3 Mobile Tech Stocks Eating Apple’s Lunch

Apple may be falling on harder times, and the technology goliath is feeling the pressure from these three fast-moving and nimble companies coming to eat up their market share and profits.

After years of leading the mobile technology revolution and helping pace large cap stocks to new highs, Apple (NASDAQ: AAPL) seems to have hit a wall. As if the Apple Watch failure wasn’t enough of a business and media flop, word that the iPhone 6s production has been cut and demand may be slipping has prompted a $100 billion reduction in the company’s market value.

Nonetheless, the Apple problems are not necessarily indicative of the growth in all mobile communications segments. In fact, many are thriving by attaining leadership status in valuable, niche segments of the industry. I have identified 3 stocks that appear primed for solid growth this year and beyond despite demand slippage that Apple mobile devices and the company are experiencing across the globe.

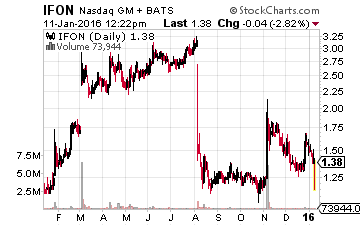

Infosonics Corp. (NASDAQ: IFON)

Known for its verykool brand, Infosonics is a U.S.-based manufacturer and provider of wireless handsets, tablets, and related products to carriers, distributors, and consumers in the United States and Latin America. The verykool portfolio runs the gamut from basic feature phones to sleek and sophisticated smartphones.

Revenue growth is on fire of late with sales jumping 50% to $12.2 million in the third quarter of 2015 as compared to $8.1 million in the same period last year. Plus, Infosonics recorded an operating loss of less than $100,000, indicating operating profits are in the offing as sales continue to rise.

In my view, the company’s popular product lineup and the December 2015 introduction of a new Android 4G LTE product line, Maverick, should drive continued interest from its big box retailer customers and end users alike. My target price of $3.50 reflects 1x expected revenue for the 2015 calendar year, which is a typical valuation afforded microcap consumer technology providers like Infosonics that have no long-term debt and are on the cusp of achieving profitability.

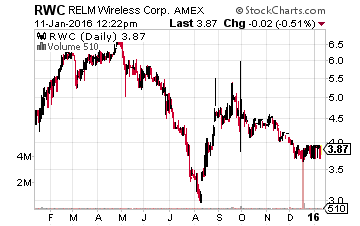

RELM Wireless Corp. (NYSE MKT: RWC)

Tracing its roots back more than 70 years, RELM Wireless produces high‑end, high-value, two‑way communications equipment for use by public safety professionals and government agencies, as well as radios for use in a wide range of commercial and industrial applications. A technology pioneer, the company was just awarded a major $26 million order from the Transportation Security Administration (TSA), along with a $2 million order from the State of Oregon, with shipments for both deals slated to commence in the first quarter of 2016.

The company has no long-term debt, is flush with cash, and has operated profitably for the past several quarters. Plus, RELM owns nearly $4 million worth of Iteris (NYSE MKT: ITI) and will likely recognize a gain in the near term of several hundred thousand dollars via the sale of this stock, which would be a nice bonus for shareholders. Although government business tends to be uneven, RELM’s visibility and financial position are solid. My target price of $6 reflects 25x my targeted EPS estimate of $0.25 for 2016, which includes new government wins and a prospective capital gain generated via the sale of its investment in Iteris.

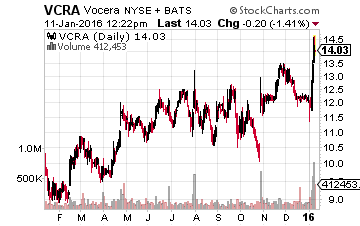

Vocera Communications Inc. (NYSE MKT: VCRA)

Vocera Communications

Vocera Communications

is a leading healthcare communications company that provides enterprise-class communication solutions that help care teams collaborate more efficiently by delivering key information on the right devices, to improve outcomes. Vocera solutions are installed in more than 1,300 organizations worldwide.

The company recently raised its revenue guidance for 2015 and Wall Street consensus forecasts call for $102 million and $111 million in sales for 2015 and 2016, respectively. Plus, Vocera also announced its largest booking and backlog to date. Add in the fact that the company has beaten the Wall Street consensus loss per share estimates for the past four quarters and confidence in future growth becomes high. My target price for these shares is $18 which represents 5x 2016 forecasted sales of $111 million and is the high end of the traditional price/revenue range for companies of this size and standing.

Disclosure: You could collect an average of $3,268 in extra monthly cash with ...

more