3 Stocks To Buy For Thanksgiving 2023

Image Source: Pexels

The Thanksgiving week is an opportune time for investors to reassess their stock portfolios for next year. The S&P 500 Index has generated strong returns in 2023, with an 18% return, not including dividends year-to-date.

But there are still many stocks with reasonable valuations and high expected returns. These 3 Thanksgiving 2023 stocks not only pay dividends to shareholders but also appear undervalued with future earnings growth potential. As a result, they all have expected total returns above 10% over the next five years.

3 Stocks to Buy for Thanksgiving 2023

Emerson Electric (EMR)

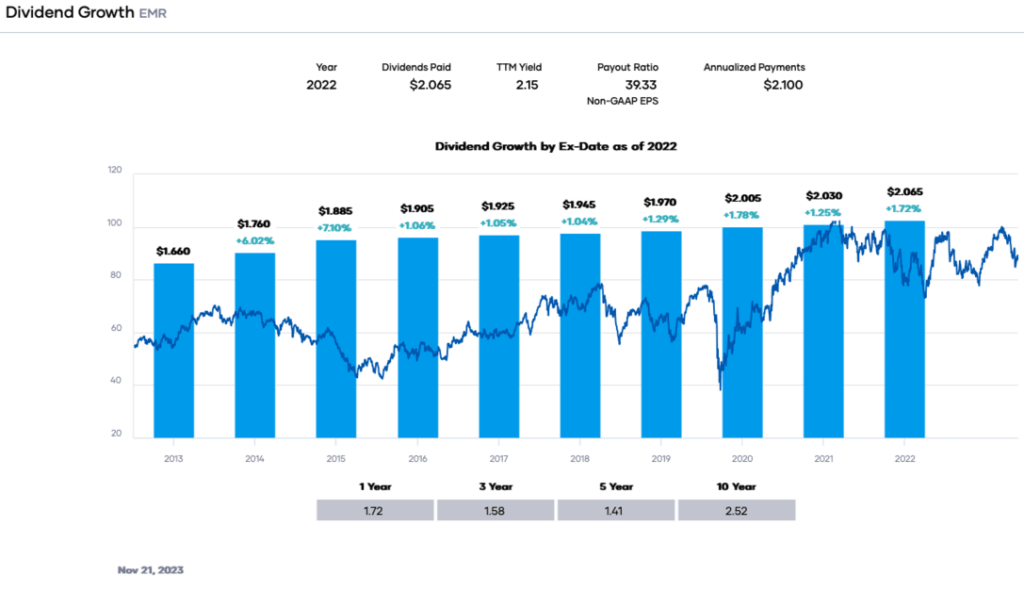

Emerson Electric operates in the industrial sector as a diversified global leader in engineered products and services. Its worldwide customer base and diverse product and service offerings generate just over $17 billion in annual revenue. The company has increased its dividend for 67 consecutive years, making it a Dividend King.

Emerson posted fourth-quarter earnings on November 7th, 2023. Adjusted earnings-per-share came to $1.29. Revenue was up 5% year-over-year to $4.09 billion but missed expectations by $100 million. Profit was $744 million for the quarter, fractionally higher year-over-year.

The company initiated 2024 guidance at $5.15 to $5.35 in adjusted earnings per share. From there, we estimate that EMR could grow its adjusted EPS by 6% per year in the next five years. There are signs of improvement in organic revenue growth and expanding profit margins. These catalysts, plus an additional tailwind from share buybacks, will be the critical drivers of earnings-per-share growth in the coming years.

Growth and Valuation

Emerson’s competitive advantage is its many decades of experience building customer relationships and engineering excellence. It has a global customer base that is seeing strong economic growth, and that underlying sales tailwind should power results going forward.

Emerson’s payout ratio is under half of earnings, and we believe it will remain under 50% for the foreseeable future. The dividend is very safe as it is well covered by free cash flow, and the yield is solid at 2.4%. Emerson’s 66-year streak of increases places it on the current list of Dividend Kings.

EMR stock trades for roughly 16X earnings, compared to our fair value estimate of 19X. As a result, EMR stock appears undervalued. Total returns could reach 10.2% per year over the next five years.

