3 Top-Ranked Stocks Tailored Toward Value Investors

Image Source: Unsplash

There are various approaches to investing, and investors can choose from different styles, including prioritizing generating income, targeting value stocks, or investing in particular industries.

Value-focused investors target mispriced stocks with the idea that others will eventually ‘catch on’ and recognize their actual value, which can lead to serious gains. After all, we all enjoy a nice deal.

And for those seeking stocks without stretched valuations – American Eagle Outfitters (AEO), AXIS Capital Holdings (AXS), and Ethan Allen Interiors (ETD) – could all be considerations.

In addition to sound valuation levels, all three sport a favorable Zacks Rank, indicating optimism among analysts. Let’s take a closer look at each.

American Eagle Outfitters

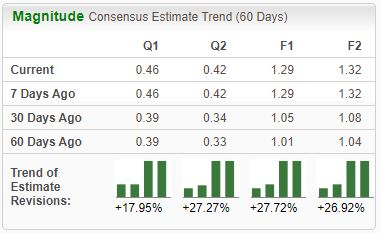

American Eagle Outfitters is a specialty retailer of casual apparel, accessories, and footwear for men and women. The stock is a Zacks Rank #1 (Strong Buy), with earnings expectations increasing across the board.

Image Source: Zacks Investment Research

AEO shares currently trade at a 12.7X forward earnings multiple, nowhere near the Zacks Retail and Wholesale sector average of 24.2X and five-year highs of 39.4X. The stock sports a Style Score of “A” for Value.

In addition, the company’s growth profile is hard to ignore, with the Zacks Consensus EPS Estimate of $1.29 for its current fiscal year suggesting 33% growth paired with a modest 2% revenue increase. AEO recently posted strong quarterly results, exceeding earnings expectations by more than 60% and posting a 1.1% sales surprise.

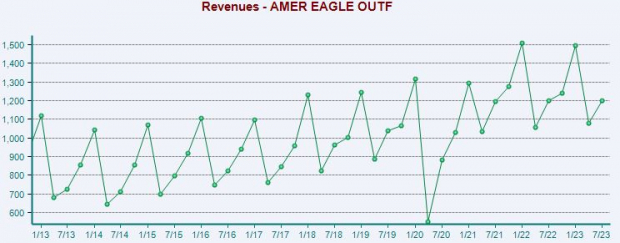

Below is a chart illustrating the company’s revenue on a quarterly basis.

Image Source: Zacks Investment Research

AXIS Capital Holdings

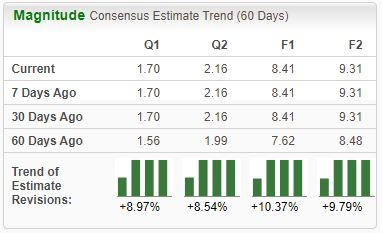

AXIS Capital, a current Zacks Rank #1 (Strong Buy), provides a broad range of specialty insurance and reinsurance solutions to its clients on a worldwide basis through operating subsidiaries and branch networks. Analysts have taken their earnings expectations higher across all timeframes.

Image Source: Zacks Investment Research

Income-focused investors could also be attracted to AXS shares, currently yielding a solid 3.1% annually paired with a payout ratio sitting sustainably at 27% of the company’s earnings. Dividend growth is also apparent, with the payout growing by a modest 2.4% annually over the last five years.

Image Source: Zacks Investment Research

Shares are cheap given the company’s growth trajectory, with earnings forecasted to climb 45% on 8% higher revenues in its current year. Shares presently trade at a small 6.9X forward earnings multiple, well beneath the 11.1X five-year median and highs of 13.2X in 2022.

Ethan Allen Interiors

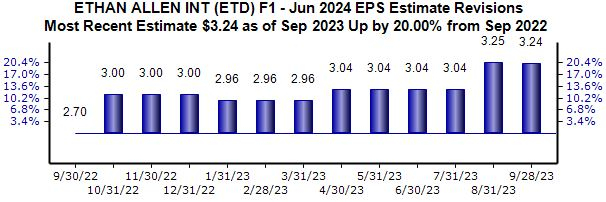

Ethan Allen Interiors is a leader in interior design, selling a full range of home furnishings through a retail network of design centers and its online website. The company sports the highly-coveted Zacks Rank #1 (Strong Buy), with earnings expectations increasing across several timeframes.

The revisions trend has been particularly potent for its current fiscal year expectations, with the $3.24 per share Zacks Consensus Estimate up 20% since September last year.

Image Source: Zacks Investment Research

Similar to AXS, those who prefer income could be attracted to ETD, as they currently yield 4.8% annually. The company has shown a notable commitment to increasingly rewarding shareholders, boasting a 15% five-year annualized dividend growth rate.

Bottom Line

Value-conscious investors are always looking for deals, sitting in the shadows and waiting for the rest of the crowd to catch on. The strategy can be quite lucrative, especially when it’s paired with the Zacks Rank.

And for those seeking stocks with sound valuations, all three above – American Eagle Outfitters, AXIS Capital Holdings, and Ethan Allen Interiors – precisely fit the criteria. On top of sound valuations, all three sport a favorable Zacks Rank, indicating optimism among analysts.

More By This Author:

Constellation Brands Reports Next Week: Wall Street Expects Earnings Growth

3 Dividend Growers To Buy For Passive Income

Nike Q1 Earnings Beat Estimates

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any specific ...

more