3 Small-Caps To Buy For Big Growth

Image: Shutterstock

Various investment styles exist, with some investors opting for income-generating assets while others focus on value or specific industries. Of course, some investors prefer a less-conservative approach, such as small-cap stocks, which sport remarkable growth potential due to being in their early stages.

And as of late, small-caps have enjoyed buying pressure, a welcomed development among market participants as we wade through a unique economic situation.

Interestingly enough, three small-caps – BJ’s Restaurants (BJRI - Free Report), Tsakos Energy Navigation (TNP - Free Report), and Blue Bird (BLBD - Free Report) – all sport improved earnings outlooks. In addition, all three sport impressive growth trajectories, making them enticing for those with a growth-focused mindset. Let’s take a closer look at each.

BJ’s Restaurants

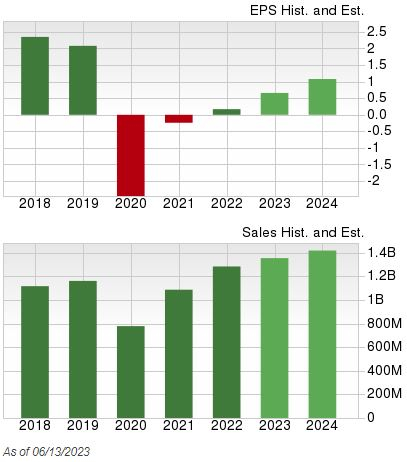

BJ's Restaurants, a current Zacks Rank #1 (Strong Buy), owns and operates a chain of high-end casual dining restaurants in the U.S. Analysts have taken their earnings expectations higher across nearly all timeframes.

The company has recently shown consistency within its quarterly results, exceeding both earnings and revenue expectations in three consecutive quarters. BJRI surprised in a big way in its latest release, exceeding the Zacks Consensus EPS estimate by 275% and sales expectations by 3%.

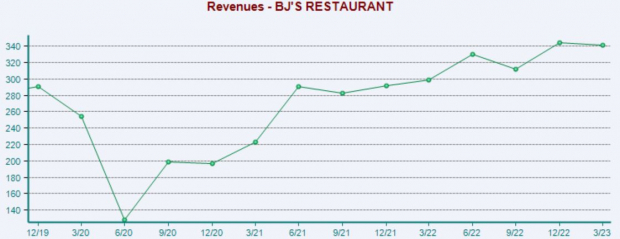

BJRI’s revenue has recovered nicely from pandemic lows, as shown in the chart below.

Image Source: Zacks Investment Research

The company’s forecasted growth is hard to ignore, with estimates calling for 320% EPS growth in its current fiscal year (FY23) and an additional 64% in FY24. The stock sports a Style Score of “B” for Growth.

Image Source: Zacks Investment Research

Keep an eye out for BJRI’s upcoming quarterly release on July 20; the Zacks Consensus EPS estimate of $0.33 suggests a 230% jump in earnings, with the quarterly estimate being revised 3% higher over the last several months.

Tsakos Energy Navigation

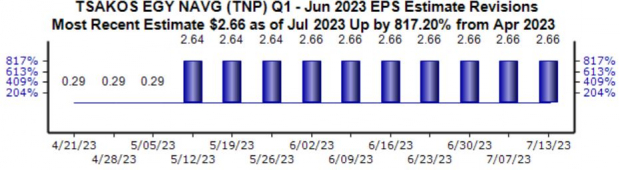

Tsakos Energy Navigation, a Zacks Rank #2 (Buy), is a leading provider of international seaborne crude oil and petroleum product transportation services. The company has enjoyed positive earnings estimate revisions nearly across the board, with the trend being particularly noteworthy for its upcoming quarterly release.

Image Source: Zacks Investment Research

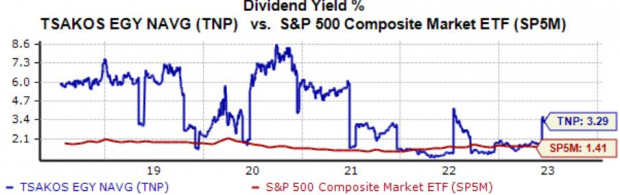

In addition, TNP shares could interest income-focused investors; shares currently yield a solid 3.3% annually with a sustainable payout ratio sitting at 3% of the company’s earnings.

Image Source: Zacks Investment Research

Shares aren’t stretched in regards to valuation, given the company’s forecasted growth, with the current 1.9X forward earnings multiple sitting in line with the five-year median. Impressively, the company is forecasted to post 56% EPS growth on 21% higher revenues in its current fiscal year (FY23).

Blue Bird

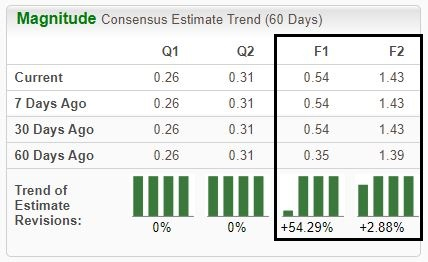

Blue Bird, a Zacks Rank #3 (Hold), is engaged in the designing, engineering, manufacturing, and sale of school buses and related parts. Analysts have taken their earnings expectations higher for the company’s current and next fiscal year over the last several months.

Image Source: Zacks Investment Research

Blue Bird bounced back in its latest release, exceeding the Zacks Consensus EPS estimate by a sizable 170% and delivering a 25% revenue surprise. Below is a chart illustrating the company’s revenue on a quarterly basis.

Image Source: Zacks Investment Research

Like BJRI, keep an eye out for the company’s next quarterly release on Aug. 9, as the Zacks Consensus Estimate of $0.26 per share suggests nearly 400% EPS growth from the year-ago quarter.

And to top it off, the company sports a rock-solid growth trajectory, forecasted to witness 150% EPS growth in its current fiscal year (FY23) and an additional 165% in FY24. Revenue growth is also apparent, forecasted to climb 40% in FY23 and a further 10% in FY24.

Bottom Line

For those who can handle a higher level of volatility and have a less conservative approach, small-cap stocks could be solid considerations. While their price swings can undoubtedly become intimidating, their growth potential is impressive.

And all three discussed above – BJ’s Restaurants (BJRI - Free Report), Tsakos Energy Navigation (TNP - Free Report), and Blue Bird (BLBD - Free Report) – boast strong growth trajectories paired with improved earnings outlooks.

More By This Author:

What's In Store For Abbott Laboratories In Q2 Earnings?Wells Fargo Beats Q2 Earnings And Revenue Estimates

BlackRock Q2 Earnings Surpass Estimates

Disclaimer: Neither Zacks Investment Research, Inc. nor its Information Providers can guarantee the accuracy, completeness, timeliness, or correct sequencing of any of the Information on the Web ...

more