3 Top-Ranked Tech Stocks To Buy For Income

Image Source: Unsplash

Building a portfolio with the goal of receiving passive income often leads investors to concentrate on sectors like utilities, finance, or consumer staples.

Income-oriented investors often find the technology sector less appealing since these companies usually allocate their profits toward growth. Still, many technology companies reward their shareholders with quarterly payouts.

For those seeking exposure to technology paired with reaping an income, three stocks – Dell Technologies (DELL - Free Report), NetEase (NTES - Free Report), and Broadcom (AVGO - Free Report) – could all be prime considerations.

In addition to providing payouts, all three sport a favorable Zacks Rank, reflecting optimism among analysts. Let’s take a closer look at each.

Dell Technologies

Dell Technologies, a current Zacks Rank #2 (Buy), provides information technology solutions. The company’s segments include Client Solutions, Enterprise Solutions Group, and Dell Software Group.

Currently, shares yield a solid 2% annually paired with a sustainable payout ratio sitting at 24% of the company’s earnings. Undoubtedly a major positive, Dell recently announced in a recent analyst meeting that it expects to grow its quarterly dividend by 10% or more annually through fiscal 2028.

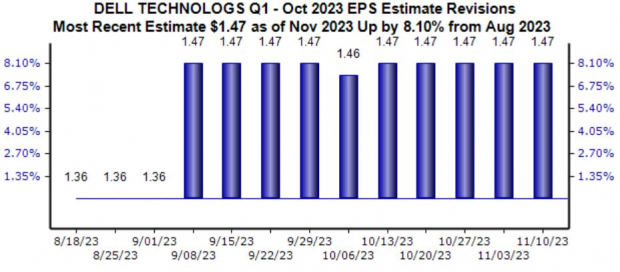

Watch for the company’s next quarterly release on November 30th. Currently, the Zacks Consensus EPS Estimate of $1.47 suggests a 35% pullback from the year-ago period, with the estimate up more than 8% since mid-August.

Image Source: Zacks Investment Research

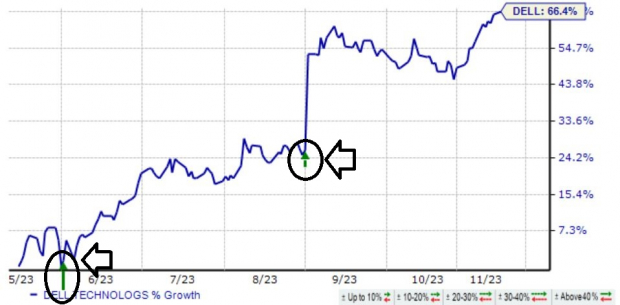

It’s worth noting that shares have seen positive reactions post-earnings in back-to-back releases, with investors pleased with quarterly results. Just in its latest release, DELL posted a sizable 50% beat relative to the Zacks Consensus EPS Estimate and reported sales 10% ahead of expectations.

Image Source: Zacks Investment Research

NetEase

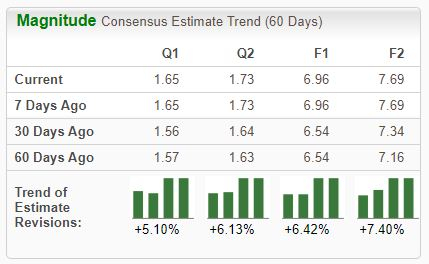

NetEase, a current Zacks Rank #1 (Strong Buy), is a Chinese internet technology company engaged in developing applications, services, and other technologies. Analysts have taken their earnings expectations higher across the board.

Image Source: Zacks Investment Research

NTES shares presently yield 1.8% annually, more than double the Zacks Computer & Technology sector average of 0.7%. Dividend growth is also more than apparent, with NTES boasting a 27% five-year annualized dividend growth rate.

And the company’s growth expectations can’t be overlooked, with consensus estimates calling for 40% earnings growth in its current year (FY23) on 2% higher sales. Peeking ahead to FY24, expectations allude to a further 10% boost in earnings paired with an 11% sales bump.

