3 Stocks To Buy Following Positive Earnings Results

Image Source: Pixabay

Earnings season continues to wind down, with the period reflecting positivity. We’ve heard from over 460 S&P 500 companies, with this week’s reporting docket primarily dominated by retail.

Total earnings for the S&P 500 members that have reported Q1 results are up +4.8% from the same period last year on +4.1% higher revenues. The earnings growth pace reflects an acceleration relative to other periods, undoubtedly a positive development.

Estimates for the coming 2024 Q2 cycle have been trending higher, reflecting optimism among analysts.

So far, several companies, including Apple (AAPL - Free Report), Eli Lilly (LLY - Free Report), and Crocs (CROX - Free Report), have seen post-earnings positivity. Let’s take a closer look at each.

Apple

Concerning headline figures, the company posted a 1.3% beat relative to the Zacks Consensus EPS estimate and posted sales 1% ahead of expectations. It reflected the company’s fifth consecutive double-beat, owing to its ability to positively surprise investors.

Notably, the tech titan announced the biggest buyback in corporate history totaling $110 billion. Reflecting further positivity, Apple also unveiled a 4% boost to its quarterly payout, reflecting the 12th consecutive year of higher payouts.

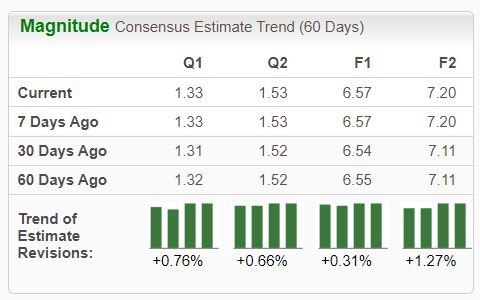

Earnings expectations have increased since the release, reflecting analysts’ optimistic view.

Image Source: Zacks Investment Research

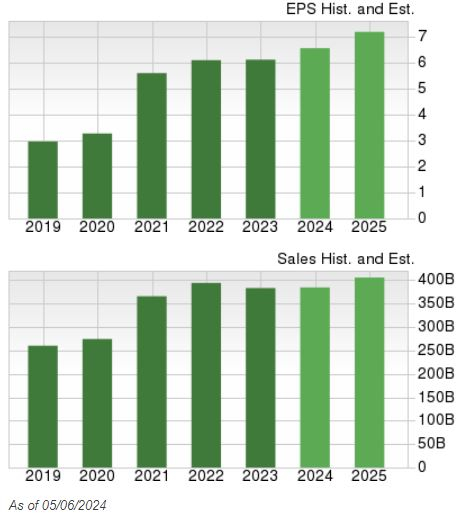

The company’s growth profile remains positive, with current expectations alluding to a 7% pop in earnings on modestly higher sales in its current fiscal year (FY24). Peeking ahead to FY25, estimates allude to an additional 9.6% climb in earnings paired with a 5.5% sales bump.

Image Source: Zacks Investment Research

Eli Lilly

Eli Lilly posted EPS of $2.58 and sales of $8.8 billion, reflecting growth rates of 46% and 26%, respectively. Revenue growth was driven by strong demand, causing LLY to up its full-year revenue guidance by $2 billion.

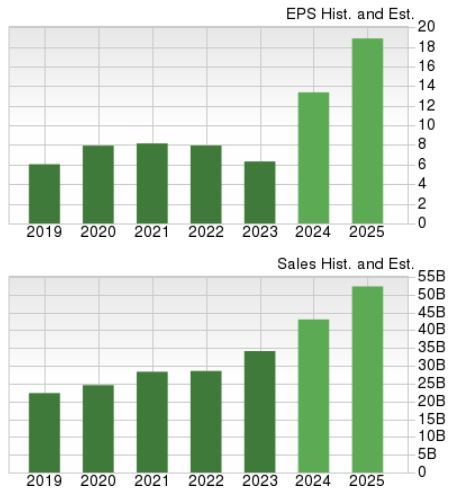

The revisions trend for its current fiscal year has been notably bullish, up 10% over the last year to $13.37 per share and suggesting 110% year-over-year growth. Sales growth is forecasted to be robust as well, with the current $43 billion estimate 26% higher than FY23.

Image Source: Zacks Investment Research

Sales growth is forecasted to be robust as well, with the current $43 billion estimate 26% higher than FY23.

Image Source: Zacks Investment Research

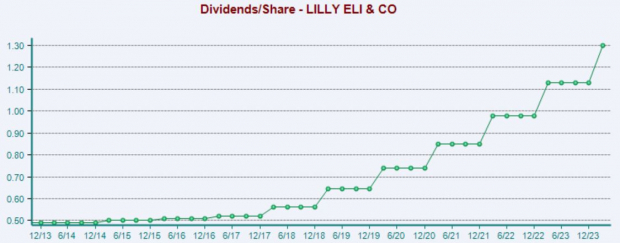

It’s worth noting that the company has increasingly rewarded its shareholders over the years, boasting a 15% five-year annualized dividend growth rate.

Image Source: Zacks Investment Research

Crocs

Crocs continued its earnings positivity, posting a 34% beat relative to the Zacks Consensus EPS estimate and reporting sales 6% ahead of expectations. Impressively, the company has exceeded our consensus EPS estimate by an average of 17% across its last four quarterly releases.

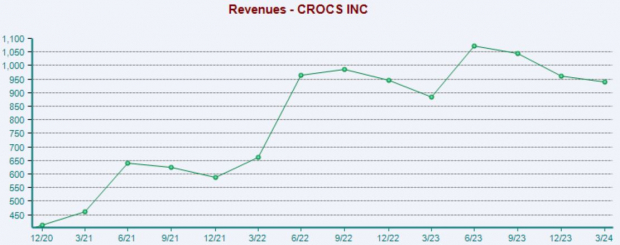

Q1 revenue of $939 million grew 6% year-over-year, also reflecting a quarterly record. The company raised its adjusted EPS guidance following the favorable quarter, further showing positivity. Below is a chart illustrating the company’s revenue on a quarterly basis.

Image Source: Zacks Investment Research

CROX shares have been notably strong in 2024, gaining 50% compared to the S&P500’s 12% gain. The stock is a Zacks Rank #2 (Buy).

Bottom Line

Overall, the 2024 Q1 earnings season has reflected positivity, underpinned by the technology sector’s strong growth.

And concerning positive surprises, all three stocks above – Apple, Eli Lilly, and Crocs – delivered just that, also enjoying post-earnings buying pressure.

More By This Author:

Earnings Season: 3 Companies Enjoying Margin ExpansionBuyback Bonanza: 3 Companies Scooping Up Shares

Three Tech Stocks To Buy For Passive Income