3 Top-Ranked Stocks Breaking 52-Week Highs

Image Source: Unsplash

Stocks making new highs tend to make even higher highs, especially when analysts' positive earnings estimate revisions begin rolling in.

And by targeting stocks breaking out or near new highs, investors find themselves in favorable trends where buyers are in control.

With the market’s rebound in 2023, many stocks are now near or breaking 52-week highs, including NetEase (NTES), Pinterest (PINS), and Stride Inc. (LRN).

In addition to seeing favorable price action, all three have enjoyed positive earnings estimate revisions, indicating optimism among analysts. Let’s take a closer look at each.

NetEase

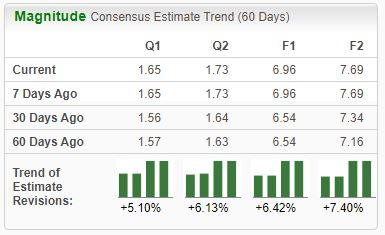

NetEase, a current Zacks Rank #1 (Strong Buy), is a Chinese internet technology company engaged in developing applications, services, and other technologies. Analysts have raised their earnings expectations across the board.

Image Source: Zacks Investment Research

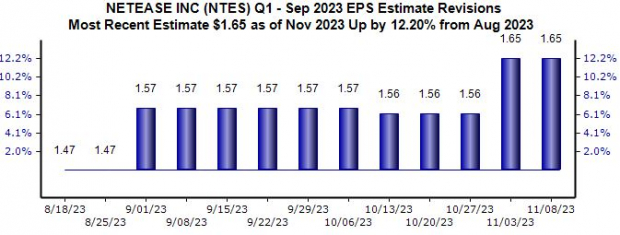

Keep an eye out for the company’s upcoming release expected on November 16th, as the Zacks Consensus EPS Estimate of $1.65 has been taken 12% higher since just mid-August. The company is forecasted to post $3.8 billion in revenue, 11% higher than the year-ago period.

Image Source: Zacks Investment Research

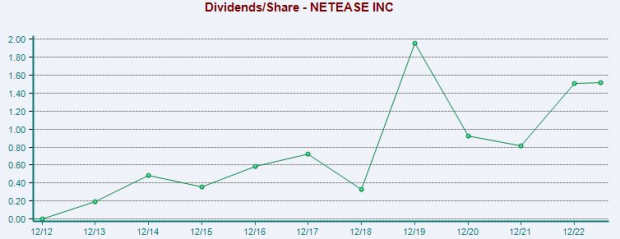

NTES shares also pay a dividend, currently yielding 1.9% annually. And the company has shown a commitment to increasingly rewarding shareholders, boasting a 27% five-year annualized dividend growth rate.

Please note that the chart below is on an annual basis.

Image Source: Zacks Investment Research

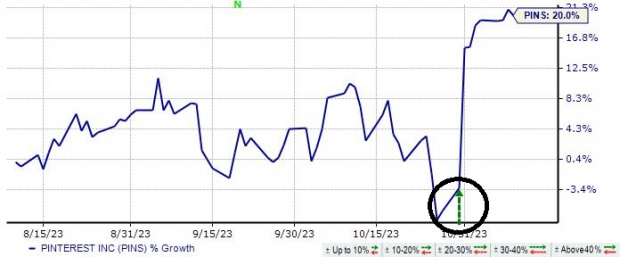

Pinterest provides a platform to show its users visual recommendations based on their personal tastes and interests, generating revenues by delivering ads on its website and mobile application. The company’s shares have found momentum following its latest quarterly release, as we can see illustrated below.

Image Source: Zacks Investment Research

Regarding the recent release, the company posted a 33% EPS beat and reported sales 3% ahead of expectations. In addition, monthly active users totaled 482 million, improving 8% year-over-year and reflecting continued platform expansion.

The company’s top line has primarily remained steady, showing consistent improvement.

Image Source: Zacks Investment Research

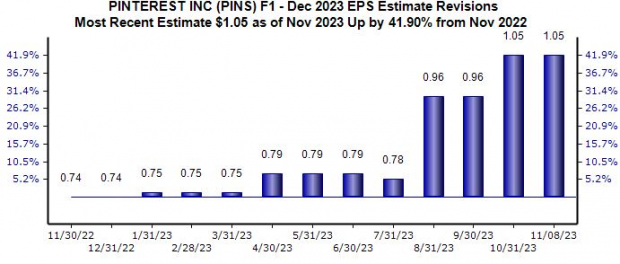

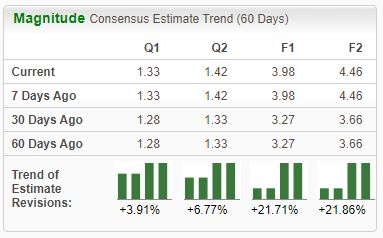

Analysts have taken their current year expectations notably higher, with the current $1.05 Zacks Consensus EPS Estimate being revised 40% higher over the last year. The stock is currently a Zacks Rank #1 (Strong Buy).

Image Source: Zacks Investment Research

Stride Inc.

Stride, a current Zacks Rank #1 (Strong Buy), is a premier provider of K-12 education for students, schools, and districts, including career learning services through middle and high school curricula. Analysts have lifted their earnings expectations across the board.

Image Source: Zacks Investment Research

The company posted a notably strong print in its latest release, exceeding the Zacks Consensus EPS Estimate by more than 120% and posting revenue 5% ahead of expectations. Shares have consistently been boosted post-earnings in 2023, as we can see below.

Image Source: Zacks Investment Research

Stride also carries solid growth expectations, with estimates alluding to 34% earnings growth in its current year on 9% higher sales. Shares currently trade at a 14.3X forward earnings multiple (F1), beneath the 17.9X five-year median and five-year highs of 64.1X.

Image Source: Zacks Investment Research

Bottom Line

Stocks nearing or breaking 52-week highs reflect considerable momentum, with positive earnings estimates from analysts commonly providing the fuel needed to continue climbing.

And for those interested in stocks seeing notable buying pressure, all three above – NetEase, Pinterest, and Stride Inc. – precisely fit the criteria.

In addition to favorable price action, all three have seen their near-term earnings outlooks shift positively.

More By This Author:

Will Continued Inflation Hurt Home Depot's Q3 Earnings?Compared To Estimates, Biogen Inc. Q3 Earnings: A Look At Key Metrics

Gilead Sciences Tops Q3 Earnings And Revenue Estimates

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any specific ...

more