3 Medical Stocks Displaying Remarkable Relative Strength In 2022

Image Source: Pexels

It’s been a historically volatile market, with a hawkish Federal Reserve and geopolitical issues spoiling the fun for stocks all year.

However, there have been a fair number of stocks in 2022 displaying remarkable relative strength year-to-date.

Relative strength focuses on stocks or other assets that have performed well relative to the market as a whole or a relevant benchmark.

Three stocks from the Zacks Medical Sector – UnitedHealth Group Inc. (UNH - Free Report), McKesson Corp. (MCK - Free Report), and AstraZeneca PLC (AZN - Free Report) – have displayed a substantial amount of relative strength year-to-date, as we can see in the chart below.

Image Source: Zacks Investment Research

Let’s take a deeper dive into each one.

UnitedHealth Group Inc. (UNH)

UnitedHealth provides a wide range of healthcare products and services, such as health maintenance organizations (HMOs), point of service plans (POS), preferred provider organizations (PPOs), and managed fee-for-service programs.

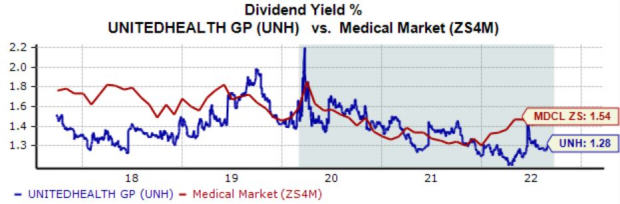

UNH has shown a commendable commitment to its shareholders – UnitedHealth has upped its dividend payout five times over the last five years with a five-year annualized dividend growth rate of a substantial 17.6%.

The company’s 1.3% annual yield is just slightly lower than its Zacks Sector average of 1.5%.

Image Source: Zacks Investment Research

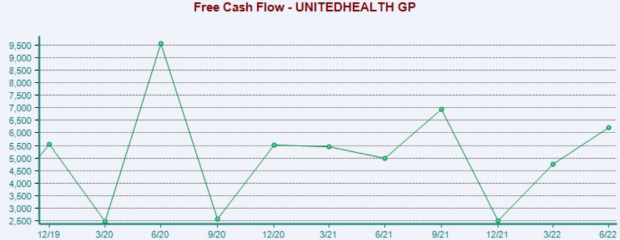

Further, the company knows how to generate serious cash – UNH’s free cash flow came in at a sizable $6.2 billion in its latest quarter, penciling in a double-digit 30% sequential increase and a 25% Y/Y uptick.

Image Source: Zacks Investment Research

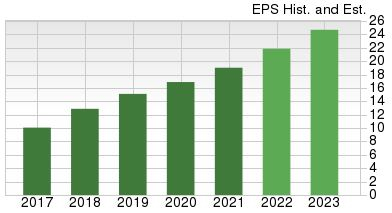

To top it off, UnitedHealth carries a notably strong growth profile – earnings are forecasted to soar 15% in FY22 and an additional 13% in FY23.

Image Source: Zacks Investment Research

McKesson Corp. (MCK)

McKesson Corp. is a healthcare services and information technology company operating through two segments: Distribution Solutions and Technology Solutions.

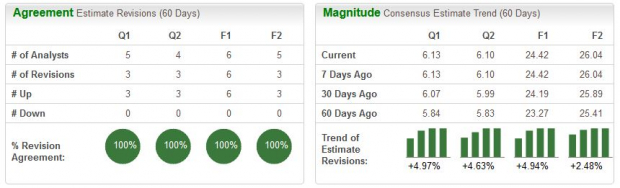

MCK’s near-term earnings outlook has turned notably bright over the last several months, helping land the stock into a favorable Zacks Rank #2 (Buy).

Image Source: Zacks Investment Research

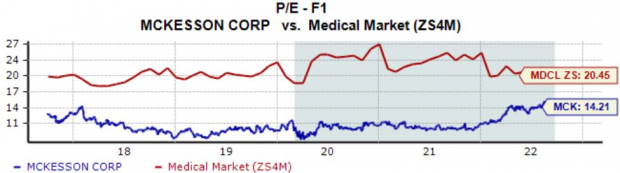

In addition, the company carries favorable valuation characteristics, further bolstered by its Value Style Score of an A.

McKesson’s forward earnings multiple sits at 14.2X, representing an enticing 31% discount relative to its Zacks Medical Sector.

Image Source: Zacks Investment Research

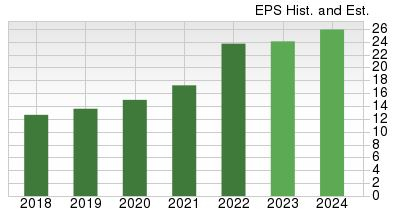

Like UNH, McKesson’s growth profile is notable; the Zacks Consensus EPS Estimate for the company’s current fiscal year (FY23) resides at $24.42, penciling in Y/Y bottom line growth of more than 3%.

And in FY24, earnings are forecasted to climb a further 7%.

Image Source: Zacks Investment Research

AstraZeneca PLC (AZN)

AstraZeneca is one of the largest biopharmaceutical companies in the world. Its business can be broken down into separate lines based on therapeutic classes, including cardiovascular, respiratory, immunology, oncology, rare diseases, and others.

For those seeking an income stream, AstraZeneca has that covered; the company’s annual dividend yields 1.6%, paired with a sizable 6.6% five-year annualized dividend growth rate.

Undoubtedly a positive, the company has upped its dividend payout five times over the last five years.

Image Source: Zacks Investment Research

AZN currently carries a 17.1X forward earnings multiple, nicely beneath its 22.3X five-year median and reflecting a sizable 17% discount relative to its Zacks Sector.

Further, AstraZeneca carries a Style Score of a B for Value.

Image Source: Zacks Investment Research

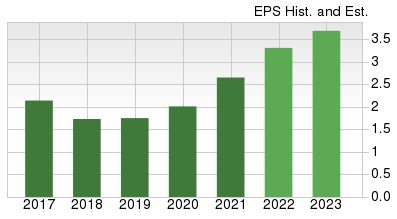

Perhaps the biggest highlight of all is the company’s forecasted growth – for AZN’s current fiscal year (FY22), the Zacks Consensus EPS Estimate of $3.31 pencils in a stellar 25% Y/Y uptick in earnings.

And in FY23, the company’s bottom line looks to expand a further double-digit by 11.4%.

Image Source: Zacks Investment Research

Bottom Line

While the market’s price action has undoubtedly been disheartening in 2022, some stocks are still weathering the storm better than most.

All three stocks above have widely outperformed the S&P 500 in 2022, telling us that market participants have defended shares at a much higher level than others.

More By This Author:

Strength Seen in Lilly (LLY): Can Its 4.9% Jump Turn into More Strength?

Netflix Gains As Market Dips: What You Should Know

3 Bank Stocks With Recently Announced Dividend Hikes To Watch

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any specific ...

more