Source: Portfolio Insight

J.M. Smucker (SJM)

J.M. Smucker has grown into an international powerhouse of packaged food and beverage products, including iconic names like Smucker’s, Jif, and Folgers and various pet food brands. Besides Folgers, the firm owns other brands, placing it on the list of coffee stocks. The company has a market capitalization of $14.5 billion and generated $8 billion in sales last year. It is the second company on the list of 3 stocks to buy for Thanksgiving 2023.

The company has increased its dividend for 27 years, making it a Dividend Aristocrat and Dividend Champion in 2023.

In late August, Smucker’s reported (8/29/23) financial results for the first quarter of fiscal 2024. Currency-neutral organic sales grew 21% over the prior year’s quarter thanks to solid volume sales of peanut butter and coffee products and material price hikes. The concrete volumes amid strong price hikes are testaments to the strength of the company’s brands. Adjusted earnings-per-share grew 32%, from $1.67 to $2.21, and exceeded the analysts’ estimates by $0.17, as price hikes more than offset the increased costs of commodities, ingredients, manufacturing, and packaging costs.

Growth and Valuation

Thanks to better-than-expected results, material price hikes, and sustained positive business trends, Smucker’s improved its already positive outlook for fiscal 2024. The company expects comparable sales growth of 8.5% to 9.5% and raised its guidance for adjusted earnings-per-share to $9.45 to $9.85.

The company has a collection of iconic brands with exposure to multiple growth categories. For example, coffee is a robust and sticky segment for the business, and Smucker’s is working to expand the current iconic lines, such as Jif, to more on-trend products like granola bars and on-the-go snacks. We are forecasting $8.18 in earnings-per-share for this year and a 4% average annual growth rate.

Given the company’s healthy payout ratio of 52% and the resilience of the company to recessions, SJM’s dividend is safe. The stock yields 3.8% with a high dividend safety grade of A+, from Portfolio Insight. Total returns are estimated at 10.4% per year over the next five years.

Source: Portfolio Insight

Visa Inc. (V)

Visa is the global leader in digital payments, with activity in more than 200 countries. The company is the third stock on the list of 3 stocks to buy for Thanksgiving 2023. The company’s global processing network provides secure and reliable payments worldwide, handling more than 65,000 transactions a second. In fiscal year 2022, the company generated $16 billion in profit.

On October 24th, 2023, Visa announced a 16% increase to the dividend to $2.08 per share annually.

In addition, Visa reported fourth quarter 2023 results for the period ending September 30th, 2023 (Visa’s fiscal year ends September 30th). For the quarter, Visa generated revenue of $8.6 billion, adjusted net income of $4.8 billion, and adjusted earnings-per-share of $2.33, marking increases of 11%, 18%, and 21%, respectively.

These results were driven by a 9% gain in Payments Volume, a 16% gain in Cross-Border Volume, and a 10% gain in Processed Transactions. Visa processed 56.0 billion transactions in the quarter.

Growth and Valuation

Over the long term, Visa has ample room to keep growing thanks to the global transition towards a cashless society. In 2019, global digital payment volume exceeded cash for the first time. However, there are still about 2 billion people worldwide who lack access to cashless payments. Notably, China and India, which have 1.4 billion people each, are still in the early phases of their transition towards a cashless economy.

Therefore, the growth potential for Visa is immense in these two countries. Through a combination of growing the number of cards, a rising number of transactions per cardholder, general economic expansion, and share repurchases, Visa should generate attractive earnings-per-share growth of 10% per year in the next five years.

Visa stock trades for about 25X earnings, which is on par with our fair value estimate. Still, the expected EPS growth and the 0.8% dividend yield result in total expected returns of 10.8% per year over the next five years.

Source: Portfolio Insight

More By This Author:

Stock Market This Week – Sunday, Nov. 19Dividend Safety Analysis: Cisco Systems

3 High Yield Stocks For Long-Term Income

Disclosure: No positions

Disclaimer: Disclaimer: Dividend Power is not a licensed or registered investment adviser or broker/dealer. We are not providing you with individual ...

more