3 Quarterly Reports To Watch Next Week

Image Source: Pexels

The Q3 earnings season officially kicked off today with ‘Big Bank Friday,’ with a surplus of companies scheduled to report in the coming weeks. We’ve already received early results from several companies that we’ll include in our Q3 tally, including those from Adobe (ADBE) and Oracle (ORCL), to list a few.

And next week, there are several notable reports investors can’t forget about, including Netflix (NFLX), Tesla (TSLA), and Taiwan Semiconductor Manufacturing (TSM).

But how do expectations stack up for each? Let’s take a closer look.

Netflix

Netflix shares have enjoyed a solid rebound in 2023, up more than 20% and modestly outperforming the S&P 500. The streaming titan will reveal quarterly results on Wednesday, October 18th.

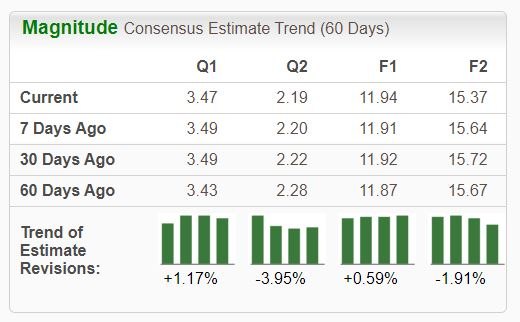

Analysts have shown modest positivity for the quarter to be released over the last several months, with the $3.47 Zacks Consensus EPS Estimate up roughly 1%. Regarding the top line, our $8.5 billion consensus revenue estimate has primarily remained unchanged.

Image Source: Zacks Investment Research

Of course, subscribers are the key metric for NFLX and will be what many focus on. For the quarter, the Zacks Consensus Estimate for Net Subscriber Adds stands at 5.8 million, well above the year-ago figure of 2.4 million. It’s worth noting that the company crushed our consensus estimate regarding the metric in its latest release by more than 250%.

Tesla

Tesla saw negative coverage following the release of its Q3 EV production and deliveries results despite warning investors of a planned factory shutdown in the prior earnings call. TSLA will report on Wednesday, October 18th.

Nonetheless, the EV leader produced over 430,000 vehicles and delivered roughly 435,000 throughout Q3, reflecting a sequential decline. Still, the company’s 2023 volume target of 1.8 million vehicles has remained unchanged, undoubtedly to the likes of investors.

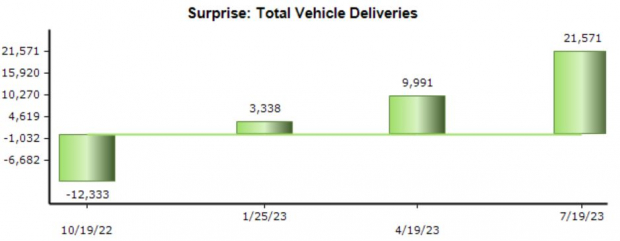

The company has consistently exceeded our consensus delivery expectations, as shown below.

Image Source: Zacks Investment Research

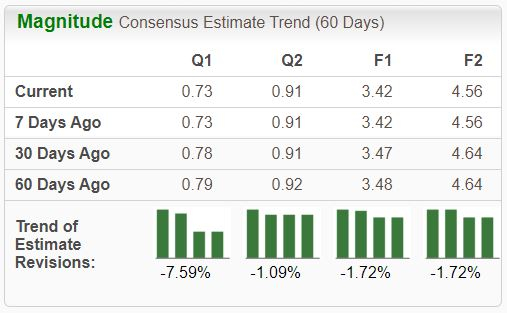

Analysts have taken their quarterly expectations lower for the upcoming release, with the $0.73 Zacks Consensus EPS Estimate down 7.6% and reflecting a pullback of 30% from the year-ago quarter.

Image Source: Zacks Investment Research

Taiwan Semiconductor Manufacturing

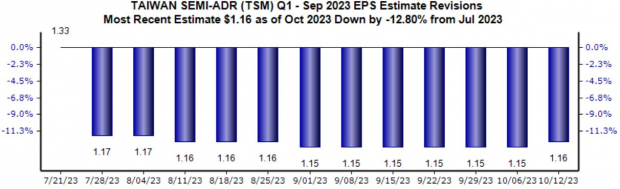

Taiwan Semiconductor is the world’s largest integrated circuit foundry. Analysts have taken their expectations lower for the quarter to be released, with the $1.16 Zacks Consensus EPS Estimate down 13% since July and reflecting a 35% pullback from the year-ago period. TSM reports on Thursday, October 19th.

Image Source: Zacks Investment Research

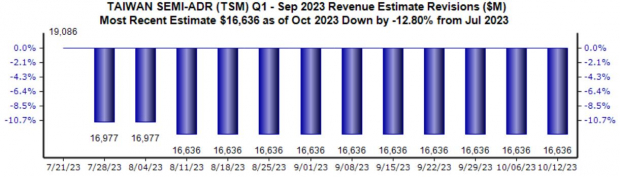

Top line expectations have also moved lower, with our $16.6 billion quarterly revenue consensus estimate down 13% over the same period since the end of July.

Image Source: Zacks Investment Research

And the company has been a consistent earnings performer, exceeding the Zacks Consensus EPS Estimate by an average of 5.5% across its last four releases. In its latest print, TSM penciled in a 6.5% EPS beat and reported revenue 1% ahead of expectations.

Bottom Line

Earnings season will soon shift into a much higher gear, with a surplus of companies preparing to deliver quarterly results in the coming weeks.

And next week, three notable releases to watch out for include Netflix, Tesla, and Taiwan Semiconductor Manufacturing.

More By This Author:

3 Long-Short Mutual Funds To Counter The Market VolatilityBear of the Day - Morgan Stanley

Wells Fargo Beats Q3 Earnings And Revenue Estimates

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any specific ...

more