3 Stocks Insiders Are Buying

The market opens the week on a weaker note as all the major indices are slightly in the red as we approach the noon hour this Monday. Last week, the S&P 500 hit another all-time high on Wednesday, before falling back on Friday as a robust Jobs Report tempered hopes for a 50 bps rate cut by the Federal Reserve.

So which stocks are insiders purchasing even with equities near all-time record levels? Here are three names that caught our eye.

Let's start with Greif (GEF). This is a packaging concern based just outside of Columbus, OH. The stock just saw the first insider activity since early in January. The company's CEO bought $490,000 in new shares on July 2nd. A director also added just less than $40,000 in additional shares to his core holdings on the same day.

(Click on image to enlarge)

The shares are down some 20% from recent highs but have perked up some so far here in July. The company produces and sells industrial packaging products and services worldwide - hardly a sexy business. However, the stock pays north of a five percent dividend yield.

In addition, shares are priced at less than nine times forward earnings and the firm is seeing profit growth in the high single digits. The analyst community does not seem very sanguine of the company's prospects, however. Just less than two weeks ago, both KeyBanc and BMO Capital issued Hold ratings with identical $28 price targets. Evidently, insiders see some longer-term value at current trading levels.

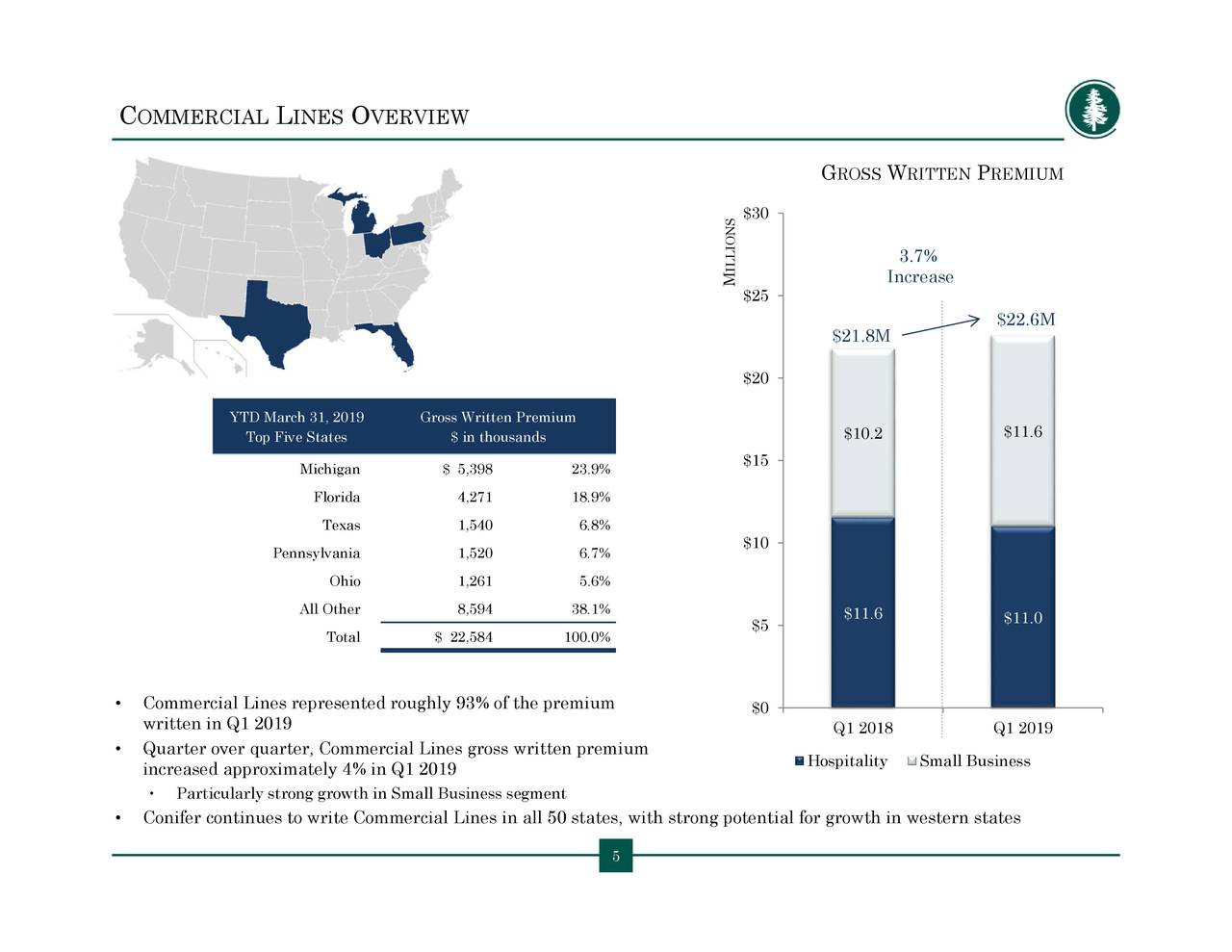

Next up is another smaller concern in a very mature and 'boring' industry. Conifer Holdings (CNFR) offers insurance coverage in specialty commercial and personal product lines and is headquartered in a wealthy suburb of Detroit. A director just bought a bit over $2.1 million in new shares on June 28th which was part of a $5 million private placement. It is the biggest single insider transaction I can find going back four years in the stock.

(Click on image to enlarge)

This is another name with few friends in the analyst community right now. The only analyst activity I can find on this stock in 2019, is a Hold rating issued last week by a small analyst firm named Boenning & Scattergood which also provided the following commentary.

We revised our 2019 and 2020 operating EPS estimates to ($0.83) [from ($0.90)] and $0.32 [from $0.35], respectively, to reflect the offering. By our calculations, the offering was 9% dilutive to our 2020 operating EPS estimate and 2% dilutive to our year-end 2019 book value per share estimate.”

A negative analyst view could very well be warranted given the company is posting losses currently. There is not much on this $40 million market cap company, but an insider taking over 40% of a recent capital raise does seem like a long term vote of confidence.

Finally, we end with a much more well-known name. This is the cruise line behemoth Carnival Corporation (CCL). One thing Carnival has in common with the lesser known names highlighted above is its stock is not loved by analysts at the moment. Morgan Stanley, Berenberg Bank, and Wolfe Research have all reissued Hold ratings on the stock over the past two weeks.

(Click on image to enlarge)

The company reported better than expected Q1 results on June 20th. However, the stock was sold off after results as Carnival offered a tepid forward guidance forecast which also triggered the Hold ratings. This prompted the first insider buying in Carnival shares so far in 2019. The CEO bought just under a $1 million in new shares via two transactions on June 25th. A director also added $930,000 to his core holdings on July 3rd.

The stock currently fetches approximately 11 times forward earnings incorporating the reduced FY2019 guidance of $4.25 to $4.35 a share. The shares also pay north of four percent in dividend payouts.

And those are three stocks seeing recent and significant insider buying even with the overall market hovering near all-time highs.