3 Stocks To Buy For Growth And Stability

Image Source: Pexels

Growth investing is a highly common strategy deployed, with investors targeting companies expected to grow their earnings and revenues at an above-average level. It’s a development that commonly follows through to share outperformance.

Of course, the strategy can be volatile. Still, we can find stability by targeting companies with positive earnings estimate revisions, effective management (ROE), and healthy liquidity.

For those interested in stocks that fit the criteria – FirstCash (FCFS), OneSpaWorld (OSW), and NVIDIA (NVDA) – could all be considered.

Let’s take a closer look at each.

NVIDIA

Investor-favorite NVIDIA continues to be a prime selection for those with an appetite for growth, with consensus expectations for its current fiscal year suggesting nearly 270% earnings growth paired with a 120% revenue climb. Peeking ahead to FY25, earnings and revenue are forecasted to see additional growth of 63% and 53%, respectively.

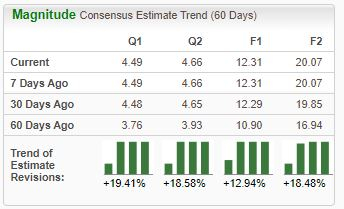

Analysts continue raising their expectations for the company, helping it keep its favorable Zacks Rank #2 (Buy).

Image Source: Zacks Investment Research

Data Center sales have been the primary focus among investors concerning NVDA, which includes revenue from AI chips. The company’s Data Center sales soared a sizable 280% year-over-year throughout its latest quarter to a quarterly record of $14.5 billion.

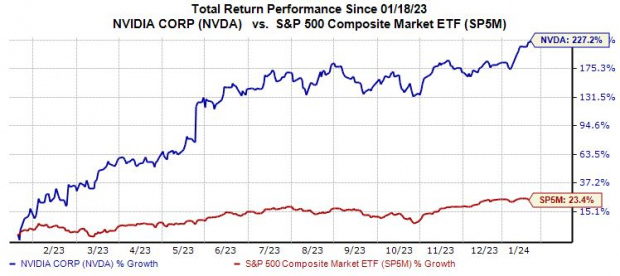

And the company’s bright growth trajectory has been reflected by its remarkable share performance, with shares up 240% over the last year vs. the S&P 500’s nearly 25% climb.

Image Source: Zacks Investment Research

FirstCash Holdings

FirstCash (Ticker: FCFS) is one of the world's largest pawn shop operators and a leading provider of technology-driven point-of-sale (POS) payment solutions. The company’s earnings are forecasted to climb 13% on 15% higher revenues in its current year (FY23), with FY24 expectations suggesting an additional 21% bump in earnings paired with an 8% sales climb.

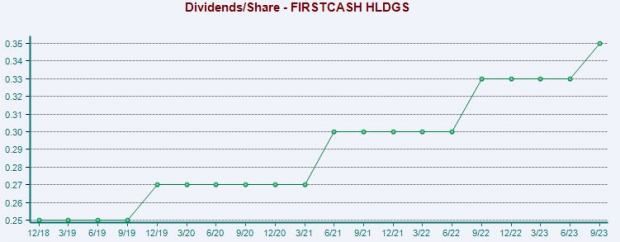

On top of healthy growth, the stock pays a solid dividend, currently yielding 1.3% annually. The company has grown its payout nicely as well, boasting a 7.6% five-year annualized dividend growth rate.

Image Source: Zacks Investment Research

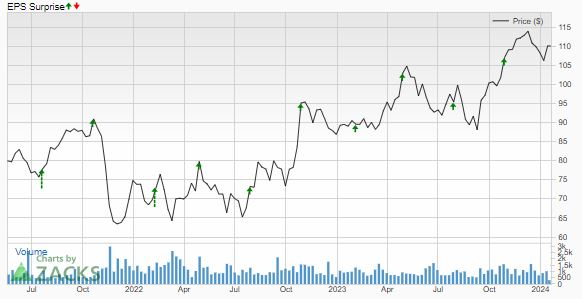

FirstCash’s growth has been aided by an expanding footprint, with the company adding 104 new pawn stores just throughout its latest quarter. Concerning headline expectations, FCFS posted an 11% beat relative to the Zacks Consensus EPS Estimate and reported revenue 2.5% ahead of expectations.

The company’s quarterly consistency can’t be overlooked, beating our consensus EPS estimates in 17 consecutive quarters.

Image Source: Zacks Investment Research

OneSpaWorld

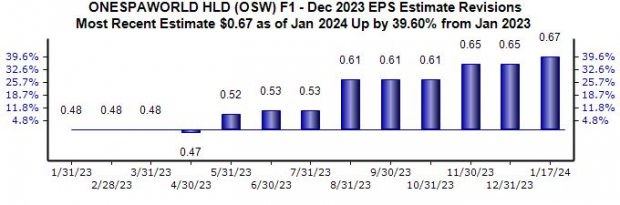

OneSpaWorld is a provider and innovator in the fields of wellness, beauty, rejuvenation, and transformation on cruise ships and land. The stock is a Zacks Rank #2 (Buy), with the revisions trend for its current fiscal year particularly bullish, up 40% to $0.67 per share over the last year.

The current value suggests 140% year-over-year earnings growth, with the top line also forecasted to witness a 45% expansion.

Image Source: Zacks Investment Research

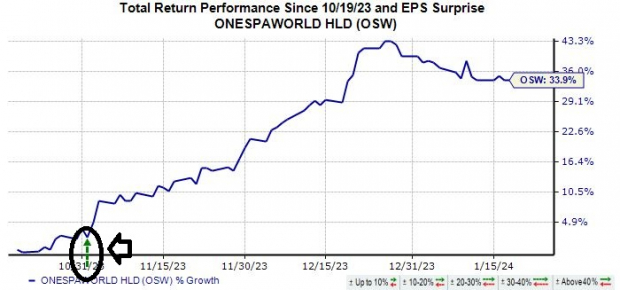

OneSpaWorld latest quarterly report was solid, with revenues climbing 33% year-over-year to a record $216 million and operating income of $17 million also reflecting a quarterly record. The company has consistently posted better-than-expected results as of late, exceeding our consensus EPS estimates by an average of 20% across its last four.

Shares got a nice boost following the release and look to continue their momentum into the next print scheduled for late February.

Image Source: Zacks Investment Research

Bottom Line

Above-average sales and earnings growth commonly lead to share outperformance, undoubtedly a welcomed development among investors.

And while growth investing can be volatile, picking companies with effective management and healthy liquidity positions helps to mitigate the concern.

All three stocks above – FirstCash, OneSpaWorld, and NVIDIA – fit the criteria nicely.

More By This Author:

American Superconductor Surges 5.4%: Is This An Indication Of Further Gains?Small Caps Offer Big Potential In 24'

3 Stocks To Buy After Massive Earnings Beats