3 Top-Ranked Stocks To Buy For Big Growth

Image Source: Pixabay

Growth investing is a widespread strategy deployed, with investors targeting companies expected to grow their earnings and revenues at an above-average level. It’s a development that commonly follows through to share outperformance.

These companies typically reinvest back into the business for expansion, commonly at the forefront of innovation. And for those seeking a group of strong growth stocks, Uber Technologies (UBER), Meta Platforms (META), and Salesforce (CRM) could all be considerations.

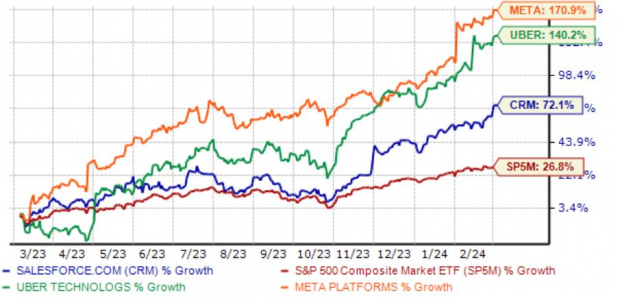

Below is a chart illustrating the performance of each over the last year, with the S&P 500 blended in as a benchmark.

Image Source: Zacks Investment Research

Let’s take a closer look at each.

Uber Technologies

Uber’s latest set of better-than-expected quarterly results impressed the market, with shares enjoying bullish activity post-earnings. Concerning headline figures, Uber exceeded the Zacks Consensus EPS estimate by more than 300% and posted sales 2% ahead of expectations, reflecting year-over-year growth rates of 127% and 15%, respectively.

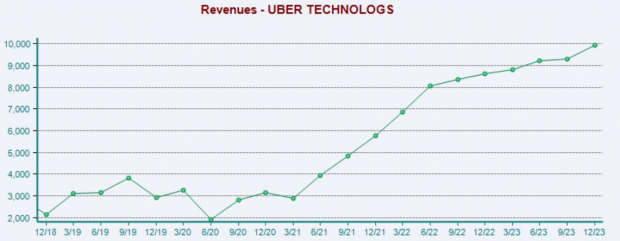

Below is a chart illustrating the company’s revenue on a quarterly basis.

Image Source: Zacks Investment Research

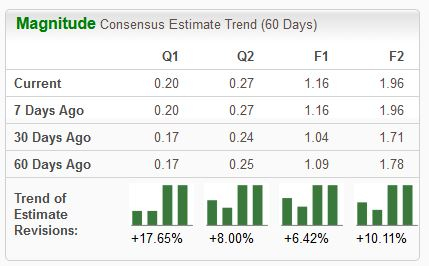

Analysts have raised their earnings outlooks across the board, landing the stock into a favorable Zacks Rank #2 (Buy). The stock remains a prime consideration for growth investors, with earnings forecasted to climb 33% on 16% higher sales in its current fiscal year.

Image Source: Zacks Investment Research

Impressively, UBER has posted double-digit percentage year-over-year sales growth in each of its last ten releases, with the stock carrying a Style Score of ‘A’ for Growth.

Meta Platforms

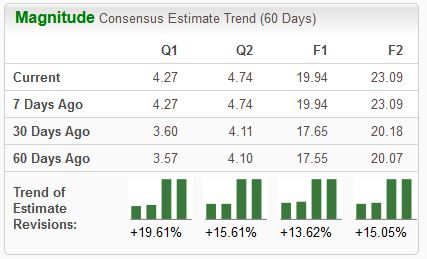

Meta shares have been on an absolute tear over the last year, adding nearly 170% on the back of robust quarterly results. The stock remains a Zacks Rank #1 (Strong Buy), with earnings expectations melting higher.

Image Source: Zacks Investment Research

Consensus expectations for its current year suggest 34% earnings growth on 18% higher sales, with FY25 earnings and revenue forecasted to see growth of 16% and 13%, respectively. The stock sports a Style Score of ‘A’ for Growth.

Image Source: Zacks Investment Research

In addition, shares aren’t overly rich regarding valuation given the growth profile, with the current 25.2X forward earnings multiple well below five-year highs of 37.1X and comparing favorably to the Zacks Internet Software industry average of 39.2X.

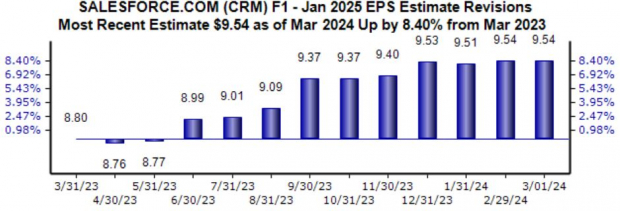

Salesforce

Salesforce, a Zacks Rank #2 (Buy), is the leading provider of on-demand Customer Relationship Management (CRM Quick QuoteCRM - Free Report) software, with shares seeing post-earnings positivity following back-to-back releases.

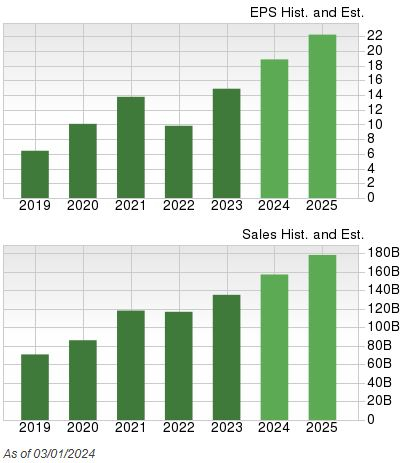

The revisions trend for its current fiscal year has remained bullish over the entire last year, with the $9.54 Zacks Consensus EPS estimate up 8% during the period and suggesting year-over-year growth of 16%.

Image Source: Zacks Investment Research

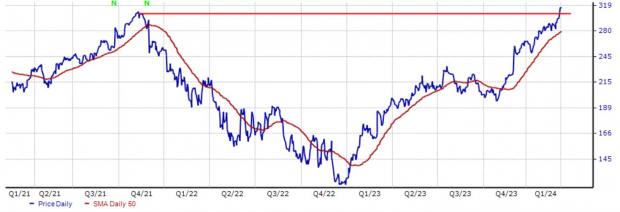

It’s worth noting that shares are busting out to all-time highs, notching a record daily close just on March 1st. Stocks making new highs tend to make even higher highs, particularly when positive earnings estimate revisions are present.

Image Source: Zacks Investment Research

Bottom Line

Above-average sales and earnings growth commonly leads to share outperformance, undoubtedly a welcomed development among investors.

And for those seeking companies with bright outlooks, all three above – Uber Technologies, Meta Platforms, and Salesforce – fit the strategy nicely.

In addition to rock-solid growth, all three sport a favorable Zacks Rank, providing bullish fuel.

More By This Author:

Will Costco Beat Estimates Again In Its Next Earnings Report?Comcast Stock Sinks As Market Gains: What You Should Know

AI's Winning Duos: BigBear.ai & Palantir, SoundHound AI & Nvidia

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any ...

more