3 Stocks To Buy For Travel & Hospitality-Related Exposure

The broader hospitality and travel industries can go hand in hand in regard to their influence on consumer discretionary spending. Optimistically social gathering events and travel-related activities continue to normalize and even see increased demand from the pandemic.

This makes the hospitality, travel, and tourism markets key areas of the economy that investors will want to pay attention to. To that point, many hospitality companies are benefitting from stronger demand for travel and tourism as well and several stocks in the Zacks Consumer Discretionary and Transportation sectors stand out at the moment.

Coveting a Zacks Rank #1 (Strong Buy) these stocks appear to be benefitting from increased travel spending as total travel spending in the United States is up 3.5% in 2023 according to the U.S. Travel Association.

Considering travel accounted for $1.2 trillion in direct spending last year with an economic footprint of $2.6 trillion, there could be lucrative upside for these highly ranked Zacks stocks.

Royal Caribbean Cruises (RCL)

We’ll start with Royal Caribbean Cruises which has a dominant footprint in the contemporary, premium, and deluxe segments of the cruise vacation industry.

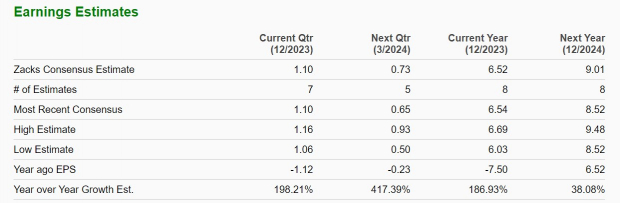

Higher inflation may still have a cloud over consumer discretionary spending but Royal Caribbean’s recovery is starting to hit full circle. Annual earnings are largely back in the black this year with fiscal 2023 EPS estimates now slated at $6.52 per share versus an adjusted loss of -$7.50 a share last year. Plus, FY24 earnings are forecasted to climb another 38% to $9.01 per share.

(Click on image to enlarge)

Image Source: Zacks Investment Research

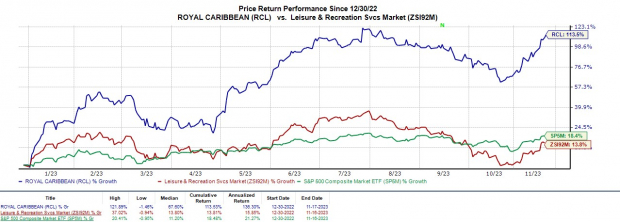

Even better, earnings estimate revisions for FY23 and FY24 are nicely up over the last 60 days with Royal Caribbean surpassing third quarter earnings expectations by 12% in late October as Q3 EPS came in at $3.85 per share compared to estimates of $3.43 a share. More intriguing, Royal Caribbean’s stock has skyrocketed +113% this year but trades reasonably at 15.9X forward earnings with the Average Zacks Price Target of $122.15 a share suggesting 18% upside.

(Click on image to enlarge)

Image Source: Zacks Investment Research

Live Nation Entertainment (LYV)

One company that may benefit from the overall economic footprint of higher travel spending is Live Nation Entertainment which owns, operates, or has exclusive booking rights in 289 venues. Many of these venues and host events are on tourists’ bucket lists as they include the House of Blues music venues and prestigious locations such as The Filmore in San Francisco and the Hollywood Palladium in Los Angeles.

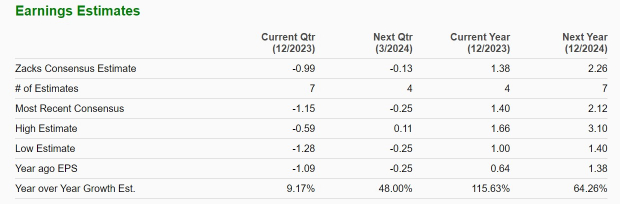

The trend of positive earnings estimate revisions has been very compelling in the last 60 days as the live entertainment company crushed its third quarter earnings expectations earlier in the month. Earnings of $1.78 per share easily surpassed Q3 estimates of $1.27 a share by 40% with Live Nation’s annual earnings now forecasted to soar 115% in FY23 to $1.38 per share versus annual EPS of $0.64 a share in 2022. Furthermore, FY24 earnings are expected to expand another 64% to $2.26 per share.

(Click on image to enlarge)

Image Source: Zacks Investment Research

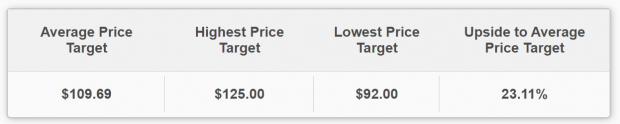

Starting to illustrate its profitability and immense earnings potential, Live Nation’s stock is up +28% in 2023 and the Average Zacks Price Target of $109.69 a share still suggests 23% upside.

(Click on image to enlarge)

Image Source: Zacks Investment Research

Air Canada (ACDVF)

Rounding out the list, increased post-pandemic demand for cross-border travel between the U.S. and Canada is making Air Canada’s stock very appealing. Air Canada flies to over 50 destinations in the U.S. which include key hubs like New York City, Chicago, and Los Angeles.

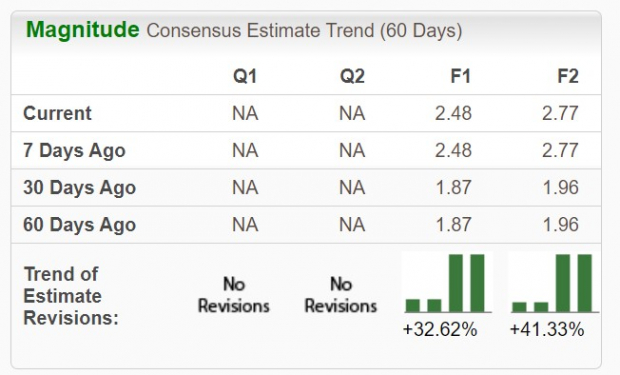

Notably, over the last 60 days, fiscal 2023 and FY24 earnings estimates have soared 32% and 41% respectively. With strong growth and recovery on the horizon, FY23 earnings are now projected at $2.48 per share compared to an adjusted loss of -$2.12 a share in 2022.

(Click on image to enlarge)

Image Source: Zacks Investment Research

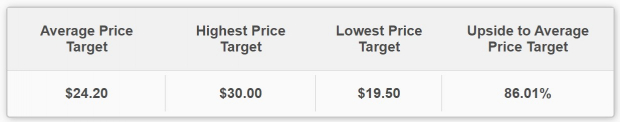

Plus, FY24 earnings are expected to rise another 11% to $2.77 per share with Air Canada’s stock making the case for being undervalued at a 5.2X forward earnings multiple and EPS estimates on the rise. To that point, Air Canada’s stock is down -9% YTD and appears to be at oversold territory as the Average Zacks Price Target of $24.20 a share suggests 86% upside.

(Click on image to enlarge)

Image Source: Zacks Investment Research

Bottom Line

The strengthening prospects of these highly ranked Zacks stocks are hard to overlook as they are prime beneficiaries of increased travel spending to and from the United States. Now looks like a good time to buy as Royal Caribbean, Live Nation, and Air Canada’s stock are shaping up to be viable investments for 2023 and beyond.

More By This Author:

NVIDIA Q3 Preview: Another Blowout Quarter Inbound?Oil Falls Below $80: ETF Areas To Win/Lose

3 Large-Cap Growth Funds To Buy As Inflation Continues To Cool

Disclaimer: Neither Zacks Investment Research, Inc. nor its Information Providers can guarantee the accuracy, completeness, timeliness, or correct sequencing of any of the Information on the Web ...

more