3 Top S&P 500 Stocks With Room To Run

Wall Street rallied in the first half of 2024, driven by an artificial intelligence (AI) frenzy and a less hawkish Federal Reserve.

A blistering rally among tech stocks led by Super Micro Computer, Inc. (SMCI) , NVIDIA Corporation (NVDA) and Micron Technology, Inc. (MU) helped the broader S&P 500 to close in the green in the first two quarters and squash recession fearmongering.

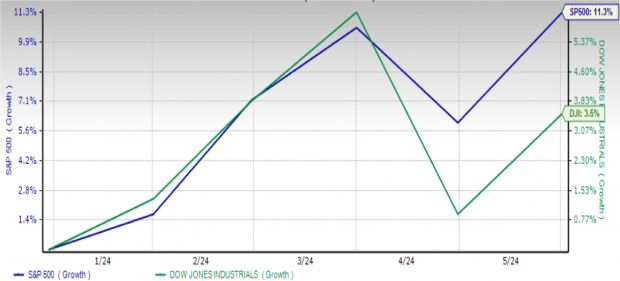

S&P 500 Notches Double-Digit Gains

The S&P 500 scaled northward in the first half of 2024 and ended tantalizingly close to its all-time closing high. The S&P 500 was just 0.5% below its record close on June 18 in the last trading session. However, the index climbed more than 4% in the second quarter, following a superb gain of 10.2% in the first three months.

The S&P 500 soared 11.3% in the first half, significantly more than its historical average gain of 4.7% since 1953, per Bespoke Investment Group. In comparison, the 30-stock Dow Jones Industrial Average recorded a paltry gain of 3.5%.

(Click on image to enlarge)

Image Source: Zacks Investment Research

What Propelled the S&P 500 Higher?

The S&P 500 shrugged off apprehensions about geopolitical turmoil and pricey valuations. Instead, the index rallied on interest rate cut optimism and an AI boom.

Inflationary pressure loosened its tight grip on the economy, with the Fed’s favored inflation gauge, the personal consumption expenditures (PCE) index, remaining unchanged in May, a tell-tale sign that price pressures are receding.

Therefore, it is widely expected that the central bank will be less aggressive and trim interest rates as early as fall, which unquestionably bodes well for the stock market. This is because, in a low-interest rate environment, consumer outlay increases, borrowing costs decrease and the economy strengthens.

Nonetheless, the unquenchable demand for AI models has mostly driven growth-oriented tech stocks higher and has been the major driving force behind the S&P 500’s stupendous gains.

Tech Stocks Lead the Race

The Technology Select Sector SPDR (XLK) was one of the top gainers among the S&P 500 sectors, up an encouraging 17.5% year to date.

Tech stocks, in particular, advanced by leaps and bounds, banking on countless AI-driven technological developments. AI is expected to revolutionize business methods and create an affable business environment.

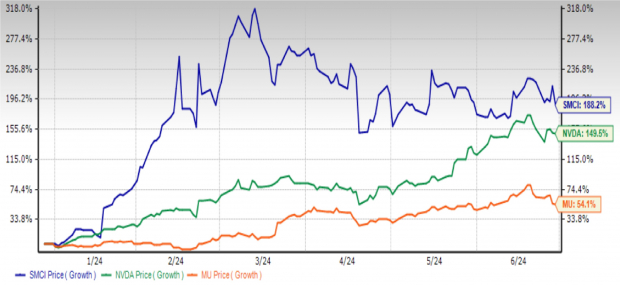

Super Micro, NVIDIA & Micron Stock Price Gains the Most

Among the tech stocks, Super Micro Computer, NVIDIA and Micron Technology have surged the most, up 188.2%, 149.5% and 54.1% so far this year.

(Click on image to enlarge)

Image Source: Zacks Investment Research

Super Micro Computer is a major producer of dedicated AI servers, whose diversified business model is helping the stock grow. Its partnerships with NVIDIA and Advanced Micro Devices, Inc. (AMD) to access data center GPUs are helping Super Micro Computer to expand its business.

Super Micro Computer currently has a Zacks Rank #1 (Strong Buy). The Zacks Consensus Estimate for its current-year earnings has moved up 9.4% over the past 60 days. SMCI’s expected earnings growth rate for the current year is a whopping 101.7%.

NVIDIA has been a market darling for quite some time as the company continues to register eye-popping growth in recent quarters. NVIDIA enjoys an economic moat as it dominates the GPU market, while its data center business skyrocketed 427% to $22.6 billion in the last fiscal quarter.

NVIDIA, at present, has a Zacks Rank #1. The Zacks Consensus Estimate for its current-year earnings has increased 12.1% over the past 60 days. NVDA’s expected earnings growth rate for the current year is a solid 106.2%.

Maker of computer memory chips, Micron Technology also saw its shares scale upward due to an uptick in demand for its products for applications in new AI server chips. Substantial demand for Micron’s high-bandwidth memory and high DRAM prices are lifting the company’s share prices.

Presently, Micron Technology has a Zacks Rank #2 (Buy). The Zacks Consensus Estimate for its current-year earnings has moved up 25.3% over the past 60 days. MU’s expected earnings growth rate for the current year is a promising 124.5%.

More By This Author:

4 Solid Stocks To Buy On A Steady Rise In Consumer Spending3 Diversified Bond Mutual Funds For Mitigating Risks

3 Must-Buy Funds On Solid Jump In Consumer Spending

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any ...

more