3 Stocks Displaying Remarkable Relative Strength In 2022

Image: Bigstock

It’s been a volatility-packed year in the market so far. A hawkish Fed has been one of the most significant impacts, with geopolitical issues also spoiling the fun. Still, plenty of stocks are displaying remarkable relative strength year-to-date. Relative strength focuses on stocks or other assets that have performed well relative to the market as a whole or a relevant benchmark.

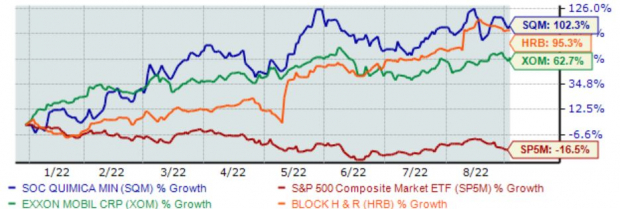

Three companies displaying remarkable relative strength year-to-date include H&R Block (HRB - Free Report), Exxon Mobil (XOM - Free Report), and Sociedad Quimica y Minera (SQM - Free Report). Below is a chart illustrating the share performance of all three companies within 2022, with the S&P 500 blended in as a benchmark.

Image Source: Zacks Investment Research

As you can see, all three companies’ shares have soared, providing investors with supercharged returns. In addition to favorable price action, all three companies carry a strong Zacks Rank paired with enticing annual dividend yields.

Let’s take a closer look at each company.

H&R Block

H&R Block (HRB - Free Report) is the world's largest income tax filing company, offering income tax return filing services for salaried individuals via three distinct methods: free online e-filing, assisted tax e-filing, and in-person tax e-filing.

HRB is currently a Zacks Rank #2 (Buy) with an overall VGM Score of a B. Analysts have rapidly upped their earnings estimates across the board over the last 60 days.

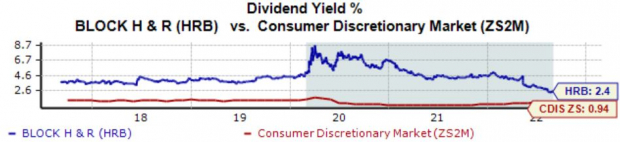

Image Source: Zacks Investment Research

Further, HRB enjoys rewarding its shareholders via its sector-beating annual dividend that yields a rock-solid 2.4%. H&R Block has upped its dividend payout four times over the last five years, undoubtedly a major positive.

Image Source: Zacks Investment Research

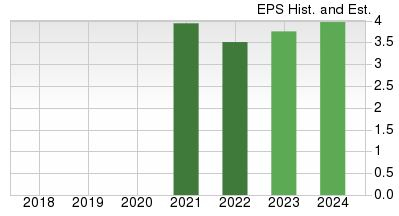

H&R Block’s projected bottom-line growth is also worth highlighting – earnings are forecasted to climb 8% in FY23 and an additional 10% in FY24.

Image Source: Zacks Investment Research

Exxon Mobil

Exxon Mobil (XOM - Free Report) is a U.S.-based oil and gas company and one of the world's largest publicly traded energy companies. XOM has been around since 1999, when Exxon Corporation and Mobil Corporation merged.

The company boasts a Zacks Rank #2 (Buy) paired with an overall VGM Score of an A. To little surprise, analysts have been bullish, raising their earnings estimates substantially over the last few months.

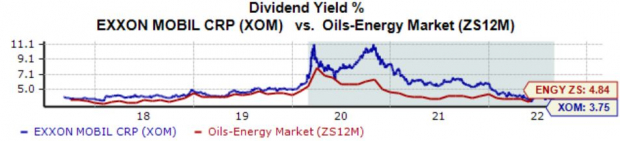

Image Source: Zacks Investment Research

XOM’s annual dividend yield of 3.8% is lower than its Zacks Sector average. Still, XOM has upped its dividend payout three times over the last five years, paired with a five-year annualized dividend growth rate of 3%.

Image Source: Zacks Investment Research

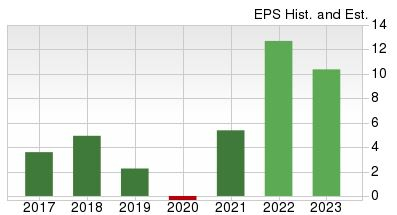

Of course, the company’s bottom-line is forecasted to skyrocket in FY22, with the Zacks Consensus EPS Estimate of $12.70 penciling in a remarkable 140% year-over-year uptick.

Image Source: Zacks Investment Research

Sociedad Quimica y Minera

Sociedad Quimica y Minera (SQM - Free Report) produces and distributes specialty plant nutrients, iodine, lithium, potassium chloride, and sulfate, industrial chemicals, and other products and services.

SQM sports a Zacks Rank #2 (Buy) paired with an overall VGM Score of an A. Undoubtedly a bullish signal, analysts have pushed their earnings estimates notably higher over the last several months.

Image Source: Zacks Investment Research

For those seeking an income stream, SQM has that more than covered – the company’s annual dividend yields a steep 9.5% with a staggering five-year annualized dividend growth rate of 12%. In addition, the yield is much higher than its Zacks Sector average.

Image Source: Zacks Investment Research

For SQM’s current fiscal year (FY22), the company’s bottom-line is projected to explode – the Zacks Consensus EPS Estimate of $12.72 pencils in an incredible 520% year-over-year uptick in earnings.

Bottom Line

While most of the market is deep in the red year-to-date, all three companies above have provided investors with serious returns in 2022. Further, rising earnings estimates have landed all three into a favorable Zacks Rank, another significant positive.

For investors searching for stocks crushing the market in 2022 paired with attractive dividend yields, look no further than H&R Block (HRB - Free Report), Sociedad Quimica y Minera (SQM - Free Report), and Exxon Mobil (XOM - Free Report).

More By This Author:

DocuSign Q2 Preview: Can Shares Find Any Relief?Zumiez Q2 Preview: Rebound Quarter Inbound?

Broadcom Inc. Q3 Earnings and Revenues Beat Estimates

Disclaimer: Neither Zacks Investment Research, Inc. nor its Information Providers can guarantee the accuracy, completeness, timeliness, or correct sequencing of any of the Information on the Web ...

more