3 Stocks To Tap The Semiconductor General Industry Potential

Image: Bigstock

Companies in the Semiconductor – General industry are at the forefront of the ongoing technological revolution based on HPC, AI, automated driving, IoT, and so on. Semiconductors also enable the cloud to function and help analyze the data into actionable insights that can be used by companies to operate more efficiently.

If anything, the pandemic has strengthened the conviction that these technological changes are required and inevitable, because it is these technology platforms that enabled us to function when it was unsafe for us to go to work or meet people. Even with the opening up of the economy, the race to digitization, cloud, AI, etc. are trends that are expected to continue at an accelerated rate, driving strong demand for semiconductors.

NVIDIA has pioneered and built a whole lot of this cutting-edge technology, so it remains a top recommendation. Our picks are STMicroelectronics (STM), Texas Instruments (TXN), and NVIDIA (NVDA).

About The Industry

The companies grouped under the Semiconductor – General category produce a broad range of semiconductor devices, both integrated and discrete, like microprocessors, graphics processors, embedded processors, chipsets, motherboards, wireless and wired connectivity products, DLPs and analog, serving multiple end markets. The industry includes companies like NVIDIA, Texas Instruments, Intel, and STMicroelectronics.

According to the latest data from the Semiconductor Industry Association (SIA), global semiconductor sales in 2021 grew 26.2% to the highest-ever annual total. Q4 sales were up 28.3%.

All regions grew, with the Americas up 27.4%, Europe up 27.3%, Asia Pacific/All Other up 25.9%, China up 27.1%, and Japan up 19.8%. Analog grew 33.1%. Logic and memory sales were also strong, growing a respective 30.8% and 30.9%. The 2022 projection of 8.8% growth remains unchanged.

Major Themes

Being on the building-block side of technology, the industry stands to benefit from the proliferation of the Internet and the growing digitization of our lives, irrespective of the direction we move in the future. And since the pandemic has accelerated this move toward digitization, we are seeing a profound impact on the semiconductor industry.

Demand for smartphones (a primary application of semiconductors) remains strong, but continued component shortages and logistical challenges are weighing on sales. So IDC expects smartphone shipments to grow 3.0% in 2022 (previous 3.4%), with 4G components being worse hit than 5G, which is already 60% of total volumes.

The other major chip consumer is the PC market, which is now slowing down following two years of very strong growth on the consumer side. Education will decline because of suppliers prioritizing the commercial segment - which will grow, according to IDC. But other segments are gaining in importance.

AI, for instance, should grow strongly (MarketsandMarkets expects a 39.7% CAGR between 2021 and 2026, from $58.3 billion to $309.6 billion). In IoT, which is still evolving, Mordor Intelligence expects a 10.53% CAGR between 2021 and 2026 from $761.4 billion to $1,386.1 billion.

Automotive electronics is another area of evolving needs and strong growth potential (Grand View Research estimates a 7.9% CAGR in 2021-2028, driven mainly by various safety systems.

Moreover, the costs of electronic components in automobiles are expected to jump from 35% of total vehicle cost to 50% by 2030. Automation and robotics, with increasing adoption across industrial operations, are other areas of growth. The strong end markets will drive continued demand for semiconductor suppliers for years to come.

Because of the growth potential in emerging markets, regulatory (and/or political) issues in China and the U.S. can play an increasingly important role. The government’s strong stance against prime trading partner China has cast a shadow over the space.

Semiconductor companies in particular stand to benefit from a truce between the U.S. and China as the Chinese government’s drive to build its own industry requires collaborations with leading semiconductor players.

Moreover, commercial sales to China would help fund costly R&D in the U.S. The government is more concerned about IP protection and is trying to delay China’s own technological maturity. Be that as it may, the $52 billion infusion from the CHIPS Act (when adopted) will be a big boost to the domestic semiconductor market.

Because end devices have to be priced lower to reach more people, the pressure on companies to bring down cost remains. But although companies still find it advantageous to move operations to places where labor may be cheaper or where the proximity to manufacturing facilities can lower transportation and other cost, governments across the world are waking up to the strategic value of producing chips onshore.

Tensions with China have also made regulators eager to develop alternative supply chains. Industry consolidation should continue however, as larger players add expertise and capacity through acquisitions. There’s also likely to be close collaboration with device makers, facilitating quicker consumption and better inventory management.

Zacks Industry Rank Indicates Improving Prospects

The Zacks Semiconductor-General Industry is a stock group within the broader Zacks Computer and Technology Sector. It carries a Zacks Industry Rank #48, which places it in the top 19% of more than 250 Zacks industries.

The group’s Zacks Industry Rank, which is basically the average of the Zacks Rank of all the member stocks, indicates positive near-term prospects. Our research shows that the top 50% of the Zacks-ranked industries outperforms the bottom 50% by a factor of more than 2 to 1.

