3 Quantum Computing Stocks On Verge Of A Breakout: D-Wave Quantum, IonQ, Quantum Computing

Image: Bigstock

The quantum computing industry has seen a surge of attention in 2025, driven by a wave of technical breakthroughs and a rapid expansion in real-world applications. Once viewed as a far-off moonshot, quantum technology is now making tangible strides, with implications for cybersecurity, drug discovery, AI, and more. As investor interest accelerates, several quantum stocks may be poised for major breakouts.

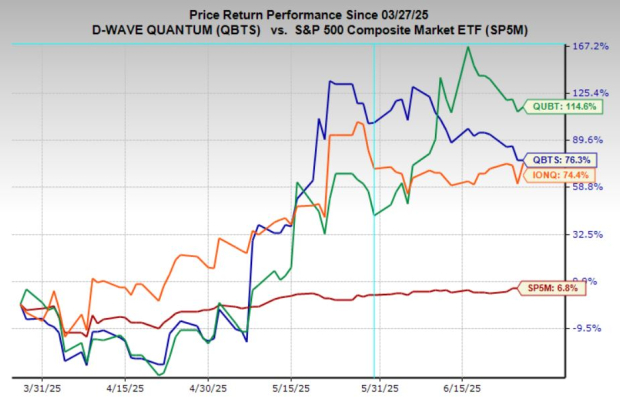

Three quantum stocks in particular stand out: Quantum Computing Inc. (QUBT - Free Report), D-Wave Quantum Inc. (QBTS - Free Report), and IonQ (IONQ - Free Report). Each have been benefiting from strong price momentum and rising earnings estimates, which are key ingredients for breakout potential. On top of that, all three have been forming bullish technical patterns that may suggest the possibility of another major run in the near-term.

Image Source: Zacks Investment Research

D-Wave Quantum: Strongest Stock in the Industry

D-Wave Quantum Inc. has emerged as a clear leader in the quantum computing space, with its stock gaining more than 1,000% since last fall. The company specializes in quantum annealing, a unique approach to quantum computing that is already being applied to real-world optimization problems in logistics, manufacturing, and AI.

Currently holding a Zacks Rank #2 (Buy) rating, D-Wave has been benefiting from a wave of bullish sentiment, as analysts have unanimously raised earnings estimates. While the company remains unprofitable, its top-line growth trajectory is impressive, as sales are expected to surge 183% this year, followed by another 62% increase in 2026.

From a technical perspective, the stock has been forming a bullish descending wedge pattern—a setup often associated with strong breakout potential. If the stock could break through resistance at the $14.70 level, such a move could trigger another explosive push to the upside, reinforcing its position as the momentum leader in the quantum space.

Image Source: TradingView

Quantum Computing Inc.: Stock Showing Relative Strength

Quantum Computing Inc. has emerged as one of the stronger performers in the quantum computing sector over the past three months, signaling growing investor interest and building momentum. The company focuses on delivering affordable and accessible quantum solutions via its full-stack quantum platform, aiming to bridge the gap between quantum and classical computing.

While Quantum Computing currently holds a Zacks Rank #3 (Hold) rating due to a lack of earnings estimate revisions in the past two months, the revenue outlook remains highly encouraging. Though still unprofitable, the company is expected to grow sales by 34% this year and an impressive 200% in 2026, suggesting a potential inflection point in its growth trajectory.

On the technical front, the stock has been forming a tightening bullish flag pattern. If Quantum Computing could break above key resistance at the $18.15 level, it could spark another strong rally and continue its recent streak of relative outperformance in the sector.

Image Source: TradingView

IonQ: Shares Rise on Big Tech Partnerships

IonQ is one of the most well-known names in quantum computing, distinguished by its trapped-ion quantum technology and growing commercial traction. The company has secured strategic partnerships with tech giants like Microsoft Azure and Amazon Web Services, which are integrating IonQ’s quantum capabilities into their cloud platforms. These collaborations not only validate IonQ’s technology, but also provide scalable pathways for adoption.

The stock currently holds a Zacks Rank #2 (Buy) rating, supported by substantial upward revisions to its earnings outlook. Analysts have raised earnings estimates by 43% for the current year and 28% for 2026, which are clear signs of improving sentiment. Though IonQ remains unprofitable, its top-line growth is robust, with revenue expected to climb 97% this year and 57% next year.

From a technical standpoint, the stock has been forming a compressing bull flag pattern, a standard bullish continuation setup. If the stock could break above key resistance at the $41.60 mark, it would likely trigger a move toward new all-time highs, fueled by both momentum and the strength of its big-tech partnerships.

Image Source: TradingView

Should Investors Buy Shares in D-Wave Quantum, IonQ, and Quantum Computing?

Quantum computing may still be in the early stages of commercialization, but investor enthusiasm is building fast, and with good reason. Technical progress is accelerating, enterprise adoption is growing, and Wall Street is beginning to recognize the long-term potential of the companies leading the charge.

Among the emerging players, D-Wave Quantum, IonQ, and Quantum Computing Inc. each offer a unique angle on the quantum revolution, backed by impressive revenue growth forecasts, rising analyst sentiment, and powerful chart setups. While these stocks remain volatile and speculative, they have been showing all the technical and fundamental traits of breakout candidates.

For investors willing to take on higher risk in pursuit of disruptive upside, these three quantum stocks are worth a close look as momentum continues to build in 2025.

More By This Author:

Monitoring The Cape Ratio: Are Stocks Overvalued Or Will The Bull Run Continue?Were Nike's Q4 Results Good Enough To Rebound Its Stock?

Nvidia Regains Its Lost Glory - Should You Buy On The Dip And Hold?

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any ...

more