3 Top-Ranked Dividend Aristorats To Buy For Income

Dividends provide many clear benefits, including a passive income stream, the ability to reap maximum returns through dividend reinvestment, and a buffer against drawdowns in other positions.

Many investors pivot to the Dividend Aristocrats when looking to generate an income stream. After all, it’s easy to understand why – these companies have upped their payouts for at least 25 consecutive years, which displays their reliability.

Currently, several members of the club, including IBM (IBM), PepsiCo (PEP) , and Target (TGT) , have seen their earnings outlooks shift positively, indicating bullishness among analysts.

For those interested in consistent and reliable payouts, let’s take a closer look at each.

IBM

IBM’s latest set of quarterly results excited the market, with shares moving well higher post-earnings and continuing a recent trend of post-earnings bullishness. The company touted its recent AI demand, undoubtedly to the likes of investors.

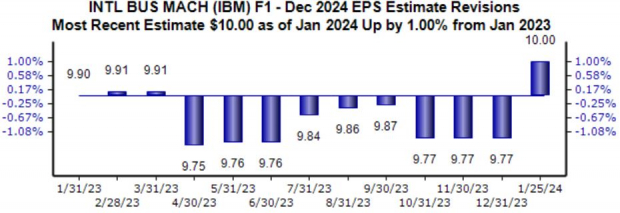

Analysts took their expectations higher for the company’s current fiscal year following the release, as we can see below.

(Click on image to enlarge)

Image Source: Zacks Investment Research

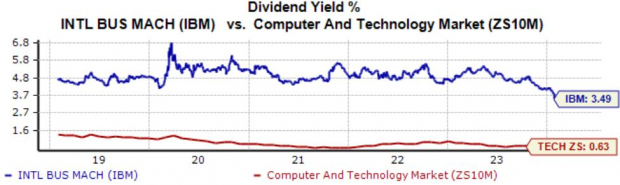

IBM shares pay a healthy dividend, yielding a sizable 3.5% annually and well above the respective Zacks Computer and Technology sector average. Dividend growth is also solid, with the company carrying an 0.8% five-year annualized dividend growth rate.

(Click on image to enlarge)

Image Source: Zacks Investment Research

Value-conscious investors may be steered away, with the current 19.4X forward earnings multiple well above the 12.7X five-year median and sitting at a five-year high. Still, investors have had little issue forking up the premium given the company’s bright outlook on AI.

PepsiCo

PepsiCo is an American multinational beverage, food, and snack corporation headquartered in New York. The stock is currently a Zacks Rank #2 (Buy), with earnings expectations rising modestly higher across several timeframes.

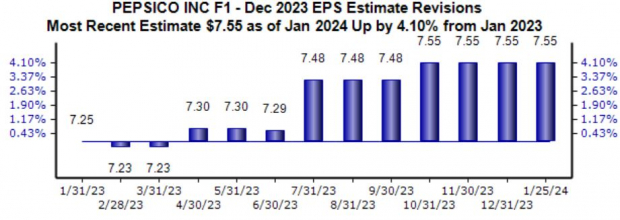

The revisions trend has been particularly strong for its current fiscal year, with the $7.55 Zacks Consensus EPS Estimate up 4% over the last year.

(Click on image to enlarge)

Image Source: Zacks Investment Research

PEP shares presently yield 3% annually, in line with the Zacks Consumer Staples sector average. Dividend growth has been strong, with PepsiCo boasting a 6.7% five-year annualized dividend growth rate.

(Click on image to enlarge)

Image Source: Zacks Investment Research

Target

Target has evolved from a pure brick-and-mortar retailer to an omnichannel entity, modernizing its supply chain to compete with pure e-commerce players.

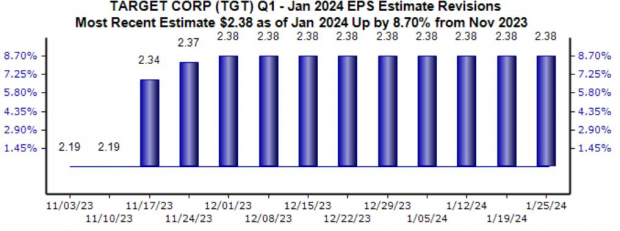

The stock is a Zacks Rank #2 (Buy), with the revisions trend for its upcoming release bullish, up nearly 9% since last November and suggesting growth of 26% from the year-ago period.

(Click on image to enlarge)

Image Source: Zacks Investment Research

The company’s profitability picture is expected to improve in a big way, with consensus expectations for its current year suggesting 40% year-over-year growth amid a more favorable operating environment.

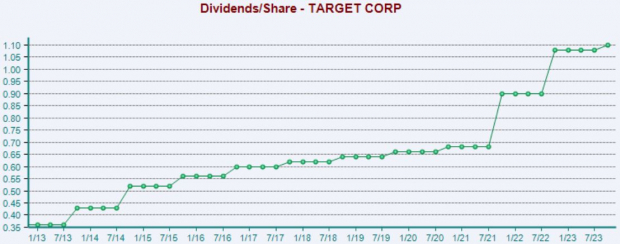

Target’s dividend growth is the most impressive of all, as the company carries a sizable 15% five-year annualized dividend growth rate. Shares presently yield 3.1% annually paired with a sustainable payout ratio sitting at 56% of its earnings.

(Click on image to enlarge)

Image Source: Zacks Investment Research

Bottom Line

Many investors pivot to the Dividend Aristocrats when looking to generate an income stream.

After all, it’s easy to understand why; these companies have upped their payouts for a minimum of 25 consecutive years, fully reflecting their reliability.

And all three members of the club above – IBM, PepsiCo, and Target – have all seen their near-term earnings outlooks drift higher, indicating optimism among analysts.

More By This Author:

5 Timeless Investing Principles Reaffirmed

Should Investors Buy The Dip In Intel's Stock After Earnings?

3 Intriguing Stocks To Buy After Earnings