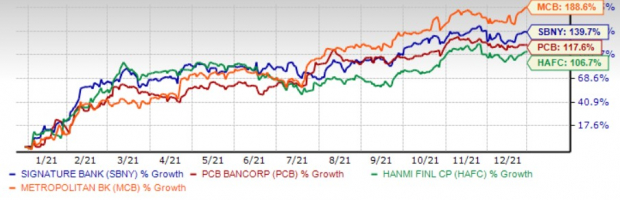

4 Stocks in Focus

One must not miss out on these favorable developments in the banking sector. With the help of the Zacks Stock Screener we shortlisted four bank stocks that have witnessed a price appreciation of 100% or more so far this year. These stocks carry a Zacks Rank of #1 (Strong Buy), 2 (Buy) or 3 (Hold) at present.

Image Source: Zacks Investment Research

PCB Bancorp, formerly known as Pacific City Financial Corporation, is the holding company of the Pacific City Bank. Pacific City Bank is a California state-chartered bank, providing a full spectrum of commercial banking services to small-to-medium-sized businesses, individuals and professionals, primarily in Southern California, and predominantly in the Korean-American and other minority communities.

As of Sept 30, 2021, total net loans and total deposits aggregated to $1.7 million and $1.8 million, respectively. Loans witnessed a CAGR (2016-2020) of 11.3%, while deposits saw a 9.9% rise as of the same time period. With the gradually improving loan commitments and a loan pipeline, PCB’s organic strength is expected to continue, thereby stoking NII growth.

PCB Bancorp maintains cash and cash equivalents of $215 million, and an available borrowing capacity of $606.9 million as of Sep 30, 2021.

On Apr 8, 2021, PCB’s board of directors approved a repurchase program authorizing up to 5% of its outstanding shares to be bought back as of the date of the board meeting, through Sep 7, 2021. As of Sep 30, 2021, the PCB Bancorp bought back and retired 680,269 shares of common stock for $10.9 million under this repurchase plan. For the third quarter of 2021, the company sequentially hiked dividends by 20%, maintaining the same payout for the fourth quarter. PCB is expected to sustain efficient capital deployments with a decent liquidity position and earnings strength.

The Zacks Consensus Estimate for PCB Bancorp's 2021 earnings has improved 6.6% over the past 60 days. PCB has an expected earnings growth rate of 148.1% for the current year. Revenue growth rate for 2021 is expected to be 23.2%. Shares of this currently Zacks Rank #1 stock have soared 117.5% so far this year.

Metropolitan Commercial Bank offers a wide range of banking and innovative financial services, such as personal banking, commercial lending, business banking and global digital payments to businesses and individuals.

Loans and deposits witnessed a CAGR (from Dec 31, 2015 through Sep 30, 2021) of 29% and 41%, respectively. Deposits were up 54.7% from the prior year quarter, while total loans were up 20.5% during the same tenure. Quarter to date loan production stood at $312.9.

Total cash and cash equivalents aggregated to $1.9 billion on Sep 30, 2021, reflecting an increase of $1.1 billion or 141.9%, from the level as of Sep 30, 2020. The rise in cash and cash equivalents underpinned strong growth in deposits as well as the cash received from the issuance of common stock during the third quarter of 2021. As of Sep 30, 2021, secured borrowings stood at $36 million. MCB’s endeavors to efficiently deploy the capital generated from these deposits and an anticipation of a gradual rise in loan demand will likely bolster revenue growth despite lower rates.

Metropolitan Commercial Bank’s strategic priorities are to fortify its position as a leader in the settlement of global and digital payments. Also, it aims to become a domineering financial infrastructure for select fintech’s to access its global payments settlement platform.

The Zacks Consensus Estimate for this presently Zacks Rank #2 stock’s 2021 earnings has improved marginally over the past 30 days. Earnings for the current year are projected to grow 34.3%. 2021 revenue growth is projected to be 24.2%. The bank’s shares have soared 139.6% so far this year.

Hanmi Financial Corporation is the second largest Korean American Bank with $6.6 billion worth of assets. Spanning across 35 branches coast to coast in major banking markets, HAFC remains committed to conservative, disciplined underwriting and a strong asset quality. Its subsidiary Hanmi Bank specializes in real estate, commercial, SBA and trade finance lending out to small and middle-market businesses.

Loans receivable stood at $4.86 billion on Sep 30, 2021. Third-quarter loan production worth $500 million has witnessed 5.5% growth since 2020 end while excluding Paycheck Protection Program (“PPP”) loans. Deposits have climbed to $5.73 billion, up 8.6% since 2020 end. Growth in loans and deposits amid a recovering economy is likely to keep supporting Hanmi Financial Corporation’s financials.

Cash and due from banks aggregated to $824 million as of Sep 30, 2021. Borrowings as of the same date stood at $137.5 million. Given its sound liquidity, HAFC’s capital-deployment activities seem sustainable. Due to its financial stability, Hanmi Bank’s board authorized an increase in the quarterly cash dividend to 20 cents per share for the fourth quarter of 2021, denoting a 67% rise from the prior-quarter level.

The Zacks Consensus Estimate for 2021 earnings has moved 3.8% north over the past 60 days. Earnings for the current year are projected to grow 98.6%, while 2021 revenue growth is expected to be 5.2%. So far, shares of this presently Zacks #2 Ranked stock have gained 106.7%.

With a market cap of $19.6 billion, Signature Bank is a diverse financial services company. Organic growth remains a key strength for SBNY, as reflected by its NII growth story. NII witnessed a CAGR of 7.3% over the last five years (2016-2020), with the trend continuing in the first nine months of 2021.

In this age of sudden technological shifts in the financial realm, Signature Bank continues to expand its digital asset business, especially with the inauguration of its blockchain-based payments platform, Signet. SBNYwas also the first FDIC-insured bank to launch a blockchain-based digital payments platform

Signature Bank has a healthy balance-sheet position. SBNY also stays focused to increase its deposits across its New York operations. Loan growth from the SBA lending segment and mortgage warehouse business is expected to be steadily supportive. Moreover, SBNY expects to onboard a new lending vertical in fourth-quarter 2021 or first-quarter 2022. Therefore, deposit and loan balances are poised to increase further with support from a gradually improving economy and growth in the mortgage warehouse space.

As of Sept 30, 2021, Signature Bank had a long-term debt (federal home loan bank borrowings and subordinate debt) of $3.23 billion, which declined over the last few quarters. With a record of consistent earnings and cash and due from banks worth $28.6 billion as of the same date, SBNY looks good from the liquidity perspective.

The Zacks Consensus Estimate for 2021 earnings has improved marginally over the past 30 days. Earnings for the current year are projected to grow 47.2%. The bank’s 2021 revenues are expected to rise 24.2%. At present, Signature Bank has a Zacks Rank #3. This New York-based bank’s shares have soared 139.6% so far this year.

Disclaimer: Neither Zacks Investment Research, Inc. nor its Information Providers can guarantee the accuracy, completeness, timeliness, or correct sequencing of any of the Information on the Web ...

more