An industry’s positioning in the top 50% of the Zacks-ranked industries is normally because the earnings outlook for the constituent companies in aggregate is encouraging. In this case, while the 2021 estimates remain on an upward trend from pre-pandemic levels, the 2022 estimate remains below this level, indicating cost increases.

Looking at the aggregate earnings estimate revisions, it appears that analysts are positive about the industry’s growth prospects in 2021 while they are factoring in uncertainties in 2022. As a result, the aggregate earnings estimate for 2021, although improving in the last few months, remains 0.2% below Feb 2021. The estimate for 2022 is down 8.6%.

Before we present a few stocks that you may want to consider for your portfolio, let’s take a look at the industry’s recent stock-market performance and valuation picture.

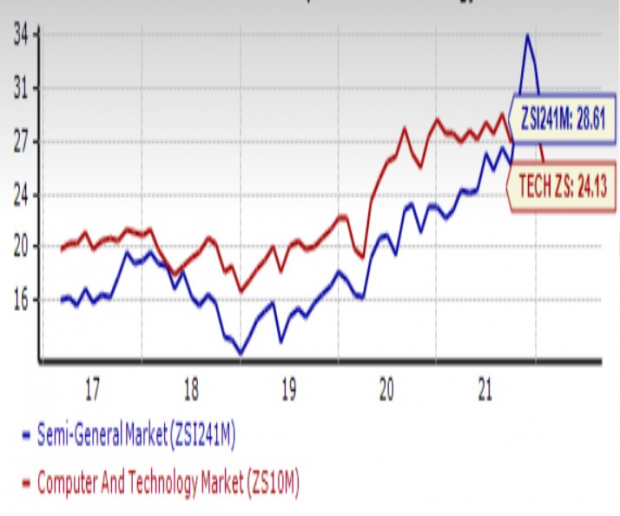

Industry Leads on Stock Market Performance

Tracking the performance of the Zacks Semiconductor – General Industry over the past year shows that the industry has mostly traded between the broader Zacks Computer and Technology Sector (on the lower side) and the S&P 500 index (on the higher side), although it has done better than both since October.

The industry gained 27.0% over the past year compared to the 1.1% gain of the broader sector and the 14.5% gain of the S&P 500 index.

One-Year Price Performance

Image Source: Zacks Investment Research

Industry's Current Valuation

On the basis of forward 12-month price-to-earnings (P/E) ratio, which is a commonly used multiple for valuing semiconductor companies, we see that the industry has been recently trading at 28.61X, which is between the median value of 26.40X and the high of 34.34X over the past year. And this is above the S&P 500’s 20.00X and the sector’s forward-12-month P/E of 24.13X.

Over the last five years, the industry has traded as high as 34.34X, as low as 12.86X ,and at the median of 18.32X, as the chart below shows.

Forward 12 Month Price-to-Earnings (P/E) Ratio

Image Source: Zacks Investment Research

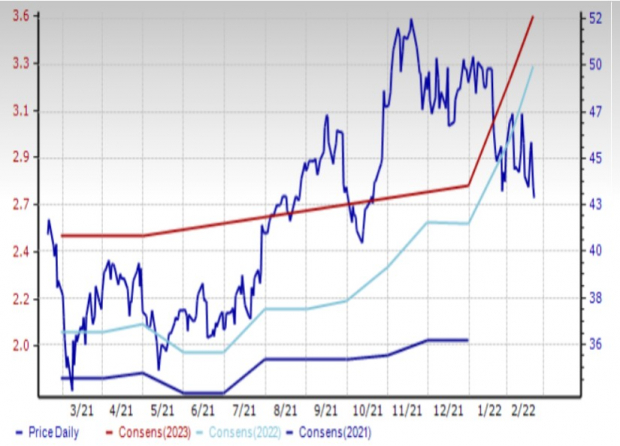

3 Stocks Worth Considering - STMicroelectronics N.V. (STM)

The company designs, develops, manufactures, and markets a broad range of semiconductor integrated circuits and discrete devices used in a wide variety of microelectronic applications, including telecommunications systems, computer systems, consumer products, automotive products, and industrial automation and control systems.

STMicroelectronics has recently been seeing very strong demand across most product lines and all end markets, which is leading to strong pricing and allowing it to operate at full capacity. Both these factors, in addition to manufacturing efficiencies and a better product mix led to strong profitability in its last-completed quarter.

Its exposure to the automotive end market (where demand remains above planned capacity expansion) and industrial markets makes this stock particularly attractive. STM beat the Zacks Consensus Estimate for the fourth quarter by 17.1%. In the last 30 days, the current year EPS estimate of this Zacks Rank #1 (Strong Buy) stock increased 61 cents (4.5%).

The shares of the company are up just 4.5% over the past year, mainly because of the pressure they have been under since the beginning of this year.

