3 Top-Ranked Tech Stocks To Buy For High Growth

Image Source: Unsplash

Investors love technology stocks, as their rapid growth and market momentum are undeniably attractive.

Still, many point to the high valuations commonly found within these stocks, steering away those with a value-conscious approach.

But for those that don’t mind valuations, three high-growth stocks – NVIDIA (NVDA), Celestica (CLS), and Uber Technologies (UBER) – could all be considerations. All three boast big growth trajectories and sport-improved earnings outlooks, with the latter reflecting optimism among analysts.

Let’s take a closer look at each.

NVIDIA

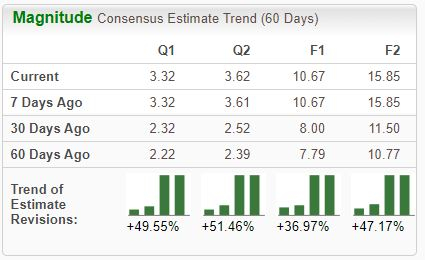

NVIDIA has been the dominant story in 2023, with its artificial intelligence (AI) operations providing significant tailwinds and causing analysts to raise their earnings expectations notably. This favorable trend in estimate revisions is illustrated below.

Image Source: Zacks Investment Research

The hype surrounding AI has NVDA forecasted to grow significantly, with Zacks Consensus Estimates suggesting 220% earnings growth in its current year on 81% higher revenues. And in FY25, earnings and revenue are forecasted to see improvements of 50% and 43%, respectively.

Image Source: Zacks Investment Research

Shares presently trade at a 39.6X forward earnings multiple, beneath the 55.6X five-year median and highs of 83.3X in 2022. Investors have had little issue forking up the premium given the company’s forecasted growth, with shares up more than 180% year-to-date.

Celestica

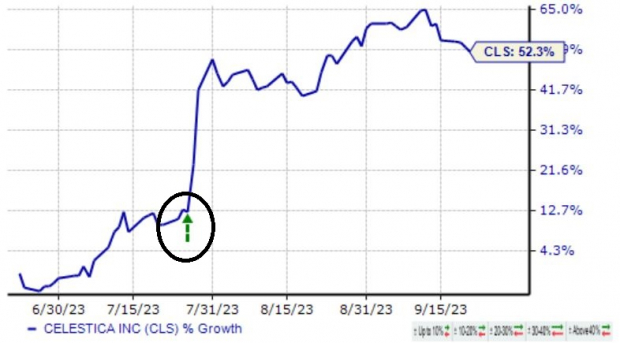

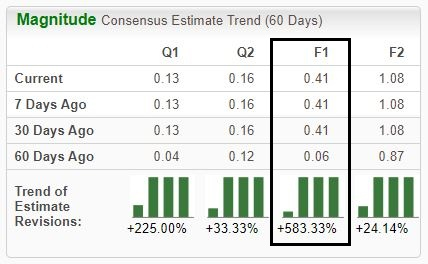

Celestica is one of the world's largest electronics manufacturing services companies, serving the computer and communications sectors. Analysts have taken their earnings expectations higher across the board, landing the stock into a Zacks Rank #1 (Strong Buy).

Image Source: Zacks Investment Research

The company’s shares aren’t valuation stretched given its growth trajectory, currently trading at a 9.9X forward earnings multiple. Celestica’s earnings are forecasted to see 20% growth on 9% higher revenues in its current year.

Celestica has been a consistent earnings performer, exceeding the Zacks Consensus EPS Estimate by an average of 12% across its last four releases. Just in its latest print, the company posted a 15% EPS surprise and reported revenue 6% ahead of expectations.

As we can see below, the market reacted strongly to the release post-earnings.

Image Source: Zacks Investment Research

Uber Technologies

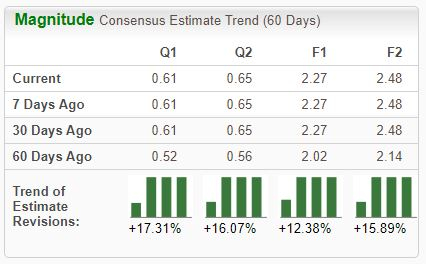

Uber has seen its near-term earnings outlook shift positively across all timeframes, helping land the stock into a Zacks Rank #1 (Strong Buy). The revisions trend has been particularly notable for its current year, as shown below.

Image Source: Zacks Investment Research

The company’s growth trajectory is impossible to ignore, with earnings forecasted to soar 110% on 18% higher revenues in its current year. And the growth is slated to continue in a big way, with expectations for FY24 suggesting 160% earnings growth paired with an 18% sales bump.

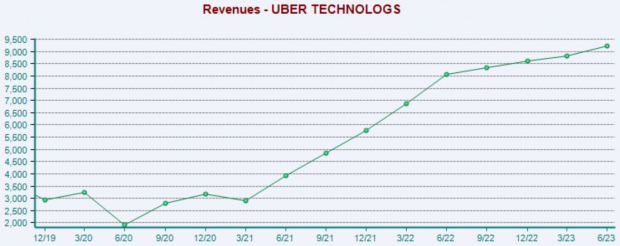

Like Celestica, Uber has been a big-time earnings performer, exceeding the Zacks Consensus EPS Estimate by an average of 475% across its last four releases. As shown below, the company’s sales growth has been rock-solid.

Image Source: Zacks Investment Research

Bottom Line

Growth-focused investors have been rewarded handsomely so far in 2023 following a harsh showing last year, with many delivering market-beating returns.

For those interested in this investing style, all three stocks above – NVIDIA, Celestica, and Uber Technologies – precisely fit the criteria.

On top of strong expected growth, all three have enjoyed positive earnings estimate revisions, indicating near-term optimism among analysts.

More By This Author:

3 Retail Stocks To Buy As The Sector Continues To Grow In 2023Markets Continue Selloff From Wednesday

Bull of the Day: Gibraltar Industries

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any specific ...

more