3 Stocks To Buy For Post-Earnings Momentum

Image Source: Pexels

The 2024 Q4 earnings season is slowly winding down, with over 98% of S&P 500 companies already delivering quarterly results.

And throughout the period, several stocks, including Philip Morris (PM - Free Report), Meta Platforms (META - Free Report), and Netflix (NFLX - Free Report), all posted results that had shares up nicely post-earnings. For those interested in post-earnings momentum, let’s take a closer look at each report.

PM Innovation Remains Strong

Philip Morris shares have benefited nicely from its latest set of better-than-expected results, with EPS growing 14% alongside a strong 7% move higher in sales. Demand has remained strong for the tobacco titan, with product innovations remaining key for its future.

Notably, smoke-free products exceeded 40 billion units for the first time throughout its FY24, with full-year net revenues for its Smoke-free Business (SFB) increasing by 14.2% alongside an 18.7% move higher in gross profit.

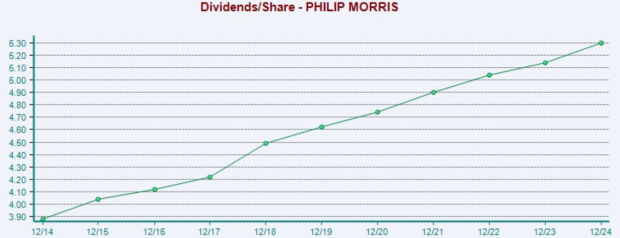

Shares also provide a high level of passive income, currently yielding a market-beating 3.5% annually. Dividend growth has been rock-solid, with PM also holding the ranks of a Dividend King. Below is a chart illustrating the company’s dividends paid on an annual basis.

Image Source: Zacks Investment Research

Meta Reports Record Profit

Concerning headline figures in its release, Meta Platforms posted adjusted EPS of $8.02 and record sales of $48.4 billion, reflecting growth rates of 50% and 21%, respectively. Net income of $20.9 billion was the company’s highest read ever.

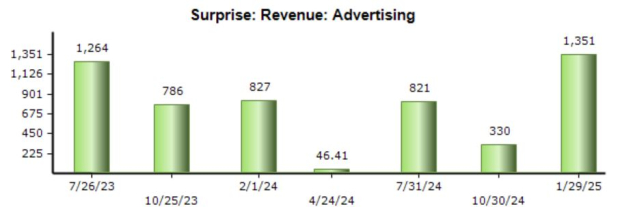

Notably, the company’s ad business continued to perform at a high level, with revenue of $46.8 billion again exceeding our consensus estimate and reflecting 20% year-over-year growth. As shown below, META’s advertising results have regularly crushed our consensus expectations as of late.

Image Source: Zacks Investment Research

In addition, META continues to see nice user growth, with Family Daily Active People (DAP) improving 4% year-over-year to roughly 3.4 billion. Average revenue per user has increased likewise amid the strong advertising efforts, improving by a sizable 41% year-over-year.

Netflix Ad-Supported Tiers Provide Tailwinds

Continued user growth and tailwinds from ad-supported memberships have been driving forces behind Netflix’s recent success, with shares delivering a stellar performance over the last year. The stock currently sports a favorable Zacks Rank #2 (Buy).

In Q4, ad-supported plans accounted for over 55% of sign-ups in supported countries, and membership in ad plans grew by nearly 30% quarter over quarter.

Image Source: Zacks Investment Research

Bottom Line

Though the market’s performance as of late has been forgettable, the results of all three companies above – Philip Morris, Meta Platforms, and Netflix – in the Q4 reporting cycle were all highly positive, with shares of each seeing momentum post-earnings.

More By This Author:

Seeking Defense? 3 Top-Ranked Low-Beta Stocks Worth A LookMag 7 Members Are Shattering Quarterly Records

Home Depot Vs. Lowe's: What's The Better Buy?

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any ...

more