3 Top Stocks Pushing 52-Week Highs

Image: Bigstock

Although the market has been weak in 2022 (to say the least), several stocks have snapped the bearish trend, providing investors with considerable gains. And some of them are pushing 52-week highs, undoubtedly a positive development.

Stocks making new highs tend to make even higher highs, especially when positive earnings estimate revisions roll in from analysts. Three companies – e.l.f. Beauty (ELF - Free Report), Scorpio Tankers Inc. (STNG - Free Report), and Global Partners (GLP - Free Report) – are all seeing their shares trade near 52-week highs.

Below is a chart illustrating the year-to-date performance of all three stocks, with the S&P 500 blended in as a benchmark.

Image Source: Zacks Investment Research

As we can see, it’s been a stellar run for all three stocks in 2022, crushing the S&P 500. Let’s take a deeper dive into each one.

Scorpio Tankers Inc.

Scorpio Tankers Inc. provides marine transportation of petroleum products worldwide for integrated oil companies, oil traders, and other customers. Analysts have significantly upped their earnings outlook over the last several months, pushing the stock into a Zacks Rank #1 (Strong Buy).

Image Source: Zacks Investment Research

STNG has been firing on all cylinders, exceeding earnings and revenue estimates in four consecutive quarters. Just in its latest release, the company registered a 13% bottom line beat paired with a nearly 10% revenue surprise. The chart below illustrates the company’s revenue on a quarterly basis.

Image Source: Zacks Investment Research

e.l.f. Beauty

e.l.f. Beauty is a cosmetics company, with its products primarily consisting of face makeup, eye makeup, lip products, nail products, and cosmetic kits. The company has seen its earnings outlook improve across nearly all timeframes over the last several months, helping land the stock into a Zacks Rank #1 (Strong Buy).

Image Source: Zacks Investment Research

Similar to STNG, e.l.f. Beauty has been on a blazing-hot earnings streak, exceeding top and bottom line estimates in seven consecutive quarters. In its latest print, ELF surpassed the Zacks Consensus EPS Estimate by more than 120% and penciled in a 15% sales surprise.

Image Source: Zacks Investment Research

Global Partners

Global Partners is one of the largest wholesale distributors of distillates such as home heating oil, diesel and kerosene, gasoline, residual oil, and bunker fuel to wholesalers, retailers, and commercial customers in New England. GLP sports a Zacks Rank #1 (Strong Buy).

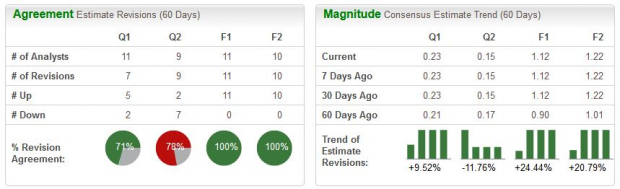

Like the stocks above, GLP’s earnings outlook has turned visibly bright over the last several months.

Image Source: Zacks Investment Research

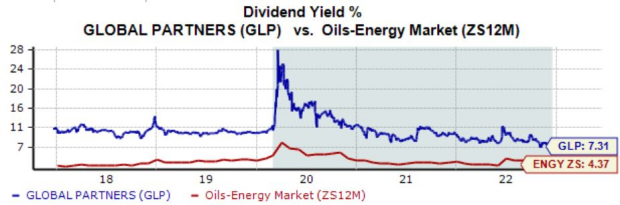

It’s hard to ignore GLP’s dividend metrics; the company’s annual dividend currently yields a steep 7.3%, notably above its Zacks Oils and Energy sector average of an already steep 4.4%. Further, the company has upped its dividend payout an impressive 14 times over the last five years, translating to a 5.7% five-year annualized growth rate.

Image Source: Zacks Investment Research

Bottom Line

While the general market has undergone a brutal stretch in 2022, all three stocks above – e.l.f. Beauty (ELF - Free Report), Scorpio Tankers Inc. (STNG - Free Report), and Global Partners (GLP - Free Report) – have sailed through calm waters, snapping the bearish trend and delivering considerable gains to investors.

In addition to favorable price action, all three stocks have witnessed positive earnings estimate revisions as of late, providing fuel for the runs to continue.

More By This Author:

Time To Buy Nike Stock For 2023?General Mills Q2 Earnings Coming Up: Things To Note

3 Top High-Yield Mutual Funds To Buy Ahead Of 2023

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any specific ...

more