3 Small-Cap Stocks To Buy Before They Surge

Image courtesy of 123rf.com

By the very nature of having a large market cap, big companies have greater access to cash inflows and borrowing capital. In contrast, small market cap stocks, valued up to $2 billion, are more reliant on financing during their growth period.

Now that interest rate cuts are creating looser financial conditions, small-caps should benefit. Per Global X ETFs data, the small-cap Russell 2000 (RUT) index returns 36% on average within 12 months after the last cut of each loosening cycle. Cumulatively, this amounts to 42% over two years.

For comparison, Russell 2000’s average annual returns have been 9% since 1986. Year-to-date, this also aligns with RUT performance of 9.34%. With this historical data in mind, which small-cap stocks represent the greatest surge potential?

The Goodyear Tire & Rubber Company (NASDAQ: GT)

Practically synonymous with quality tires, Goodyear remains the leading tire brand in the US at 10.5% market share followed closely by Michelin. Due to tire demand corresponding with winter and summer seasons, the company’s business is largely seasonal despite the growing all-season tires’ segment.

In the US market increasingly dominated by SUVs, bigger wheel sizes also contribute to boosting Goodyear’s bottom line. The all-season Vector 4Seasons Gen-3 has done particularly well, having earned class A rating in the EU. In financial terms, the results are visible in Goodyear’s Q2 2024 earnings report.

The company earned 173.4% more year-over-year from operating income to $339 million. Although net sales went down by 6.1% YoY to $4.57 billion, the segment operating income (SOI) margin gained 5.4 points to 8.9% YoY. This means that Goodyear achieved higher profitability and exerted greater cost control.

Compared to last year’s net loss of $208 million, the company’s net income was $85 million in the last quarter, representing 140.9% improvement. However, due to lower sales and relatively high debt of $8.47 billion, GT stock is down 41% year-to-date.

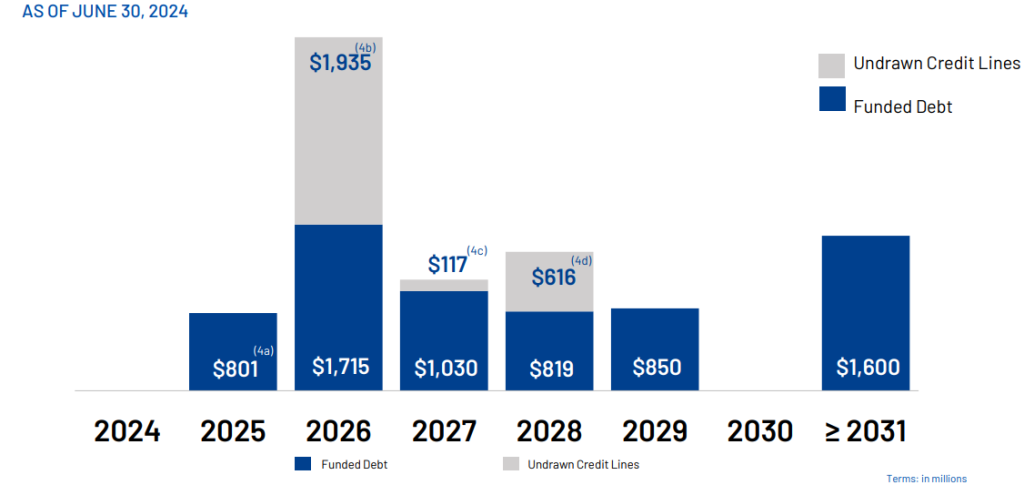

Likewise, Goodyear’s free cash flow is down 14.9% YoY for the first six months of 2024. Nonetheless, with looser financial conditions on the table, the company is well-positioned to restructure its debt, with plenty of undrawn credit lines even before the first rate cut in September took place.

(Click on image to enlarge)

Image credit: Goodyear

Heading into Q1 2025, Goodyear typically sees higher sales due to post-holiday demand and the start of the spring season. Combined with this year’s poor GT performance, this makes for solid GT exposure entry.

Against the 52-week average of $11.95, GT stock is now priced at $8.39 per share. Per Nasdaq forecasting data, the average GT price target is $13.6 with the bottom outlook of $10.2 per share. The high ceiling for GT stock is $17 per share, having the potential for double gains in the next 12 months.

MARA Holdings, Inc. (Nasdaq: MARA)

After the 4th halving in April, Bitcoin’s inflation rate dropped to 0.84%, as 94.12% of Bitcoin’s total supply is already mined. Historically, it takes up to 18 months for Bitcoin to rise to a new all-time high price after each halving.

When that happens, Bitcoin mining companies like MARA Holdings increase their profit margins significantly. At present, MARA holds 14 data centers worth 1,100 MW of compute capacity. In Q2 2024, MARA mined 2,058 BTC, having increased unrestricted cash and cash equivalents and BTC holdings to $1.4 billion.

From the year-ago quarter, MARA doubled its hash rate from 17.7 EH/s to 36.9 EH/s, having invested in facility upgrades and deploying immersion cooling technology in Granbury data center in Texas.

Year-to-date, MARA stock is down nearly 30%, suffering a dip in August after the announcement for $250 million worth of convertible debt issuance. Nonetheless, if MARA materializes 50 EH/s hashrate capacity by the end of 2024, this would make the company the top Bitcoin mining player.

More importantly, investors should ask themselves is it more likely that USG will cut spending or increase spending and monetize debt via the Federal Reserve instead? Regardless of November’s presidential elections, the latter is more likely. And in that scenario, Bitcoin is now more mature than ever to attract new capital inflows, boosting MARA’s bottom line in turn.

Against the 52-week average of $18.07, MARA stock is now priced at $15.99 per share. Per Nasdaq forecasting data, the average MARA price target is $20.5 per share. However, Bitcoin price moves could rapidly shift that forecast even beyond the present high ceiling of $27 per share.

Magnite, Inc. (Nasdaq: MGNI)

Operating as a sell-side advertising platform (SSP), Magnite is highly popular among publishers to monetize available ad space (inventory). The company established its reputation by connecting publishers with ad exchanges where advertisers bid on available ad space, leading to optimal ad price for publishers.

Furthermore, Magnite combines supply-side and demand-side tools to facilitate real-time bidding and yield optimization. Through its unified marketplace, Magnite streamlined the entire process while also partnering with Amazon and Google as shareholders.

Previously known as Rubicon Project, the company merged with Telaria which then became known as Magnite in 2020. The following year, Magnite acquired SpotX to expand into the connected TV (CTV) market as a vehicle to bring ads to streaming.

In the Q2 2024 earnings report, Magnite increased revenue by 7% YoY to $162.9 million, having significantly improved net loss to $1.1 million compared to a net loss of $73.9 million in the year-ago quarter. For the entire fiscal 2024, Magnite expects positive net income and earnings per share (EPS).

From Q3 ‘23 to Q1 ‘24, the company beat EPS estimates by a large margin. Against the 52-week average of $10.73, MGNI stock is now priced close at $11.97 per share. The average MGNI price target is $18.06, with the bottom forecast at $15 per share, making for an opportune entry exposure.

More By This Author:

SMCI Stock Gains As Firm Reports Strong Sales Data For Liquid-Cooled GPU Racks

Starboard Value Reportedly Acquires $1B Stake In Pfizer As Stock Lags S&P 500 By 46%

Everything You Need To Know About Tesla’s Upcoming Robotaxi Event

Disclosure: The author does not hold or have a position in any securities discussed in the article.