3 Manufacturing Stocks Benefiting From Supply-Chain Shifts Into 2026

Image: Bigstock

Key Takeaways

- Caterpillar is expanding US facilities and diversifying suppliers to reduce global supply-chain risks.

- EnerSys is shifting production to the US to cut tariff exposure and improve resilience.

- Honeywell International is using dual sourcing and local materials to stabilize supply and support deliveries.

The global supply chain is expected to change significantly in 2026. The year 2025 was marked by ongoing geopolitical tensions, shifting regulations, and rising cost pressures that disrupted international trade and increased uncertainty for businesses worldwide.

The Trump administration sharply increased tariffs on steel, aluminum, and industrial imports. These measures were aimed at encouraging domestic production. However, they also raised production costs and disrupted supply chains for many companies. Also, as labor costs are usually higher in domestic markets, it has been increasing overall production costs.

As businesses head into 2026, many manufacturing companies are assessing their sourcing and production strategies with a stronger focus on domestic manufacturing, technological advancement, and building more resilient supply-chain networks. This strategic shift is driving increased investment in US-based facilities, productivity-enhancing technologies, and regional suppliers.

As a result, industrial manufacturing companies with strong domestic operations, reliable supply chains, and essential product offerings are well-positioned to benefit from these evolving market trends.

Amid such a scenario, the following three manufacturing stocks stand out as potential opportunities. Caterpillar Inc. (CAT - Free Report), EnerSys (ENS - Free Report), and Honeywell International Inc. (HON - Free Report) are well-positioned for potential gains from supply-chain diversification into 2026.

3 Manufacturing Stocks Worth A Look

Presented below is a brief rundown of the previously-mentioned stocks to consider.

Caterpillar

Based in Irving, TX, Caterpillar is the largest global construction and mining equipment manufacturer. The company offers products and services to several sectors, including infrastructure, construction, mining, oil & gas, and transportation.

Caterpillar is diversifying its supply chain by building a strong, reliable, and flexible network of suppliers while reducing its dependence on a limited number of suppliers. The company has been working closely with suppliers through regular engagement programs, safety and quality councils, and recognition initiatives, which helps ensure steady access to important components and advanced materials needed for manufacturing products.

Caterpillar is also following responsible sourcing practices through its Supplier Code of Conduct and conflict minerals policies, which are helping it manage ethical, legal, and geopolitical risks while expanding where materials are sourced from. The company is focusing on supplier diversity, increasing business with diverse and minority-owned suppliers through partnerships, which expand its supplier base.

Alongside these efforts, Caterpillar is strengthening regional production by expanding its operations in the United States, including new facilities in the Dallas-Fort Worth (DFW) area and major investments in Indiana to build workforce skills and increase engine production. Together, these actions are helping to localize production, secure skilled labor, improve transparency, and reduce exposure to global supply-chain risks.

This Zacks Rank #2 (Buy) rated stock has surged 54.6% in the past year. The company outpaced estimates in two of the trailing four quarters and missed the mark in the other two, with the average earnings surprise being 2.1%. The Zacks Consensus Estimate for its 2025 earnings has been revised 3.5% upward over the past 60 days.

Image Source: Zacks Investment Research

EnerSys

Headquartered in Pennsylvania, EnerSys engages in the manufacturing, marketing, and distribution of various industrial batteries. The company also develops battery chargers and accessories, power equipment, and outdoor cabinet enclosures. Apart from this, it provides support services for clients.

EnerSys is actively pursuing supply-chain diversification through relocation and operational strategies. The company is realigning its manufacturing footprint by closing its flooded lead-acid battery plant in Monterrey, Mexico, and shifting production to its Richmond, KY facility, thereby reducing its dependency on foreign supply chains, lowering tariffs, and international exposure.

EnerSys also emphasizes supplier diversification, engaging minority and veteran-owned suppliers and implementing sustainability and ESG surveys to broaden its supplier ecosystem and strengthen resilience. Additionally, the company is reorganizing operations into technology-focused Centers of Excellence, which enhances agility, enables product-specific sourcing, and supports multi-region production strategies. These initiatives are expected to enhance EnerSys’ supply-chain resilience, risk management, and long-term operational flexibility.

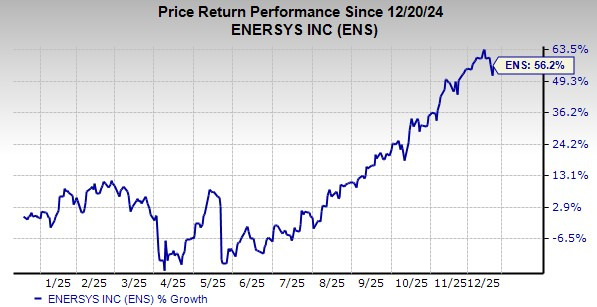

This Zacks Rank #2 (Buy) rated company’s earnings surpassed the Zacks Consensus Estimate in each of the trailing four quarters, with the average surprise being 4.9%. The Zacks Consensus Estimate for fiscal 2026 (ending March 2026) earnings has been revised 5.3% upward over the past 60 days. Shares of the stock have surged 56.2% in the past year.

Image Source: Zacks Investment Research

Honeywell

Based in Charlotte, NC, Honeywell is a global diversified technology and manufacturing company with a wide range of products and services. Its diversified portfolio of solutions serves customers globally with aerospace products and services, energy-efficient products and solutions for businesses, as well as technology, electronic, and specialty chemicals.

Honeywell is diversifying its supply chain by reducing dependence on single suppliers, regions, or materials in response to global conflicts, tariffs, labor disruptions, and regulatory pressures. The company is simplifying its operations by sourcing more materials locally and implementing dual-sourcing strategies to ensure the continued supply of critical components and raw materials.

Honeywell works closely with both primary and secondary suppliers, proactively manages raw material shortages, and identifies new suppliers when necessary. In some cases, the company also redesigns products to accommodate alternative raw material sources without compromising quality. To further support supplier stability, Honeywell has been offering a supply-chain financing (SCF) program, allowing suppliers to access early payments through third-party financial institutions.

These diversification efforts are helping the company to reduce supply risk, stabilize pricing, support new product development, and ensure reliable product delivery to customers. By combining operational strategies with financial support tools, Honeywell is building a more flexible and robust global supply chain capable of adapting to evolving market challenges.

Although shares of this Zacks Rank #3 (Hold) rated company lost 13.2% in the past year, they rebounded 5.3% in the past month. Honeywell outpaced estimates in each of the trailing four quarters, with the average earnings surprise being 8.7%. The Zacks Consensus Estimate for 2025 earnings has been revised 1.4% upward over the past 60 days.

Image Source: Zacks Investment Research

More By This Author:

3 Stocks To Watch Near All-Time Highs: COF, MAR, TSLA3 Large-Cap Blend Mutual Funds To Buy Ahead Of 2026

3 Stocks From The Transport Equipment & Leasing Industry To Watch

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any ...

more