3 Top-Ranked Large Caps To Buy For A Steady Approach

Image: Shutterstock

Large cap stocks can often be seen in almost every portfolio. They carry a well-established nature, have greater analyst coverage, and commonly pay dividends, all of which make them so popular. Of course, their steady nature may not appeal to all. Still, the decreased volatility large caps often possess may be well worth it in the eyes of more conservative investors.

For those seeking large cap exposure, three stocks – Arch Capital Group (ACGL - Free Report), PACCAR (PCAR - Free Report), and Aflac (AFL - Free Report) – have all seen their near-term outlooks shift positively. Here is a closer look at each.

Arch Capital Group

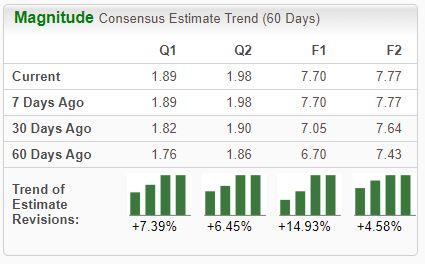

Arch Capital Group writes insurance, reinsurance, and mortgage insurance worldwide. The stock is a Zacks Rank #1 (Strong Buy), with earnings expectations recently seen moving higher across the board.

Image Source: Zacks Investment Research

ACGL shares don't seem expensive given its forecasted growth, with consensus expectations for its current fiscal year suggesting 60% earnings growth on 32% higher sales. Shares have recently been seen trading at a 10.7X forward earnings multiple (F1), nicely beneath the 12.5X five-year median.

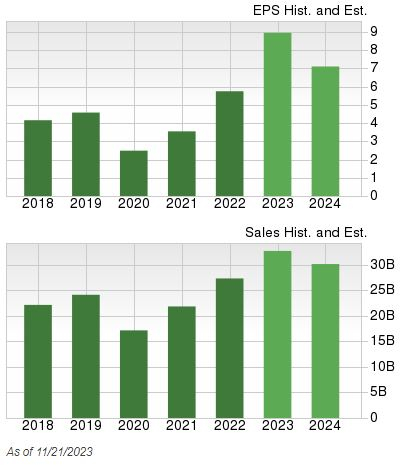

The company’s revenue growth has been strong, as we can see in the annual chart below.

Image Source: Zacks Investment Research

It’s worth noting that Arch Capital has been a stellar earnings performer, exceeding the Zacks Consensus EPS Estimate by an average of 35% across its last four releases. Just in its latest print, ACGL posted a 50% EPS beat and posted revenue 2% ahead of expectations.

PACCAR

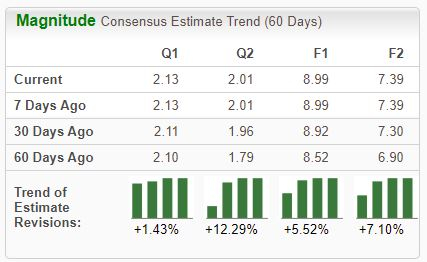

PACCAR, a current Zacks Rank #2 (Buy), is a global leader in the design, manufacture, and customer support of high-quality premium trucks. Analysts have taken their earnings expectations higher across all timeframes.

Image Source: Zacks Investment Research

Like ACGL, it’s hard to ignore the company’s forecasted growth, with consensus expectations for its current fiscal year (FY23) suggesting 56% earnings growth on 20% improved sales. Growth cools in FY24, as expectations allude to an 18% pullback in the bottom line on modestly lower sales.

Image Source: Zacks Investment Research

Shares also provide a passive income stream, yielding a respectable 1.2% annually. While the yield may not entice all, the company’s 5% five-year annualized dividend growth rate helps to pick up the slack nicely.

Aflac

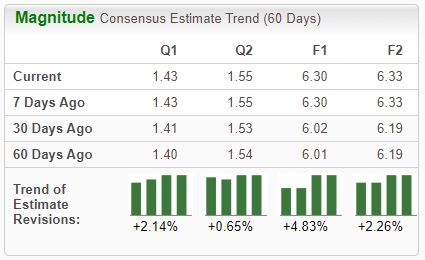

Aflac, a current Zacks Rank #2 (Buy), is an American insurance company and a massive supplier of supplemental insurance within the United States. The company has seen modest positive earnings estimate revisions among all timeframes.

Image Source: Zacks Investment Research

Like ACGL, Aflac has consistently posted bottom line results above expectations, exceeding the Zacks Consensus EPS Estimate by an average of 15% across its last four releases. Just in its latest print, Aflac posted a 28% EPS beat and reported sales nearly 11% above the consensus.

In addition, the company is a member of the elite Dividend Aristocrats group, reflecting its commitment to shareholders through a minimum of 25+ years of increased payouts. AFL shares yield a solid 2.1% annually, with a payout ratio sitting sustainably at 30% of its earnings.

Please note that the chart below is on an annual basis.

Image Source: Zacks Investment Research

Bottom Line

Large caps are found in nearly every portfolio, as their stable nature and successful track records are impossible to ignore. And for those seeking large cap exposure, all three stocks discussed above – Arch Capital Group (ACGL - Free Report), PACCAR (PCAR - Free Report), and Aflac (AFL - Free Report) – could be great considerations, as all boast improved earnings outlooks.

More By This Author:

Insiders Are Buying These 3 Tech StocksTime to Buy These Affordable Tech Stocks for More Upside

Best & Worst ETFs Of November

Disclaimer: Neither Zacks Investment Research, Inc. nor its Information Providers can guarantee the accuracy, completeness, timeliness, or correct sequencing of any of the Information on the Web ...

more