3 Top-Ranked, Market-Beating Stocks To Buy

The S&P 500 and the Nasdaq ripped higher after the Fed signaled on Wednesday that three interest rate cuts were still on the table in 2024. Wall Street is now more hopeful about rate cuts starting in June or July vs. September or beyond.

Of course, healthy pullbacks will be thrown in throughout 2024. But as long as earnings results and guidance are relatively solid (starting with Q1), the bulls appear poised to remain in control.

Textron Inc. (TXT)

Textron is an aerospace and defense industry standout that also operates commercial segments, including Arctic Cat and private aviation giant Cessna. TXT’s Bell division landed a massive contract with the U.S. Army in late 2022 for its next-generation helicopters.

Textron’s earnings outlook for 2024 and 2025 have climbed higher and higher to help TXT land a Zacks Rank #1 (Strong Buy). TXT is also set to post its best stretch of revenue growth in the past 30 years.

(Click on image to enlarge)

Image Source: Zacks Investment Research

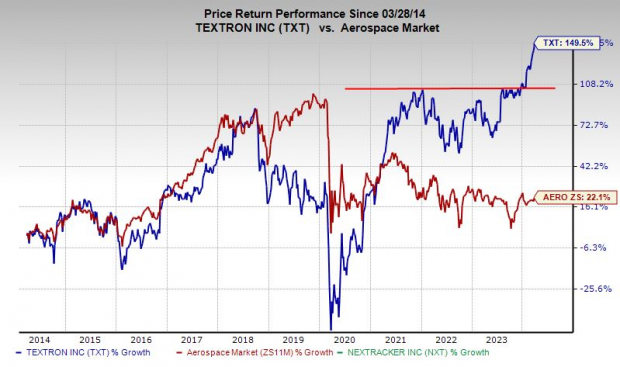

Textron shares have outclimbed the Zacks Aerospace sector over the last 20 years and blown away that group during the last 10 years, up 150% vs. 22%. TXT has soared over 40% in the past year and 20% YTD. Textron broke out of a trading range in January and sits at new highs.

(Click on image to enlarge)

Image Source: Zacks Investment Research

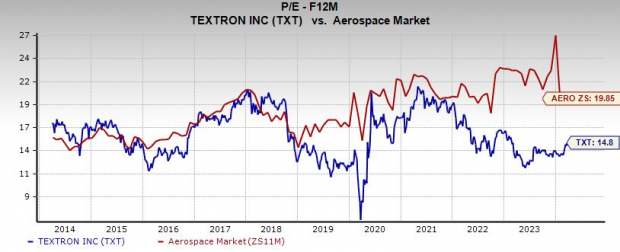

Despite the surge, Textron trades at a 26% discount to its sector and 30% below its 10-year highs at 14.8X forward 12-month earnings. At under $100 per share, TXT might look attractive to some compared to industry peers such as Lockheed Martin (LMT) which trades for over $400 a share.

AppLovin (APP)

AppLovin designs end-to-end software solutions to help app developers improve marketing, revenue generation, and more to drive profitable expansion. AppLovin’s offerings are critical in the competitive world of digital apps, where countless companies fight for awareness and screentime.

The company’s earnings outlook is soaring, driven by its AI-based updates and ability to drive ROI for clients across phones, connected-TV, and beyond.

(Click on image to enlarge)

Image Source: Zacks Investment Research

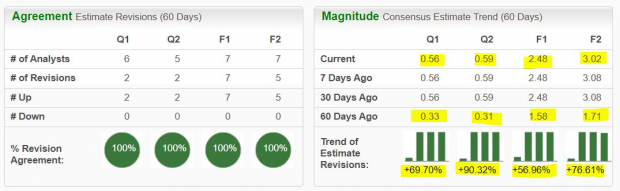

APP’s big beat-and-raise fourth quarter has seen its FY24 consensus surge 57%, with its FY25 outlook 77% higher. APP’s bottom line positivity helps it land a Zacks Rank #1 (Strong Buy) right now.

(Click on image to enlarge)

Image Source: Zacks Investment Research

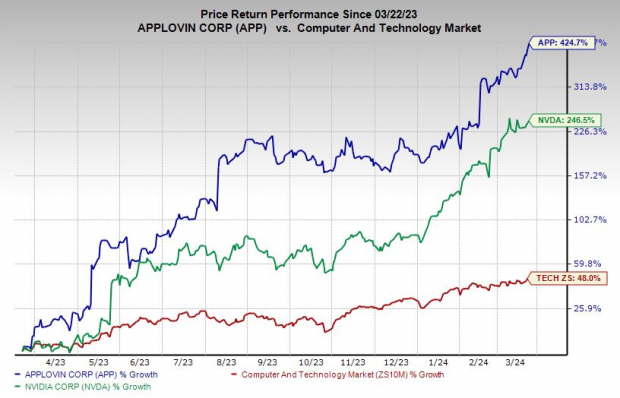

APP shares have skyrocketed 420% over the last year to blow away Nvidia’s (NVDA) 250%, including an 80% YTD surge. Despite its run, AppLovin trades 30% below its record highs. On the valuation front, APP trades at a 45% discount to its median and not too far above tech at 26.9X forward 12-month earnings.

Nextracker Inc. (NXT)

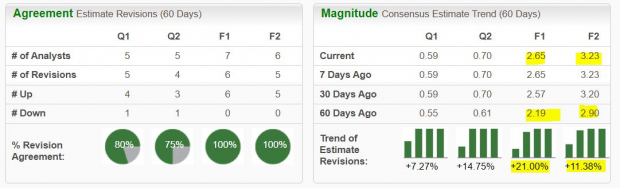

Nextracker is a solar tracker maker, with offerings that constantly reposition solar panels and modules. NXT’s EPS outlook has gone straight up since its February 2023 IPO, including recent positivity that earns it a Zacks Rank #1 (Strong Buy). The solar industry suffered a rough stretch. But interest rates have peaked and some nearly unstoppable forces are set to drive solar expansion.

(Click on image to enlarge)

Image Source: Zacks Investment Research

Nextracker is projected to post 29% revenue growth in FY24 and 17% in FY25. NXT’s adjusted EPS are set to skyrocket from $0.24 per share to $2.65 in FY24 and jump 22% higher next year. It crushed our bottom-line estimates by over 90% in the past two quarters.

(Click on image to enlarge)

Image Source: Zacks Investment Research

NXT stock has climbed by over 90% since its IPO vs. the solar industry’s 50% tumble. Nextracker has popped 25% YTD but it has moved sideways since the end of January.

The stock trades at a 21% discount to its highs and below the Zacks solar industry at 22.9X forward 12-month earnings. Wall Street is very high on Nextracker, with 20 of the 22 brokerage recommendations Zacks has sitting at “Strong Buys.”

More By This Author:

3 Soaring Top-Ranked Stocks To Buy For Long-Term ValueBull Of The Day: Veeva Systems Inc.

3 Standout Tech Stocks Down At Least 15% - Time To Buy?

Disclaimer: Neither Zacks Investment Research, Inc. nor its Information Providers can guarantee the accuracy, completeness, timeliness, or correct sequencing of any of the Information on the Web ...

more