3 Upcoming Quarterly Reports Investors Can't Ignore

Image: Bigstock

It’s been a massive week for earnings, with many companies pulling the curtain back and unveiling what’s transpired behind the scenes in Q2. So far, the season has been primarily positive, with many companies posting better-than-expected results and lifting sentiment.

As of Wednesday, Aug. 2, we have seen results from 335 S&P 500 companies. For these companies, total earnings are down -9.8% from the same period last year on +0.3% higher revenues, with 80.6% beating EPS estimates and 66.3% beating revenue estimates.

And next week, there are many notable companies slated to report as well, including United Parcel Service (UPS - Free Report), Disney (DIS - Free Report), and Sony (SONY - Free Report). But how do estimates fare for each as they head into their respective prints? Let’s take a closer look.

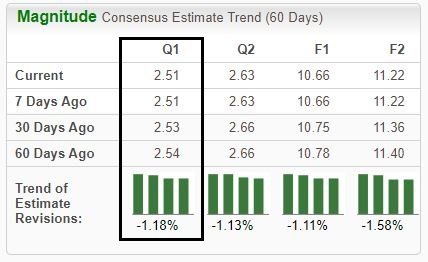

United Parcel Service

Analysts have been slightly bearish for the company’s quarter to be reported, with the $2.51 per share estimate down 1.2% over the last several months. The value reflects a 23% pullback in earnings from last year's comparable period.

Image Source: Zacks Investment Research

Our consensus revenue estimate presently stands at $22.9 billion, forecasting an 8% drop in sales year-over-year. Analysts have primarily kept their top-line expectations muted, with the estimate down a fractional 0.2% since May.

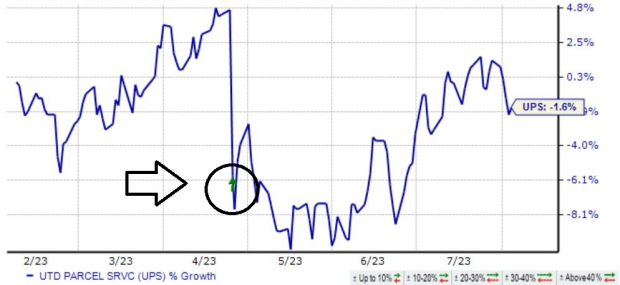

The transportation titan has posted somewhat-mixed quarterly results as of late, exceeding earnings expectations in three consecutive quarters but falling short of revenue estimates in each instance. The market reacted negatively to the most recent print, but shares have since rebounded modestly.

Image Source: Zacks Investment Research

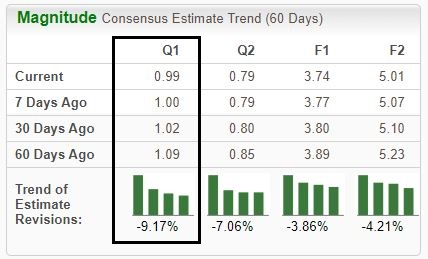

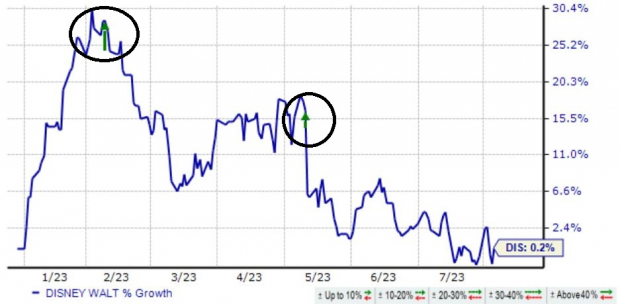

Disney

Disney has witnessed bearish activity among analysts for its upcoming release, with the $0.99 per share estimate down nearly 10% over the last 60 days. The value reflects an almost 10% drop in earnings year-over-year.

As shown below, analysts have taken their expectations lower for the quarter to be reported and for all other periods.

Image Source: Zacks Investment Research

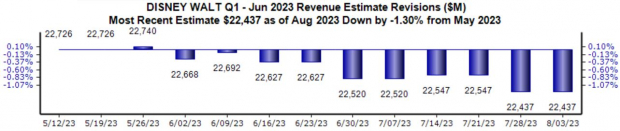

In addition, revenue forecasts have been taken modestly lower since mid-May, with the $22.4 billion estimate down 1.3% and reflecting an improvement of roughly 5% from the year-ago period.

Image Source: Zacks Investment Research

The entertainment giant posted a modest EPS beat in its latest release, but the market reacted negatively, with DIS shares plunging post-earnings. In fact, shares have sold off following back-to-back prints.

Image Source: Zacks Investment Research

Sony

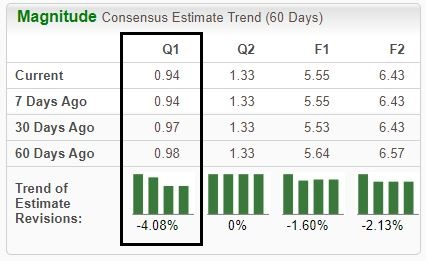

Like those discussed above, earnings expectations for Sony’s quarter have been lowered by analysts over the last few months, with the $0.94 per share estimate down 4%, reflecting a pullback of 30% from the year-ago period.

Image Source: Zacks Investment Research

The company is forecasted to post $18.6 billion in quarterly revenue, 4.3% higher than year-ago sales of $17.8 billion. It’s worth noting that the quarterly estimate has been revised 3% lower since mid-May, reflecting some pessimism.

Sony posted a sizable beat in its latest release, exceeding the Zacks Consensus EPS Estimate by nearly 40% and reporting revenue modestly ahead of expectations. Shares soared post-earnings but have since given up their gains, as shown below.

Image Source: Zacks Investment Research

Bottom Line

We’ve crossed the halfway mark in earnings season, but there are still many companies yet to report. We’ve already heard from the big banks and mega-cap tech, whose results were primarily positive.

And next week, we’ll hear from Sony (SONY - Free Report), Disney (DIS - Free Report), and United Parcel Service (UPS - Free Report). All three stocks are presently rated with a Zacks Rank #3 (Hold) ranking.

More By This Author:

Eli Lilly To Report Q2 Earnings: What's In The Cards?Bear Of The Day: Royal Gold (RGLD)

Bull of the Day: Royal Caribbean Cruises

For a detailed analysis of Q2 earnings, I invite you to view our weekly Earnings Trends report: more