3 Stocks To Watch Before The Market Opens Tomorrow (October 21, 2016)

(Click on image to enlarge)

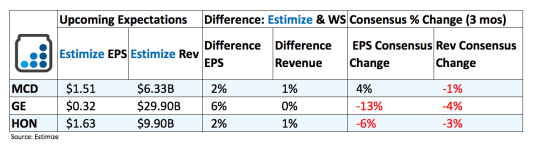

McDonald’s (MCD): After the implementation of a strategic turnaround plan last year, McDonald’s seems to be heading for its first road block in Q3. Despite 5 quarters of earnings growth, mostly brought about by share buybacks, revenue growth has been declining for 8 consecutive quarters. Popular menu introductions such as all day breakfast and the McPick 2 have lead to an increase in foot traffic, but not prolonged traffic, and they haven’t necessarily helped with the sales of other items. Another headwind may be a broader pullback in Europe after the Brexit ruling, and prolonged currency headwinds. McDonald’s has a huge presence in Europe with the region accounting for 37% of its total revenue.

One bright spot is the US consumer which remains healthy, with consumer sentiment and retail sales coming in strong for September. The consumer, however, has become very value focused, which could potentially help fast food restaurants like McDonald’s which continue to offer healthier options at value prices.

General Electric (GE): General Electric has been one of the least beaten down industrials. While the industry is expecting negative growth, GE is in line to record a 17% increase on the bottom line and 7% on the top. A majority of its growth has come from power, aviation and healthcare, which are now the largest divisions in the company following the divestiture of GE Capital. Meanwhile its new found fondness of technology is expected to help drive growth and streamline operations. General Electric, like many of the industrials, is beginning to embrace digital technology to prevent its own obsolescence.

Honeywell (HON): Honeywell was in the news recently after lowering its upper end sales and profit forecast range, due to a slowdown in its aerospace and aviation division. Honeywell said sales would fall 3% in the third quarter, compared to the crowd’s expectations of a 2% increase. For the year, profits are now expected to fall in the range of $6.60 to $6.64 a share, down from its previous forecast of $6.60-$6.70, with sales down 1-2% from a year earlier. The downturn comes largely due to a slowdown in its jet and general aviation business that started from a decline in the oil and gas industry. Analysts have edged down estimates since the announcement, that even the smallest beat could send shares soaring.

Disclosure: Each week, Forcerank runs a variety of games covering different industries. What we have found, is that the highest ranked companies in their ...

more

Thanks for sharing