3 Stocks To Watch As Trump Reaches Trade Deal With The U.K.: BP, NOMD, RYCEY

Image Source: Unsplash

The stock market’s historic rebound continued on Thursday as President Trump announced a new trade deal with the United Kingdom.

With the deal focused on reducing trade barriers, it’s noteworthy that several British ADRs (American Depository Receipts) are standing out and may be worthy of investors' consideration.

Nomad Foods – NOMD: Zacks Rank #1 (Strong Buy)

With the U.S. and the U.K. set to collaborate on agricultural market success, Nomad Foods (NOMD - Free Report) stock is appealing and was recently flagged as the Zacks Bull of the Day. Sporting a Zacks Rank #1 (Strong Buy), Nomad is the largest frozen food company in Europe and has served as a pleasant hedge against market volatility, with NOMD up +16% in 2025.

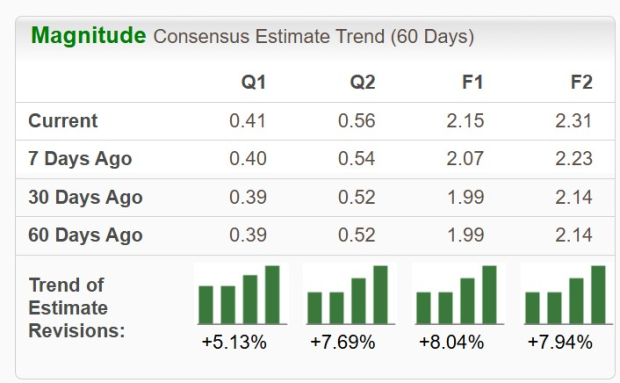

Furthermore, the strong price performance could continue as EPS estimates have continued to trend higher over the last 60 days. Plus, NOMD still trades under $20 and at just 8.9X forward earnings, with Nomad’s EPS now expected to rise 11% this year and projected to increase another 7% in fiscal 2026 to $2.31.

Image Source: Zacks Investment Research

RollsRoyce – RYCEY: Zacks Rank #2 (Buy)

Rolls-Royce (RYCEY - Free Report) was a topic of conversation in Thursday’s meeting in the Oval Office, with President Trump joking that he has owned a few of the high-end luxury vehicles. The premise here was that U.K. car tariffs will be lowered from 25% to 10% on the first 100,000 imported vehicles.

At around $10 a share, the risk-to-reward has become more favorable for this British ADR, and Rolls-Royce is also a renowned provider of power systems for the aerospace and energy markets.

BP – BP: Zacks Rank #3 (Hold)

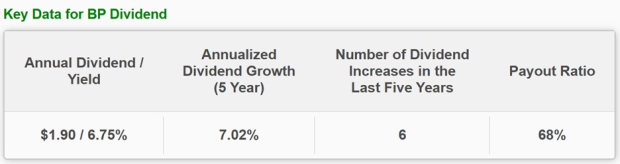

Formerly known as British Petroleum, BP (BP - Free Report) ) stock is shaping up to be a viable buy-the-dip candidate. Although there could still be better buying opportunities ahead, BP shares are trading under $30 and offer a very generous 6.75% annual dividend yield at current levels.

As one of the most recognizable oil and energy companies in the world, BP stock will likely regain its mojo as crude prices stabilize. It’s also noteworthy that BP was facing issues related to infrastructure projects due to higher steel and aluminum tariffs, which will be eliminated from a previous tax rate of 25% and should help the energy giant significantly.

Image Source: Zacks Investment Research

Bottom Line

With the U.K. striking a trade deal with the U.S., these three ADRs are certainly worth watching in the coming weeks, and it wouldn’t be surprising if analyst become more bullish on their short-term outlook.

More By This Author:

Buy The Spike In AMD Stock After Q1 Earnings?4 Energy Firms Likely To Outperform Q1 Earnings Estimates

4 Stocks To Watch That Recently Declared Dividend Hikes Amid Volatility

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any ...

more