3 Must-See Earnings Reports Next Week (Alphabet, Meta, Apple)

Image: Bigstock

Next week, three of the biggest names in tech are set to report earnings, and investors will be watching closely. Alphabet (GOOGL - Free Report), Meta Platforms (META - Free Report), and Apple (AAPL - Free Report) remain stalwarts of this market, and their quarterly earning reports not only affect their stock prices, but also the broader market.

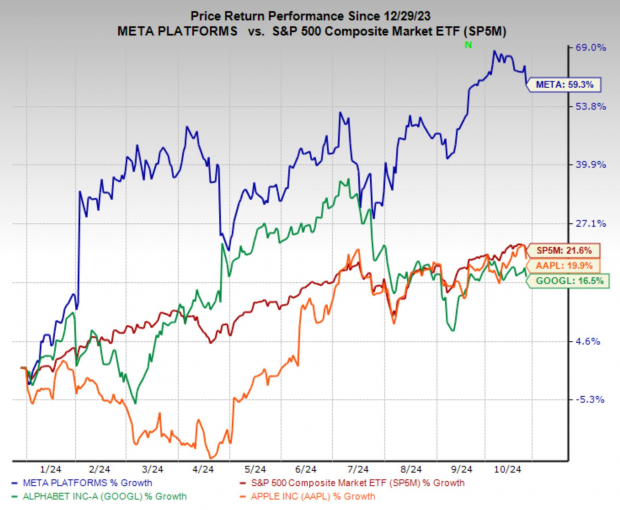

During this year we have seen an interesting divergence in performance among these stocks, although even the worst performer, Alphabet, has still put up a decent return. Meta Platforms has been the clear outperformer year-to-date, as it more than tripled the returns of the others, and Apple has slightly underperformed the market.

The near-term outlooks for these companies are also varied, although frankly, their business supremacy is still evident, and the long-term outlooks are still very bright in my opinion. Let’s dive deeper into the details below.

Image Source: Zacks Investment Research

Meta Platforms: Strong Outlook for the Stock

Meta Platforms has been one of the best performing stocks in the market since the 2022 bear market. In terms of large-cap stocks, only Nvidia has been better. Over the last two years, Meta's stock has rallied an incredible 346%. But that strong performance shouldn’t shake investors’ confidence, because it seems likely that the stock will continue to perform well.

Meta Platforms enjoys numerous bullish catalysts that should make the stock a must watch. Currently, it enjoys a Zacks Rank #2 (Buy) rating, reflecting upward trending earnings revisions, and it has a Zacks Earnings ESP of 2.83%. Earnings are forecast to grow at an impressive 19.15% annually over the next three to five years, while the company also has a reasonable valuation of 26.5x forward earnings, just above the market average.

Looking at Meta's stock chart, I can also see a compelling technical setup. We can see that just a few weeks ago, the stock broke out from a clear bull flag, which sent it to new record highs. Today, there is a very similar pattern building. If the stock can break out above the $580 level, it should send shares again to new highs. However, the market may wait until the earnings report to make the move.

Image Source: TradingView

Alphabet: Cheapest Stock Among the Group

Although Alphabet stock has struggled this year when compared to Apple, Meta, and the broad market, it remains one of the premier assets in the market. Its entrenched business model and growth catalysts, combined with a relatively cheap valuation, make it a must watch stock as well. Alphabet stock also enjoys a Zacks Rank #2 (Buy) rating, indicating upward trending earnings revisions.

The growth catalysts are, I think, very exciting and surprisingly overlooked by most market participants. Self-driving cars is one of the hottest topics out there today, and Alphabet’s Waymo seems to be quietly winning the race. The self-driving technology has already been deployed in several cities across the country, completing some 100,000 rides per week by partnering with Uber Technologies (UBER - Free Report).

It also seems that Waymo’s technology, which uses a suite of sensors rather than cameras, is a superior approach. This approach will also give it a business advantage, as it may be able to be implemented through software rather than having to develop entire vehicles.

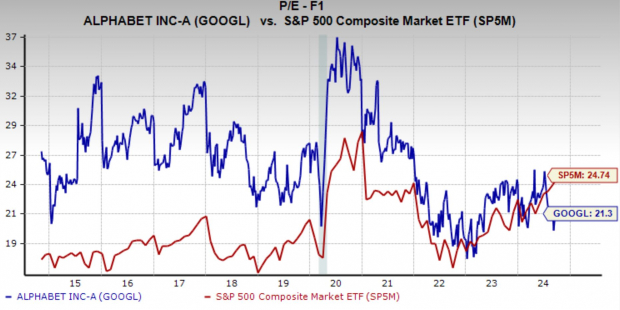

What is crazy to me is that even with these factors, the stock trades at a forward earnings multiple of 21.3x, below the market average and its 10-year median of 25.8x. It also forecasts earnings to grow 17.2% annually over the next three to five years. Finally, its Zacks Earnings ESP is 0.4%, meaning it is expected to beat earnings estimates slightly at the next report.

Image Source: Zacks Investment Research

Apple: Steady Growth, But AI Could Push the Stock Higher

Apple, one of the greatest stocks and companies of the world, has a slightly worse near-term outlook than the other two. It currently has a Zacks Rank #3 (Hold) rating and a worrying Zacks Earnings ESP of -17.7%. It also has the richest valuation at 30.6x forward earnings, and the lowest earnings growth projections, at 12.7% annual growth over the next three to five years.

However, you should never count this stock out. Because Apple’s products are so widely used, its foray into AI may become the most effective and widely used option out there. Apple Intelligence will enhance user experiences in areas like Siri, camera capabilities, health monitoring, and app functionalities, making its devices even smarter and more intuitive. I believe every incremental improvement in its products further increases our reliance on the product, deepens its moat, and improves selling points.

Especially notable is the technical setup in the stock. Although we have seen the price action trade in a sideways and volatile manner over the last four months, it has formed a very large and compelling bull flag. I would not be surprised if Apple surprised investors at its upcoming earnings and blasted higher through the breakout level. However, investors should be cautious here, as we noted the risks which could easily send the stock through the support level as well.

Image Source: TradingView

Should Investors Buy Apple, Alphabet, and Meta Shares?

While these tech giants face unique challenges, their long-term growth prospects remain strong.

Meta’s robust earnings growth and favorable technical setup make it an intriguing opportunity, especially if it breaks out above key levels. Alphabet stands out for its relatively low valuation and the potential of Waymo’s self-driving technology to drive future growth. Apple, despite near-term concerns, could see upside if its AI initiatives boost user engagement and enhance product capabilities.

It is always hard to say if investors should buy a stock before earnings, because the results are difficult to predict and the stocks can be extremely volatile. Nonetheless, each of these stocks may offer compelling, long-term opportunities and can fit into nearly any investor's portfolio.

More By This Author:

Top Airline Stocks To Buy After Q3 Earnings: AAL & LUVINTC Stock Before Q3 Earnings Release: To Buy Or Not To Buy?

American Airlines Surpasses Q3 Earnings And Revenue Estimates

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any specific ...

more