3 Stocks With Juicy Dividend Yields Greater Than 20%

It’s common for investors to park their hard-earned cash into income-generating assets. Paydays are, after all, the best.

In a historically-volatile 2022, dividends have become a hot topic.

And it’s easy to understand why – dividends help alleviate drawdowns in other positions, and of course, it provides more than one way to reap a return from your investment.

It’s common for companies to up their dividend payouts when business is fruitful, making them enticing investments for income-focused investors from a shorter-term perspective.

Three stocks that currently carry an annual dividend yield above 20% – Petroleo Brasileiro S.A. Petrobras (PBR) , Star Bulk Carriers Corp. (SBLK) , and Golden Ocean Group Limited (GOGL) – could all be of interest to income-focused investors looking to build a cash pile quick.

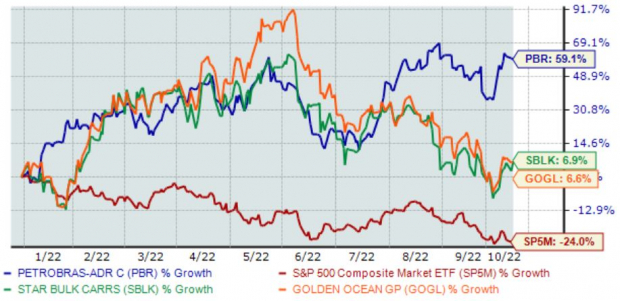

Below is a chart illustrating the share performance of all three companies in 2022, with the S&P 500 blended in as a benchmark.

Image Source: Zacks Investment Research

Let’s take a deeper dive into each one.

Petroleo Brasileiro S.A.

Petroleo Brasileiro S.A. (or Petrobras S.A.) is Brazil’s largest integrated energy firm, with operations in the exploration, production, and distribution of oil and gas.

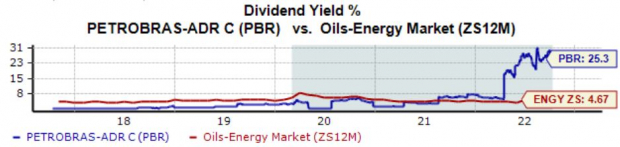

PBR’s dividend metrics would thrill any income investor; the company’s annual dividend currently yields a massive 25.3%, notably higher than its Zacks Sector average of an already steep 4.7%.

Even more impressive, the company has upped its dividend payout 11 times over the last five years, paired with a triple-digit 145% five-year annualized dividend growth rate.

PBR’s payout ratio sits at 80% of earnings.

(Click on image to enlarge)

Image Source: Zacks Investment Research

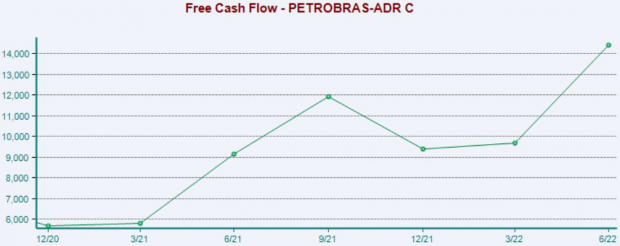

Further, the company carries a strong free cash flow; PBR reported quarterly free cash flow of a steep $14.4 billion in its latest quarter (Q2 2022), good enough for a 50% sequential increase and a 58% Y/Y uptick.

Image Source: Zacks Investment Research

Golden Ocean Group Limited

Golden Ocean Group Limited is a shipping company engaging in the transportation of dry bulk cargoes, operating primarily in the Capesize and Panamax market.

GOGL’s annual dividend yield currently comes in at a steep 28.9%, with a payout ratio sitting at 61% of earnings.

The company has also consistently upped its dividend payout, with nine dividend increases over the last five years and a substantial 66.4% five-year annualized dividend growth rate.

(Click on image to enlarge)

Image Source: Zacks Investment Research

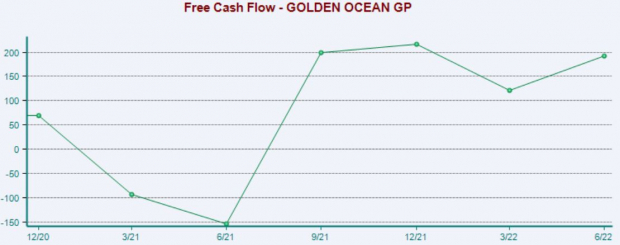

In addition, the company has a strong free cash flow trend – GOGL’s free cash flow came in at $192 million in its latest quarterly print (Q2 2022), reflecting a sizable 57% sequential increase.

(Click on image to enlarge)

Image Source: Zacks Investment Research

Star Bulk Carriers

Star Bulk Carriers is a global shipping company that provides seaborne transportation solutions in the dry bulk sector.

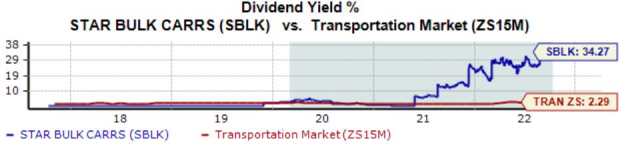

SBLK’s annual dividend comes in at the highest of all three, sitting at 34.3% with a payout ratio of 74% of earnings.

The company has shown a stellar commitment to increasingly rewarding its shareholders, upping its dividend payout five times over the last five years with a substantial 500% five-year annualized dividend growth rate.

(Click on image to enlarge)

Image Source: Zacks Investment Research

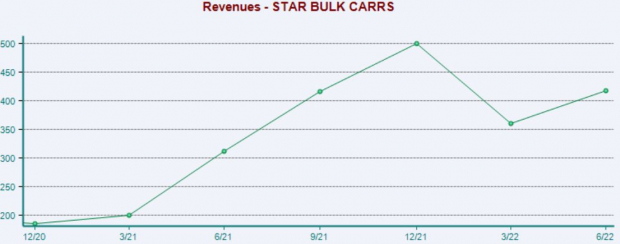

Further, SBLK has a strong earnings track record as of late, exceeding revenue and earnings estimates in each of its previous four quarterly prints. Below is a chart illustrating the company’s revenue on a quarterly basis.

(Click on image to enlarge)

Image Source: Zacks Investment Research

Bottom Line

Investing for an income stream is a widely-deployed strategy.

And all three stocks above - Petroleo Brasileiro S.A. Petrobras (PBR) , Star Bulk Carriers Corp. (SBLK) , and Golden Ocean Group Limited (GOGL) – pay investors handsomely, currently carrying annual dividend yields greater than 20%.

Still, investors should be highly aware that steep annual dividend yields can be unsustainable from a long-term perspective and typically get cut when business isn’t as fruitful, perhaps steering away income investors that prefer reliability.

For those seeking stability in dividends, pivoting to companies that are part of the elite Dividend King group would be a great alternative.

Dividend Kings have upped their dividend payouts for a minimum of 50 consecutive years.

More By This Author:

Is Food Inflation Here to Stay?The Bank of New York Mellon Corporation Earnings Expected to Grow: What to Know Ahead of Next Week's Release

Wall Street Waits For Q3 2022 Earnings To Kick Off

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any specific ...

more