3 Top-Ranked Small-Caps Delivering Large Gains

Image Source: Unsplash

Small-caps have found plenty of buyers over the last few months, undoubtedly a welcomed development as investors look to find strength outside of large-caps.

Many small-cap stocks turn out to be big winners in the long run, and they typically have less analyst coverage, providing investors an opportunity to get in somewhat "early" before the crowd. Of course, investors also need to be aware of their increased volatility.

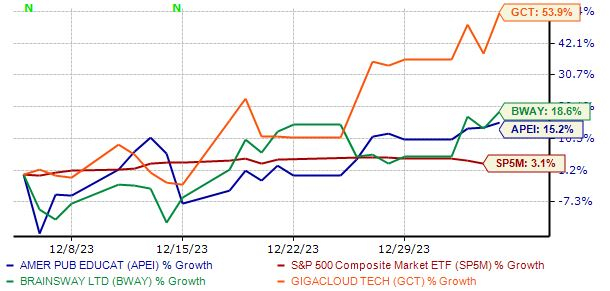

For those seeking exposure to small-caps, three stocks – BrainsWay (BWAY), GigaCloud Technology (GCT), and American Public Education (APEI) – could all be considered.

All three have seen positive price action over the last month and have enjoyed positive earnings estimate revisions, with the latter indicating optimism among analysts. Let’s take a closer look at each.

Image Source: Zacks Investment Research

GigaCloud Technology

GigaCloud Technology Inc. is a pioneer of global end-to-end B2B e-commerce solutions for large parcel merchandise. Their platform integrates various aspects of e-commerce, including product discovery, payment processing, and logistics, to streamline the buying and selling process for large items.

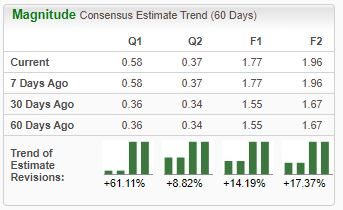

Analysts have taken their earnings expectations higher across the board, landing the stock into a Zacks Rank #1 (Strong Buy).

Image Source: Zacks Investment Research

The company’s latest quarterly results caused shares to melt higher post earnings, with GCT exceeding the Zacks Consensus EPS Estimate by more than 50% and reporting revenue 8% ahead of expectations. GCT posted its third consecutive quarter of record profitability and saw its gross margin improve to 27.4% vs. 17.6% in the year prior.

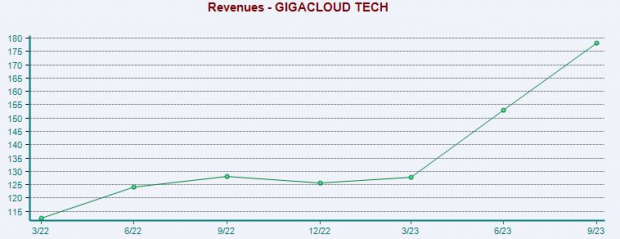

As we can see below, the company’s top line has seen a notable acceleration.

Image Source: Zacks Investment Research

GCT’s growth trajectory also remains bright, with consensus estimates for its current fiscal year (FY23) suggesting 200% earnings growth on nearly 40% higher sales. Peeking a bit ahead, consensus FY24 expectations indicate an 11% earnings boost paired with a 48% revenue bump.

BrainsWay

BrainsWay is a medical device company focused on the development and sale of non-invasive neuromodulation products using Deep Transcranial Magnetic Stimulation (TMS) technology for the treatment of major depressive disorder and obsessive-compulsive disorder.

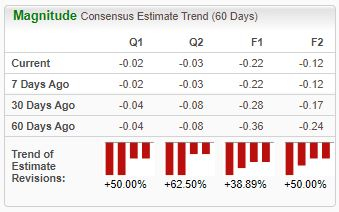

The stock is currently a Zacks Rank #1 (Strong Buy), with analysts raising their expectations across all timeframes.

Image Source: Zacks Investment Research

Like GCT, better-than-expected quarterly results have helped shares find buyers post-earnings and continue their bullish trend. BrainsWay has benefited from continued strong demand for its TMS technology, helping drive 61% year-over-year revenue growth throughout its latest period (2023 Q3).

The green arrows circled in the chart below represent quarterly releases.

Image Source: Zacks Investment Research

BrainsWay expects positive operating income and higher adjusted EBITDA for its Q4, driven by strong revenue generation and successful cost-optimizing measures. The company’s earnings are forecasted to climb 45% on 14% higher sales in its current year.

American Public Education

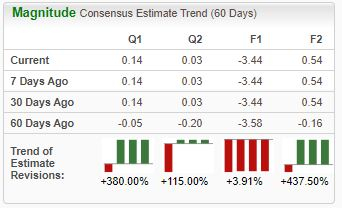

American Public Education is an online provider of higher education focused on serving the military and public service communities. The stock sports a Zacks Rank #1 (Strong Buy), with analysts raising their expectations.

Image Source: Zacks Investment Research

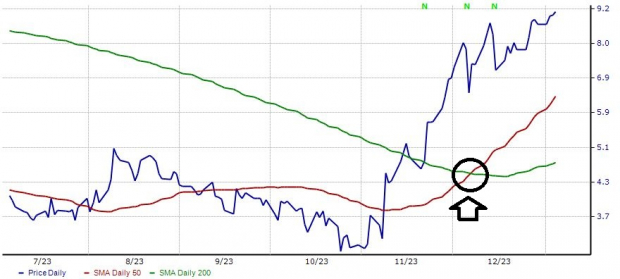

APEI shares have also recently experienced the ‘Golden Cross,’ as illustrated in the chart below. The Golden Cross occurs when the shorter 50-day moving average rises above the 200-day moving average, reflecting bullish momentum.

Image Source: Zacks Investment Research

Zacks Consensus EPS Estimates for its current and next fiscal year presently suggest growth rates of 43% and 115%, respectively.

Bottom Line

Small-cap stocks can be solid considerations for those who can handle a higher level of volatility and have a less conservative approach.

While their price swings can undoubtedly become spooky, their growth potential is impressive.

And all three above – BrainsWay, GigaCloud Technology, and American Public Education – boast strong growth trajectories paired with improved earnings outlooks and positive price action.

More By This Author:

2 Agriculture Stocks To Buy For The New Year3 Airline Stocks That Could Fly Higher In 2024

3 Healthcare Mutual Funds For Remarkable Returns

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any specific ...

more