3 Sports Betting Stocks With Free Cash Flow And Higher Margins

Stocks related to sports betting have fallen significantly from their March highs, which one analyst argues could present value for investors.

The Gaming Analyst: Bank of America analyst Shaun C. Kelley has a Buy rating on Boyd Gaming Corp BYD.

and a price target of $80.

The analyst has a Buy rating on Churchill Downs Inc CHDN and a price target of $250.

The analyst has a Buy rating on Penn National Gaming PENN and a price target of $131.

The Analyst Takeaways: The S&P 500 is down 1% from its highs in March, which compares to declines of 41% for Penn National and DraftKings Inc DKNG.

“We believe that most of this revaluation is market related vs. fundamental with other high-growth sectors/stocks -25% to -45% from their highs,” Kelley wrote in a note.

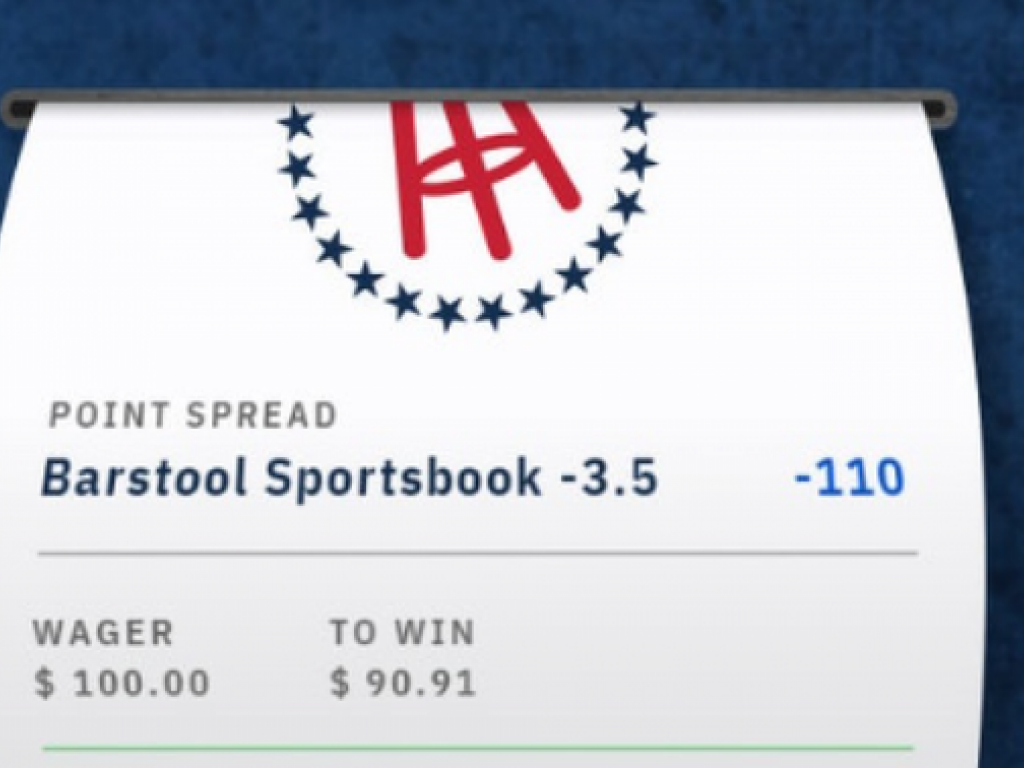

Fundamental concerns for sports betting-related stocks are a weaker season sports calendar, less momentum for new states legalizing sports betting and increased competition in the sector.

Kelley calls the competition a large concern with new entrants launching in new states by the start of the NFL season, which could put pressure on existing players in those states. Adding up all of the sports betting operator’s expected market shares paints an interesting picture of competition.

“With up to 200% targeted share, someone is at risk," said Kelley.

Kelley says the market needs to increase its addressable size or several of the companies in the sports betting space could underperform their market share expectations. The analyst sees flatter market share distribution than is currently seen, and also said consolidation could be coming to the sector.

The analyst looks for a compelling risk-reward profile right now with companies that have free cash flow and strong margins. This weeds out some of the pure-play online sports betting companies and puts a larger emphasis on companies with existing business models in place that could have upside from growth in sports betting.

“We see some particularly attractive opportunities at present levels including Boyd Gaming, Churchill Downs and Penn National, which all are meaningful cash flow positive today, have structurally higher margins post-COVID and preserve some optionality and upside for the sports and digital themes," the analyst wrote in the note.

Price Action: Shares of Boyd Gaming are up 2.4% to $61.90 on Tuesday.

Churchill Downs shares are up 0.6% at $195.32.

Penn National Gaming shares are up 1.3% to $81.94.

© 2021 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.