3 Top-Ranked Large Caps To Buy For Growth

Large-cap stocks are frequently targeted among investors. They typically have greater stability and a proven track record, two reasons why they're beloved.

They also frequently pay dividends, providing another advantage for those seeking exposure. Large caps typically aren't as explosive as small-cap stocks, being tailored toward more conservative investors.

Still, many large-caps carry favorable growth expectations, including Alphabet (GOOGL - Free Report), Progressive (PGR - Free Report), and Arista Networks (ANET - Free Report).

All three carry a favorable Zacks Rank, reflecting upward earnings estimate revisions among analysts. Let’s take a closer look at each.

Video Length: 00:01:00

Arista Networks

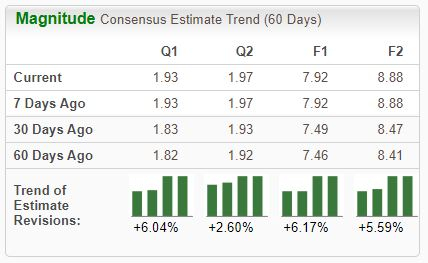

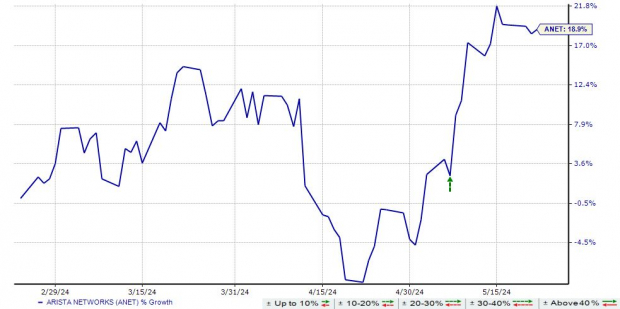

Arista Networks provides cloud networking solutions for data centers and cloud computing environments. The stock is a solid consideration for those seeking AI exposure, currently sporting a Zacks Rank #1 (Strong Buy) with earnings expectations higher across the board.

Image Source: Zacks Investment Research

The company’s quarterly results have regularly brought post-earnings fireworks, exceeding the Zacks Consensus EPS estimate by an average of 15% across its last four releases. Shares melted higher post-earnings following its latest release, reflective of the robust results.

Image Source: Zacks Investment Research

Progressive

Progressive is a leading independent agency writer of private passenger auto coverage and the market share leader for motorcycle products since 1998. Analysts have raised their earnings expectations across the board, landing the stock into a Zacks Rank #1 (Strong Buy).

Image Source: Zacks Investment Research

The stock remains a prime consideration for growth-focused investors, with consensus expectations for its current fiscal year (FY24) suggesting 90% earnings growth. Peeking ahead to FY25, expectations currently allude to an additional 4.5% growth in earnings on nearly 32% higher sales.

Image Source: Zacks Investment Research

Alphabet

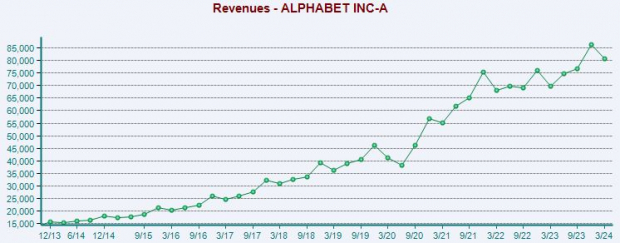

A member of the beloved ‘Mag 7’ group, GOOGL shares have been notably strong year-to-date, gaining 26% and widely outperforming relative to the S&P 500. The stock sports a Zacks Rank #1 (Strong Buy), with earnings expectations higher across all timeframes.

Image Source: Zacks Investment Research

Like ANET, the company has consistently exceeded quarterly expectations as of late, beating our consensus EPS estimate by an average of 11% across its last four releases. Impressively, GOOGL posted 61% EPS growth paired with a 15% year-over-year sales climb in its latest quarterly print.

Below is a chart illustrating the company’s revenue on a quarterly basis.

Image Source: Zacks Investment Research

Bottom Line

Large caps are found in nearly every portfolio, as their stable nature and successful track records are impossible to ignore.

And for those seeking large-cap exposure, all three stocks above – Alphabet, Progressive, and Arista Networks – could be great considerations, all boasting improved earnings outlooks.

More By This Author:

Nvidia Earnings Loom: A Closer LookDividend Watch - 3 Companies Boosting Payouts

3 Stocks To Buy Following Positive Earnings Results