3 Under-the-Radar Tech Stocks About To Pop

It is no secret that demand for Apple’s (NASDAQ: AAPL) next-generation iPhone, the iPhone 6s, and its new and larger tablet, the iPad Pro, has been huge. While this good news does not yet seem to have a profound effect on Apple’s share price, 3 bottomed out small cap tech stocks that are beneficiaries of these Apple launches could turn into big winners.

Under the Radar

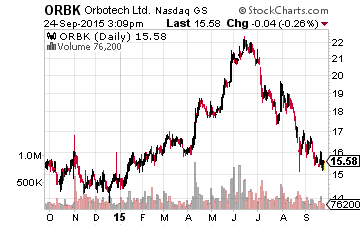

The most obvious beneficiary of these new technology gadget releases is Orbotech Ltd. (NASDAQ: ORBK), an under-the-radar stock that is a major player in the technology world. The last sentence buried in the company’s description is the key takeaway: Virtually every electronic device in the world is produced using Orbotech systems.

The company has the world’s leading market share in the sale of automated optical inspection equipment used in the production of printed circuit boards, flat panel displays, and other micro-electronic components. With the advancement in technology capabilities and the migration to smaller and thinner components, Orbotech’s inspection equipment ensures there are no defects and thus enhances the production yield for manufacturers all over the world, including the producers of the iPhone 6s.

Down over 30% from its June 2015 high due to the recent Asian contagion, Orbotech’s shares trade at a ridiculous valuation. The Street is projecting earnings per share (EPS) to grow from $0.83 in 2014 to $1.98 in 2015 and $2.24 in 2016. Yet, trading in the $15 range, the P/E on 2015 estimated earnings is under 8x, despite the fact that EPS for the first six months of 2015 is already $1.01, a 21% rise over EPS for all of last year! High product demand and profitability should serve as catalysts to drive the low-valuation stock back to the $22 level in the coming months, which would represent a paltry 11 P/E on 2015 earnings per share.

Cash-Rich But Out of Favor

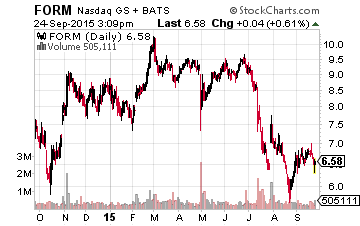

FormFactor (NASDAQ: FORM) is another victim of the potential China growth slowdown. Trading 40% below its 2015 high, this cash-rich, profitable semiconductor chip testing company is clearly out of favor, but I believe all the bad news is already reflected in the stock. For example, FormFactor’s earnings per share estimates have recently been slashed by Wall Street analysts to the tune of 40% for 2015 and 16% for 2016 due to industry slowdown concerns, which are likely overdone. Plus, with half of its current market value in cash, risk is limited and upside is high as new product introductions such as the iPhone 6s and iPad Pro drive its customers’ production growth.

The semiconductor industry is very cyclical and estimates tend to reflect either boom or bust, which is why these stocks and their forecasts can be quite volatile. The key to success with semiconductor stocks is to catch them before they bounce when the rest of the Street finds them out of favor.

For FormFactor, it looks like that bounce is right around the corner.

According to a recent article in Electronics Weekly, the semiconductor monthly book-to-bill ratio, the key metric for future trends, just went positive last month following big monthly declines mid-year. This signals that future business bookings are greater than those billed during the period. On the heels of this news, and considering its valuation and growth potential, our target for FormFactor is a 50% rise to $9.00, up from the current $6.00 share price. At $9.00, the stock’s 2016 P/E is 17x based on $0.51 in EPS next year, which is standard for the industry.

New Acquisition is Key

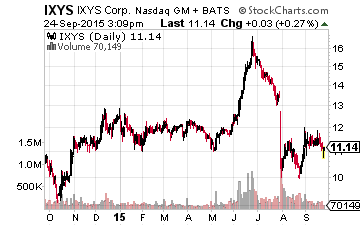

Since we are profiling bottomed out tech stocks in the manufacturing and semiconductor testing industries, we would be remiss if we omitted a pure semiconductor company. With over 3,500 customers, IXYS Corp (NASDAQ: IXYS) is a pioneer in the development of power semiconductors and high voltage integrated circuits. IXYS also had its EPS for March 2016 cut and the stock is down 35% from its high. The key catalyst is the recent acquisition of a company called RadioPulse which gives them entry into the next generation “Internet of Things” market and creates a brand new sales channel. As with FormFactor, IXYS benefits from the overall new technology production spurt, although its new industry positioning may not truly be reflected in the stock price until the early part of 2016. At under $11, IXYS trades at 8x the Street’s March 2017 EPS forecast of $1.22, which reflects a 60% rise from the year ending March 2016.

Disclosure: You could collect an average of $3,268 in extra monthly cash with ...

more