NetEase is scheduled to reveal quarterly results just in a few days on Thursday, November 16th. Currently, the Zacks Consensus EPS Estimate of $1.65 suggests 4% growth, being revised well higher since August.

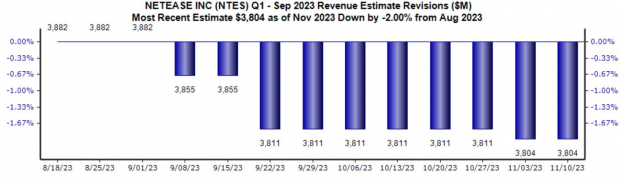

Our consensus revenue estimate presently stands at $3.8 billion, 11% higher than year-ago sales of $3.4 billion. It’s worth noting that analysts have been slightly bearish regarding top line results, with the quarterly estimate down 2% since August.

Image Source: Zacks Investment Research

Broadcom

Broadcom is a premier designer, developer, and global supplier of a broad range of semiconductor devices. The stock is currently a Zacks Rank #2 (Buy), with the revisions trend particularly notable for its current fiscal year, up 5% since last November.

Image Source: Zacks Investment Research

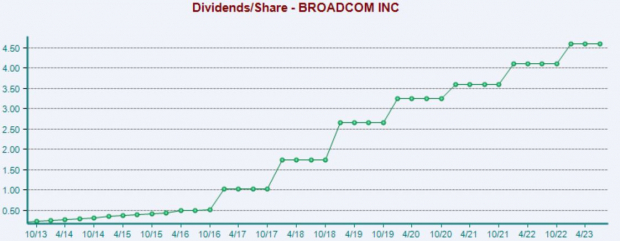

AVGO shares presently yield 1.9% annually paired with a payout ratio sitting at 48% of the company’s earnings. The company has consistently boosted its quarterly payout, boasting a 16% five-year annualized dividend growth rate.

Image Source: Zacks Investment Research

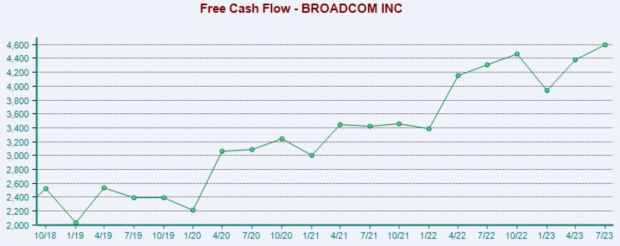

Broadcom generates ample cash, with a free cash flow of $4.6 billion throughout its latest quarter improving 7% from the year-ago period. As we can see below, Broadcom has been a cash-generating machine.

Image Source: Zacks Investment Research

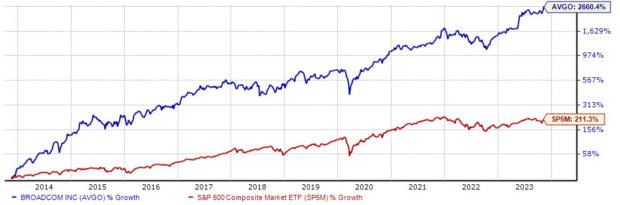

The stock has been a long-term outperformer, with shares up more than 2600% over the last decade compared to the S&P 500’s 211% gain. The annualized return throughout the period works out to be a remarkable 40%.

Image Source: Zacks Investment Research

Bottom Line

Dividend-paying stocks don’t always have to be ‘boring,’ as many exciting companies from the technology sector also reward their shareholders with payouts.

And for those interested in gaining exposure to the sector paired with quarterly payouts, all three stocks above – Dell Technologies (DELL - Free Report), NetEase (NTES - Free Report), and Broadcom (AVGO - Free Report) – fit the criteria nicely.

On top of quarterly payouts, all three currently sport a favorable Zacks Rank, reflecting positive outlooks among analysts.

More By This Author:

Cisco To Report Q1 Earnings: Key Factors To Consider

3 Diversified Chemical Stocks To Watch Amid Demand Worries

Airline Stock Roundup: Allegiant's Q3 Earnings Miss, Gol Linhas' Loss & More

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any specific ...

more