3 Quarterly Releases To Watch Next Week

Image: Bigstock

The Q3 cycle is on the horizon, with several S&P 500 companies already revealing their quarterly results. For the 8 S&P 500 members that have reported already, total earnings and revenues are up +8% and +0.09% from the same period last year, with 87.5% beating both EPS and revenue estimates. For a detailed view of the upcoming Q3 earnings cycle, I invite you to view our weekly Earnings Trends report - Current Earnings Outlook Reflects Stability.

And next week, several notable companies are slated to report, including Costco (COST - Free Report), Nike (NKE - Free Report), and Carnival Cruise Line (CCL - Free Report). But how do expectations stack up heading into the quarterly releases? Let’s take a closer look at quarterly expectations.

Nike

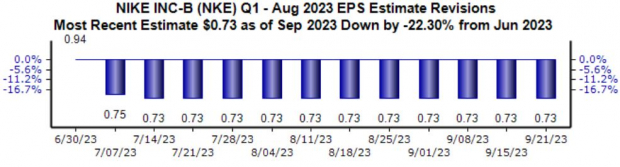

Nike designs, develops, and markets athletic footwear, apparel, equipment, and services for men, women, and children worldwide. The company is expected to reveal quarterly results on Thursday, Sept. 28. Analysts have lowered their earnings expectations for the quarter to be reported, with the $0.73 Zacks Consensus EPS Estimate down 22% since June of this year.

Image Source: Zacks Investment Research

We expect the company to post $12.9 billion in quarterly revenue, 2.2% higher than the year-ago period. Analysts have also taken their top line expectations lower since June, with the current estimate down nearly 4% since.

Image Source: Zacks Investment Research

Costco

Costco Wholesale sells high volumes of foods and general merchandise (including household products and appliances) at discounted prices through membership warehouses. The company’s quarterly release is expected on Tuesday, Sept. 26. Analysts have shown modest positivity for the release, with the $4.71 Zacks Consensus EPS Estimate up roughly 2% since June, reflecting year-over-year growth of 12%.

Image Source: Zacks Investment Research

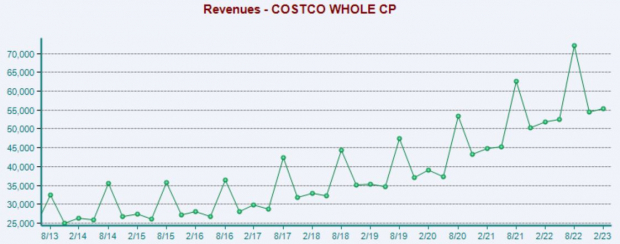

The company is also expected to post revenue growth, with the $78.6 billion consensus estimate 9% higher than year-ago sales of $72.1 billion. The company’s revenue has a history of seasonality but overall remains steady, as shown below.

Image Source: Zacks Investment Research

Carnival Cruise Line

Carnival, a cruise and vacation company, is the world's leading leisure travel firm, carrying nearly half of global cruise guests. The company’s quarterly release is expected to hit the tape on Friday, Sept. 29.

Analysts have left their earnings expectations unchanged since June, with the $0.75 Zacks Consensus EPS Estimate flat since. The value reflects a sizable 230% uptick in earnings, likely reflecting lowered costs.

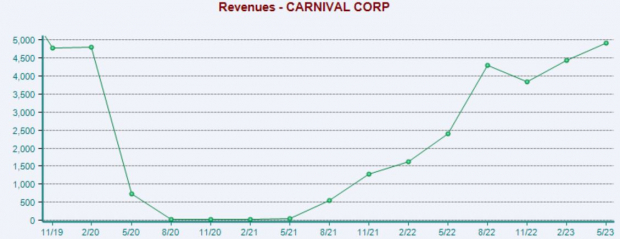

Concerning the top line, the $6.7 billion quarterly revenue estimate has inched 0.5% higher since June, indicating slight positivity. The company’s revenue has recovered nicely from pandemic lows, further illustrated in the chart below.

Image Source: Zacks Investment Research

Bottom Line

The Q3 cycle is just around the corner, undoubtedly an exciting period. So far, we’ve had a few S&P 500 companies reveal quarterly results, although the sample size is too small to draw any conclusions from.

And next week, several notable quarterly releases should catch the attention of investors, including Costco (COST - Free Report), Nike (NKE - Free Report), and Carnival Cruise Line (CCL - Free Report).

More By This Author:

Three Mutual Fund Picks For Your Retirement3 Top-Ranked Tech Stocks To Buy For High Growth

3 Retail Stocks To Buy As The Sector Continues To Grow In 2023

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any specific ...

more