3 Tech Stocks Suited Nicely For Income Investors

Image Source: Unsplash

Tech stocks have been red-hot in 2023, delivering outsized gains. They’ve jumped back in favor following a tough 2022, with expectations of a less-hawkish fed helping drive performances.

Other than tech stocks, investors also love dividends, as they can provide a nice buffer against drawdowns in other positions and a passive income stream.

Interestingly enough, several tech stocks – Microsoft (MSFT - Free Report), NetEase (NTES - Free Report), and International Business Machines (IBM - Free Report) – reward their shareholders with quarterly payouts.

Let’s take a closer look at each.

Microsoft

Microsoft shares have been big-time outperformers in 2023 thanks to artificial intelligence excitement and a broader sentiment shift overall. Analysts have taken a bullish stance on the company’s current year outlook, with the $11.13 Zacks Consensus EPS Estimate 2% higher over the last year.

Image Source: Zacks Investment Research

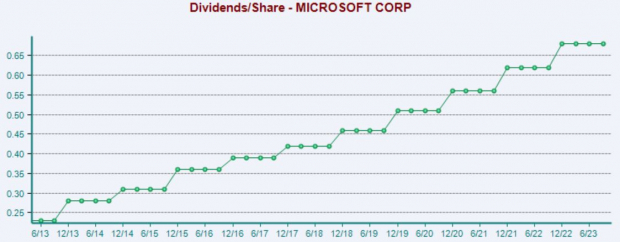

MSFT shares presently yield a respectable 0.8% annually, modestly above the respective Zacks sector average. And the tech titan has shown a commitment to shareholders, carrying a 10% five-year annualized dividend growth rate.

Image Source: Zacks Investment Research

Microsoft’s cash-generating abilities help secure the payout. The company generated a sizable $59.5 billion in free cash flow in FY23, with the trailing twelve-month figure totaling an equally impressive $63.3 billion.

NetEase

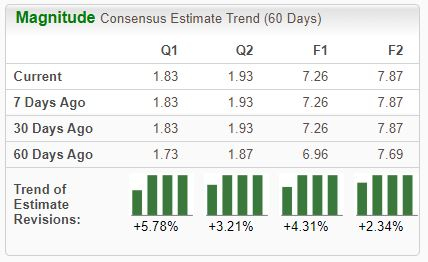

NetEase, Inc. is an Internet technology company engaged in the development of applications, services, and other technologies for the Internet in China. The stock is a Zacks Rank #2 (Buy), with earnings expectations moving higher across all timeframes.

Image Source: Zacks Investment Research

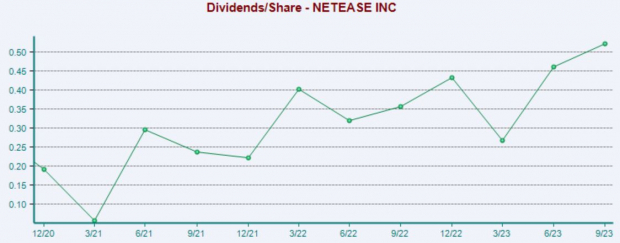

Shares currently yield a solid 2.3% annually paired with a sustainable payout ratio sitting at 36% of the company’s earnings. And NetEase has shown a notable commitment to increasingly rewarding shareholders, boasting a 27% five-year annualized dividend growth rate.

Image Source: Zacks Investment Research

In addition, the company’s growth profile is impossible to ignore, with consensus expectations for its current year suggesting 45% earnings growth on 2% higher sales. Peeking ahead to FY24, estimates allude to an additional 8% earnings growth paired with a 12% revenue bump.

IBM

IBM is an information technology (IT) company. Shares have been considerable outperformers over the last three months, up 18% compared to the S&P 500’s 11% gain on the back of better-than-expected quarterly results.

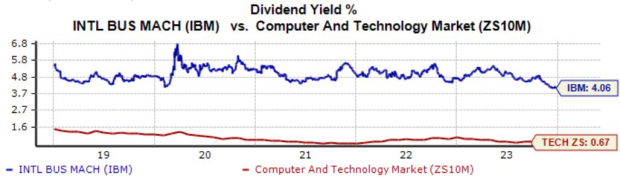

Shares currently yield a sizable 4.1% annually, nowhere near the 0.7% average within the Zacks Computer and Technology sector. Impressively, the company is a member of the elite Dividend Aristocrats group, showing a commendable commitment to shareholders through 25+ years of increased payouts.

Image Source: Zacks Investment Research

Bottom Line

Investors love tech stocks. And dividends.

For those seeking exposure to each, all three above – Microsoft (MSFT - Free Report), NetEase (NTES - Free Report), and International Business Machines (IBM - Free Report) – fit the criteria nicely.

More By This Author:

2 Energy Stocks To Buy With Robust Bottom Lines Going Into 20243 Stocks Displaying Considerable Momentum Heading Into 2024

3 Top Efficient Stocks To Enrich Your Portfolio In 2024

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any specific ...

more