Price and Consensus: STM

Image Source: Zacks Investment Research

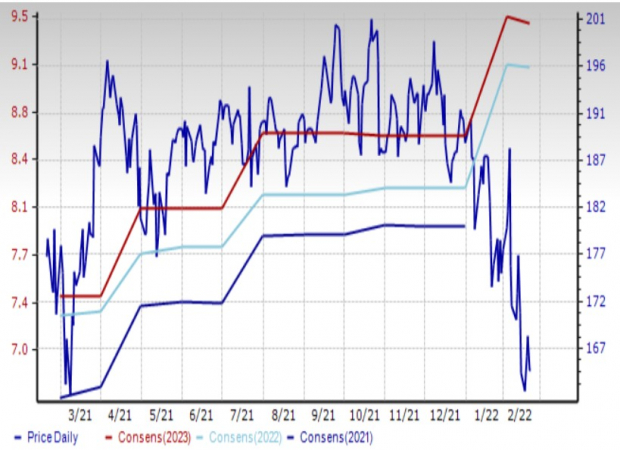

Texas Instruments, Inc (TXN - Free Report)

Texas Instruments is an original equipment manufacturer of analog, mixed signal, and digital signal processing (DSP) integrated circuits. Texas Instruments has significant exposure to the industrial and automotive markets, where the semiconductor shortage is driving strong demand and pricing strength.

TXN is known for operating a flexible manufacturing base that includes both internal capabilities and external sources, thus making it a bit of a defensive play in downcycles. But the secular growth prospects in its served markets coupled with the current chip shortage is driving the company to increase capacity.

Those extra costs notwithstanding, Texas Instruments continues to generate solid cash flows. It also returns cash to investors through regular share repurchases and dividends. This is one of the steadiest performing companies and continues to deliver, quarter-upon-quarter.

So in its fiscal fourth quarter, Texas Instruments generated earnings that topped the Zacks Consensus Estimate by 16.4% on revenues that beat by 8.9%. The Zacks Consensus Estimate for 2022 is up 87 cents (10.6%). Shares of this Zacks Rank #1 company are down 7.7% over the past year, mainly due to the broad market meltdown since January.

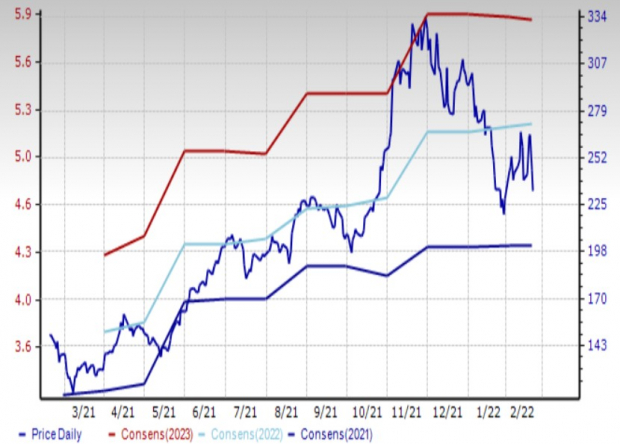

Price and Consensus: TXN

Image Source: Zacks Investment Research

NVIDIA Corp (NVDA- Free Report)

NVIDIA Corporation is the worldwide leader in visual computing technologies and the inventor of the graphic processing unit, or GPU. As the GPU’s parallel processing capabilities were increasingly found to be even more effective for complex computing applications, the company saw its addressable market expand.

Today, it is these chips that drive the high performance computations in not only gaming, but also in a variety of other applications like artificial intelligence and virtual reality. Considering the scope of application and the fact that these are all at the cutting edge of technology, the company should see sustained growth for years to come.

The strongest investment case for NVIDIA is the way that it is facilitating advances in AI, digital biology, climate sciences, gaming, creative design, autonomous vehicles, and robotics. This makes it a central player in innovating in these impactful fields.

And after acquiring Mellanox for $7 billion last year, the company has cemented its competitive moat against Intel (INTC) in AI and HPC, the two most-happening areas with the greatest growth potential. So it is now even better positioned for growth.

The company has recently been seeing strong momentum across its businesses and its innovation engine is in full throttle. This is what ultimately drives its strong cash flows and returns to investors through buybacks and dividends.

NCVIDIA’s fourth quarter results topped the Zacks Consensus Estimate by 8.2%. The current year EPS estimate of this Zacks Rank #2 (Buy) stock increased 3 cents in the last week or so. Since the company has recently reported, there could be further increases in the coming days. The shares are up 57.2% over the past year.

Price and Consensus: NVDA

Image Source: Zacks Investment Research

Disclaimer: Neither Zacks Investment Research, Inc. nor its Information Providers can guarantee the accuracy, completeness, timeliness, or correct sequencing of any of the Information on the Web ...

more