3 Uncanny Indicators Say U.S. Is Headed Toward A Recession (Or Is In One Already)

Image Source: Pixabay

These Economic Indicators Say a Recession Is Looming

There are some uncanny indicators saying the U.S. economy is headed toward a recession (if it’s not in one already). Why bother paying attention to these indicators? They could tell us what’s ahead for the economy.

Three economic indicators worth watching closely are the production and shipping of cardboard boxes; spending on recreational goods and vehicles; and sales of luxury real estate. All three of these indicators look alarming right now.

Cardboard Box Production & Shipping Drop

The first economic indicator worth watching is cardboard box production and shipping in the U.S. economy. The relevance of this economic indicator is simple but powerful: a decline in cardboard box production and shipping is a sign that the U.S. economy is slowing and that a recession is looming.

Cardboard boxes are used for packaging in almost all industries. If the companies that make cardboard boxes aren’t producing or shipping a lot of them, it could be a sign that various industries are having a hard time selling their goods.

According to data from the Fibre Box Association, U.S. box shipments fell by 8.4% in the fourth quarter of 2022. Here’s the kicker: it was the biggest quarterly decline in box shipments since the Great Recession of 2007–2009. The association also said that U.S. box operating rates dropped to 80.9% in the fourth quarter of 2022, their lowest percentage since the first quarter of 2009! (Source here, FreightWaves, January 30, 2023.)

Moreover, the American Forest & Paper Association said that, during the fourth quarter of 2022, a packaging material called boxboard (thinner than cardboard and doesn’t have air pockets) had one of its lowest operating rates in five years.

This indicator is telling us a scary tale: a recession is around the corner for the U.S. economy.

Consumers Ditch Spending on Recreational Goods & Vehicles

The second economic indicator worth looking at is consumer spending on recreational goods and vehicles. In booming economic times, consumers like to go out, travel, and buy fancy toys. In poor economic times, they watch what they spend.

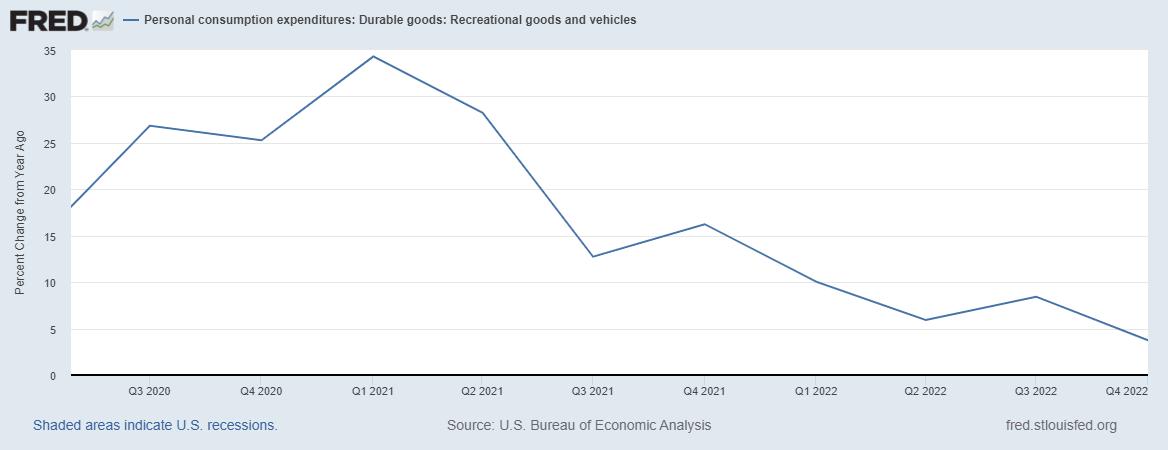

Look at the chart below. It plots the U.S. year-over-year change in quarterly personal consumption expenditures on recreational goods and vehicles.

(Click on image to enlarge)

(Source here, Federal Reserve Bank of St. Louis, last accessed February 8, 2023.)

Notice something? U.S. consumers have really pulled back on their spending on recreational goods and vehicles. In the first quarter of 2021, American consumer spending on recreational goods and vehicles grew by about 35%. In the fourth quarter of 2022, it only grew by 3.7%. This is an immense deceleration.

Therefore, this indicator is saying a recession is brewing in the U.S.

Luxury Real Estate Market Nosediving

The third economic indicator worth watching is luxury real estate sales. In anticipation of a recession, luxury real estate sales tend to cool off.

According to data from Redfin, a real estate company, luxury real estate sales have been falling off a cliff lately. In the three months ending November 30, 2022, sales of luxury homes in the U.S. plummeted by 38.1%, the biggest such decline on record! (Source here, Redfin, December 28, 2022.)

In Nassau County, NY (Long Island), luxury home sales dropped by 65.6% year-over-year for the three months ending November 30, 2022. The luxury home sales figures in some key markets in California were gruesome. In San Diego, luxury home sales nosedived by 60.4%; in San Jose, they declined by 58.7%; in Riverside, they plunged by 55.6%; and in Anaheim, they fell by 55.5%.

At the very least, the luxury real estate market is sending a chilling message that a recession could be just around the corner (if it’s not embedded already).

U.S. Economic Outlook: Hard Landing Ahead

You may have heard the expression, “If it looks like a duck, swims like a duck, and quacks like a duck, then it probably is a duck.” As it stands, the U.S. economic data makes a very strong case that a recession is coming. It’s not about if there will be a recession, but when—and how bad it will be.

While the mainstream financial press and economists say we’re headed for a soft landing, I believe the U.S. economy could be headed toward a hard landing. In my opinion, based on the data, a mild recession would actually be the best-case scenario.

What does this mean for investors?

Stock investing involves knowing the economic cycles. The stock market tries to move ahead of the economic cycle. Throughout 2022, investors bought into the idea that there was a recession coming, so the stock market traded lower. In 2023, don’t be shocked if a severe recession and poor business earnings start to get priced into the stock market. So, we can expect wild moves on the key stock indices.

I’ll end with this: the release of economic data tends to be delayed, so the stock market tends to bottom well ahead of the economic data being released. So, be mindful and be ready. Speaking from experience, the time to invest is when there’s extreme uncertainty, not when the data confirms there are horrific developments in the economy.

More By This Author:

Slowing Global Economy Could Trigger Financial Crisis & Stock Market Crash

Gold Rush in the Making? Case for Higher Gold Prices Gets Stronger

Odds Of U.S. Dollar Collapsing Overnight? Commonsense Facts You Should Know

Disclaimer: There is no magic formula to getting rich. Success in investment vehicles with the best prospects for price appreciation can only be achieved through proper and rigorous research and ...

more