3 Under-The-Radar Large-Cap Stocks To Buy In August

Stocks surged higher on Friday. The positivity came after the Fed’s preferred inflation gauge showcased cooling prices and hit its lowest level in nearly two years.

Jay Powell didn’t declare victory over inflation when the Fed raised rates by 0.25% on Wednesday. But he certainly wasn’t hawkish either.

Wall Street is growing increasingly confident that the Fed is all but done hiking. On top of that, the earnings picture is holding up very well as we get deeper into the heart of Q2 earnings season.

With this in mind, we dive into three somewhat under-the-radar large-cap stocks that all reported upbeat quarterly results already that investors might want to buy as we head into August.

Paychex (PAYX - Free Report)

Paychex is a software company focused on payroll and other HR-centric offerings such as benefit management, insurance, and beyond. Paychex’s growing suite of HR-based software and technology has helped it amass roughly 740k customers across the U.S. and Europe. The firm is not a household name like Salesforce and some other business software companies. Yet Paychex boasts that its software helps pay one out of every 12 private sector employees in the U.S.

Paychex has grown its revenue and earnings at steady clips over the last decade, including 14% top-line expansion in its fiscal 2022 and 9% in FY23—period ended on May 31, 2023—to reach $5 billion for the first time. Looking ahead, PAYX’s revenue is projected to pop 7% in FY24 and another 5% in FY25 to reach $5.62 billion. Meanwhile, its adjusted earnings are expected to climb by 10% in FY24 and 7% higher in its fiscal 2024, which comes on top of 13% EPS growth last year.

Image Source: Zacks Investment Research

Paychex’s earnings revisions have continued to climb over the last several years and its more recent upbeat EPS trends help it grab a Zacks Rank #2 (Buy) right now. The company boosted its dividend payout by 13% earlier this year, with a yield of 2.8% right now. It is worth stressing as well that digital payroll services and more are nearly ubiquitous and never going out of style.

Paychex stock has climbed 210% in the last decade to top the S&P 500 and its industry, which are both up around 180%. PAYX shares have surged 72% in the past three years, but are down around 1% in the past 12 months vs. the benchmark’s 10% climb. That said, the stock has ripped 16% higher since its Q4 FY23 report on June 29.

Image Source: Zacks Investment Research

Despite the rebound, Paychex trades 9% below its record highs. Plus, PAYX climbed back above its 50-week moving average in early July and it is now above its 50-day and 200-day, with it prepared to complete the golden cross, where the shorter-dated trendline climbs back above the longer-term trend. Paychex is also trading at a 25% discount to its highs at 26.9X forward earnings and right near its own decade-long median.

Textron (TXT - Free Report)

Textron operates in the broader Aerospace – Defense segment with a wide-range of offerings in the field, as well as far more commercial segments. TXT’s various units and brands include Bell, Cessna, Beechcraft, Pipistrel, Arctic Cat, and more. For instance, Arctic Cat is a leader in the snowmobile and the small off-road vehicle space such as ATVs and side-by-sides. Textron’s Cessna unit is a major player in the world of private aviation for business travel and other, mostly non-commercial flight.

Textron’s Pipistrel segment is attempting to push the boundaries of electric aircrafts. TXT’s portfolio also includes Bell, which landed a potentially huge contract with the U.S. Army in late 2022. Textron’s next-generation helicopters are set to become the U.S. Army’s new long-range assault aircraft. The contract could be worth up to $80 billion based on multiple reports.

Image Source: Zacks Investment Research

Textron, which currently lands a Zacks Rank #2 (Buy), on July 27 posted an impressive beat-and-raise quarter. TXT topped our Q2 EPS estimate by 22%, with its adjusted earnings up 32% YoY. The company also boosted its bottom-line outlook to between $5.20 - $5.30 a share vs. our current $5.09 consensus, which would already mark 27% growth.

Zacks estimates call for another solid year of bottom-line expansion in FY24 and strong revenue expansion. And expect analysts to raise these outlooks in the coming days and weeks following TXT’s Q2 report.

Textron earlier this month said it approved a new stock buyback program. And six of the 11 brokerage recommendations Zacks has are “Strong Buys,” next to five “Holds.”

TXT stock is up 165% in the last 10 years to blow away its Aerospace – Defense industry’s 29%. This run includes a 121% surge in the last 36 months. TXT stock has, however, chopped around rather heavily over the last two years.

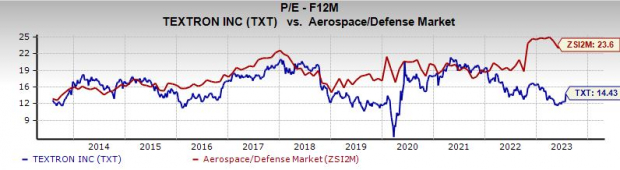

Image Source: Zacks Investment Research

Textron is now up 8% YTD, after it soared following its blowout Q2 results and guidance. TXT is attempting to hit new highs and break out of its current range. TXT is now back above its 50-week moving average and it soared above its 200-day.

TXT currently trades below its average Zacks price target. Some investors might appreciate that it sits at around $76 per share, while Lockheed Martin and Northrop Grumman both trade for around $450 per share.

Despite its long-term outperformance of the Aerospace – Defense industry, Textron trades at a roughly 40% discount at 14.4X forward 12-month earnings. TXT’s current valuation also represents 9% value vs. its own decade-long median and 32% compared to its own highs.

United Rentals (URI - Free Report)

United Rentals is one of the world’s largest equipment rental firms. URI’s portfolio allows its customers, which include construction firms, utility companies, and far beyond, to rent scissor lifts, towable light towers, generators, and nearly everything else under the sun. The firm’s revenue was booming prior to Covid, with sales up between 15% to 21% for three straight years until they slipped in 2020. But URI quickly left its setbacks behind and posted 14% sales growth in FY21 and 20% in 2022.

Image Source: Zacks Investment Research

United Rentals has been able to lift its prices alongside inflation, while benefiting from its Ahern Rentals acquisition in late 2022. United Rentals carried over its momentum into 2023, and it topped our Q2 earnings and revenue estimates on July 26.

URI, which grabs a Zacks Rank #2 (Buy) right now, also boosted its FY23 outlook. CEO Matthew Flannery said in prepared remarks that it remains “encouraged by the momentum we are carrying into the busiest part of our season as well as our customers’ continued optimism.”

Current Zacks estimates call for URI’s sales to jump 20% in 2023 and another 4% in 2024. Meanwhile, its adjusted earnings are projected to surge by 22% and 9%, respectively. And expect these projections to improve as more analysts update their outlooks. United Rentals aims to keep capitalizing on multi-year tailwinds across infrastructure, manufacturing, and energy and power.

Image Source: Zacks Investment Research

URI has surged 650% in the past 10 years to crush the S&P 500’s 180% and the Zacks construction sector’s 160%. United Rentals is up 37% in the last 12 months, with it hovering around 8% below its all-time highs.

The stock found support at its 50-week moving back in May, and its recent run has it trading above its 50-day and 200-day moving averages. And URI is trading at a 40% discount to its own decade-long highs and right at its median of 10.6X forward 12-month earnings.

More By This Author:

2 Soaring Stocks to Buy Now for Growth and ValueBull Of The Day: Salesforce

2 Stocks To Buy As The S&P 500 Enters A New Bull Market

Disclaimer: Neither Zacks Investment Research, Inc. nor its Information Providers can guarantee the accuracy, completeness, timeliness, or correct sequencing of any of the Information on the Web ...

more