3 Top-Ranked Stocks To Buy For Stability

Image Source: Unsplash

Low-beta stocks can provide several beneficial advantages for portfolios, including defensive qualities and stabilization when combined with high-beta stocks, helping to provide a more balanced risk profile.

And for those seeking a less volatile approach, three low-beta stocks – Cigna Group (CI), Cardinal Health (CAH), and W.R. Berkley (WRB) – could be considered. All three sport a favorable Zacks Rank, carry solid growth, and sport sound valuations.

Below is a chart illustrating the performance of each over the last year.

Image Source: Zacks Investment Research

Let’s take a deeper dive.

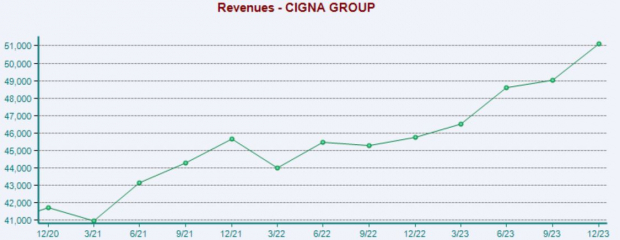

Cigna Group

Cigna enjoyed a rock-solid quarter throughout its latest period, exceeding our consensus EPS estimate by 4% and posting a 5% revenue beat. Earnings saw year-over-year growth of 37%, whereas revenue was 12% higher from the year-ago period.

The company raised its FY24 adjusted EPS outlook and boosted its quarterly dividend payout by 14% following the release, owing to its successful operations. The stock is currently a Zacks Rank #2 (Buy), boasting consistent top line expansion over the last several years.

Image Source: Zacks Investment Research

Shares could also entice value-focused investors, underpinned by its Style Score of ‘A’ for Value. The current forward 12-month earnings multiple works out to 11.6X, a few ticks above the five-year median and comparing favorably to the Zacks – HMOs industry average of 15.5X.

Shares have traded as high as 14.3X over the last five years.

Image Source: Zacks Investment Research

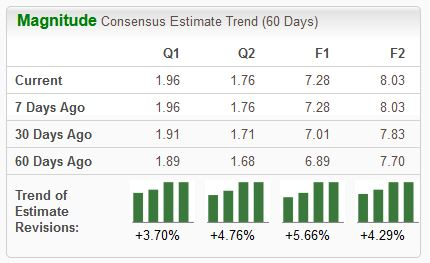

Cardinal Health

Better-than-expected quarterly results have helped drive the bullish move of CAH shares over the last year, with the company exceeding our consensus EPS estimates by an average of 15% across its last four releases.

Analysts have raised their earnings outlook across the board, particularly following its latest quarterly release. The stock sports the highly-coveted Zacks Rank #1 (Strong Buy).

Image Source: Zacks Investment Research

Like CI, value-conscious investors could find a liking to CAH shares, with the current 14.4X forward 12-month earnings multiple comparing favorably to the Zacks Medical – Dental Supplies industry average of 19.0X.

The stock sports a Style Score of ‘A’ for Value.

Image Source: Zacks Investment Research

Shares also pay a solid dividend, yielding a solid 1.8% annually paired with a sustainable payout ratio sitting at 29% of the company’s earnings.

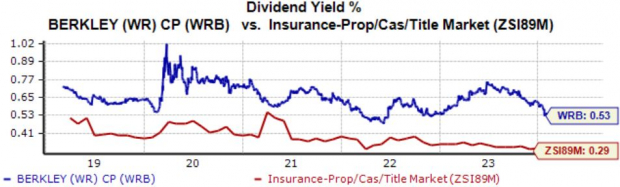

W.R. Berkley

WRB shares modestly outperformed relative to the S&P 500 over the last year, enjoying post-earnings positivity in three consecutive releases. The stock holds a Zacks Rank #2 (Buy), with earnings expectations creeping higher across the board.

Image Source: Zacks Investment Research

Shares currently yield a modest 0.5% annually, undoubtedly on the lower end of the spectrum. Still, the company’s 10.8% five-year annualized dividend growth rate helps pick up the slack in a big way, reflecting its shareholder-friendly nature.

Image Source: Zacks Investment Research

The company’s growth profile is notably strong for being non-tech, with consensus expectations for its current fiscal year (FY24) suggesting 22% earnings growth on 10% higher sales. Peeking ahead to FY25, current consensus expectations allude to a 9% bump in earnings paired with a 6% sales increase.

Bottom Line

During periods of heightened volatility, targeting low beta stocks can provide a valuable layer of defense.

And for those looking to blend in a layer of defense, all three low-beta stocks above – Cigna Group, Cardinal Health, and W.R. Berkley – could be considered.

All three sport a favorable Zacks Rank, with analysts becoming optimistic about near-term outlooks.

More By This Author:

These Highly Ranked Construction Sector Stocks Could March Higher This Month3 Top-Ranked Stocks To Buy For Big Growth

Will Costco Beat Estimates Again In Its Next Earnings Report?

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any ...

more