3 Standout Stocks Of This Week's Busy Earnings Lineup

Image Source: Pixabay

In the most anticipated week of the Q2 earnings season, several top-rated Zacks stocks are standing out after exceeding their quarterly top and bottom line expectations on Tuesday.

Setting themselves apart from a slew of popular companies that have reported this week, let’s review the Q2 results of three of these top stocks which all sport a Zacks Rank #2 (Buy).

Arista Networks (ANET - Free Report)

Big tech has been the highlight of this week’s earnings lineup and Arista Networks joins the conversation as Q2 EPS of $2.10 beat estimates by 8% and soared 33% from $1.58 a share in the comparative quarter. The cloud networking solutions provider surpassed sales estimates by 3% with its top line expanding 16% year over year to $1.69 billion compared to $1.45 billion in Q2 2023.

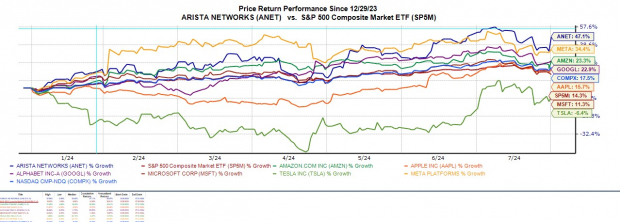

Furthermore, Arista Networks has continued a very impressive streak of surpassing EPS estimates in every quarter since the company went public in 2014. Plus, ANET is up +47% year to date which has outperformed the broader indexes and all of the Magnificent Seven-themed tech stocks outside of Nvidia (NVDA - Free Report).

Image Source: Zacks Investment Research

PayPal (PYPL - Free Report)

One tech stock that may have been flying under the radar this week is PayPal which was able to post Q2 EPS of $1.19. This crushed estimates of $0.96 a share by 24% and rose 2% from the prior year quarter.

The payment solutions provider attributed the strong quarter to its transformation in positioning PayPal for long-term durability and profitable growth while receiving contributions from its Braintree and Venmo brands as well.

Notably, PayPal raised its EPS guidance for fiscal 2024 with Q2 sales of $7.85 billion coming in 1% better than expected and increasing 8% from $7.28 billion a year ago. PayPal‘s stock is up a respectable +7% YTD and has eclipsed earnings expectations for four straight quarters posting an average EPS surprise of 14%.

Image Source: Zacks Investment Research

Northern Oil and Gas (NOG - Free Report)

Geopolitical tensions in the Middle East have propelled crude oil prices back toward $80 a barrel and Northern Oil and Gas is a stock to consider after Q2 EPS of $1.46 blasted estimates of $1.20 a share by 21%.

This was despite earnings dipping from $1.49 per share in a tough-to-compete-against operating period. Still, Q2 sales of $561.03 million beat top line estimates by 4% and climbed 35% from $416.49 million in the comparative quarter.

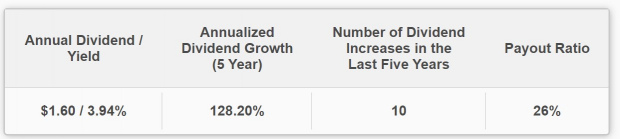

More intriguing is that NOG is up +16% YTD and still trades at an attractive 7.9X forward earnings multiple. Even better, NOG has a generous 3.94% annual dividend yield that it has increased 10 times in the last five years and its 26% payout ratio alludes to more hikes in the future.

Image Source: Zacks Investment Research

Bottom Line

Following their strong Q2 results these top-rated stocks looked poised for more upside as earnings estimate revisions are likely to trend higher in the following weeks. This makes now an ideal time to invest in Arista Networks, PayPal, and Northern Oil and Gas as they should also be viable long-term investments.

More By This Author:

Bull of the Day: Badger Meter (BMI)Time To Buy Meta Platforms Stock As Q2 Earnings Approach?

Time To Buy Stock In The World's Most Valuable Company As Earnings Approach?

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any specific ...

more