3 Low-Beta Stocks To Buy For Technology Exposure

Image Source: Unsplash

The technology sector has been a favorite among investors, providing explosive gains. Of course, many are aware of the sector’s increased volatility.

However, targeting low-beta technology stocks could be a great solution for investors wanting to blend in an added layer of defense.

Three low-beta technology stocks – Dell Technologies (DELL), NetEase (NTES), and Check Point Software Technologies (CHKP) – could all be considered.

Let’s take a closer look at each one.

Dell Technologies

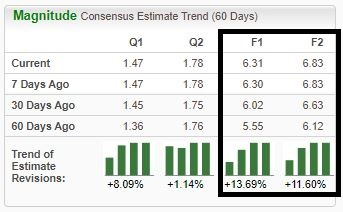

Dell Technologies, a current Zacks Rank #1 (Strong Buy), provides information technology solutions. Analysts have raised their expectations among all timeframes, with the revisions trends particularly notable for its current and next fiscal years.

Image Source: Zacks Investment Research

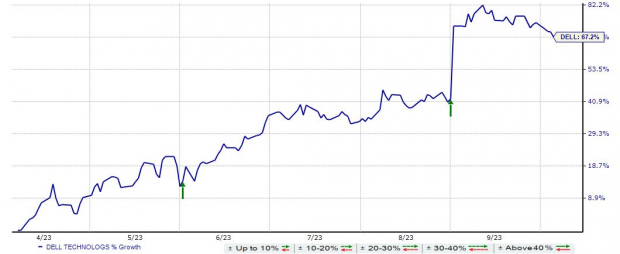

The company has consistently exceeded quarterly expectations as of late, beating the Zacks Consensus EPS Estimate by an average of 40% across its last four releases. Just in its latest release, DELL posted a 54% EPS beat and reported revenue 10% ahead of expectations.

The market has reacted favorably following back-to-back releases, as shown below.

Image Source: Zacks Investment Research

NetEase

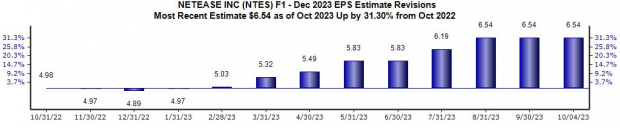

NetEase, a current Zacks Rank #1 (Strong Buy), is an Internet technology company engaged in the development of applications, services, and other technologies for the Internet in China.

Analysts have taken their earnings expectations higher across nearly all timeframes, with the trend particularly notable for its current fiscal year.

Image Source: Zacks Investment Research

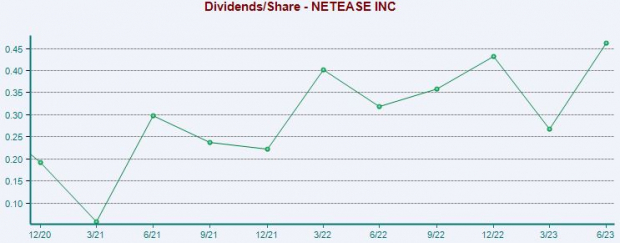

Shares could also interest those with a preference for income, currently yielding a solid 2.1% annually. As shown below, the company’s payout has grown nicely over the recent years, sporting a 26% five-year annualized dividend growth rate.

Image Source: Zacks Investment Research

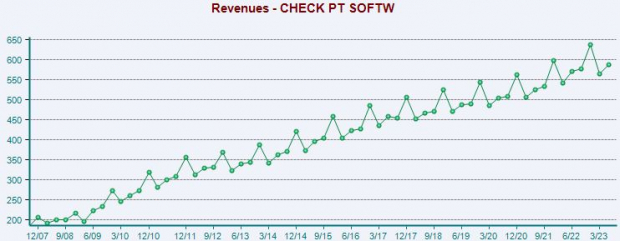

Check Point Software Technologies

Check Point Software Technologies is a well-known provider of information technology (IT) security solutions worldwide. Like those above, the stock has enjoyed positive earnings estimate revisions, landing it into a favorable Zacks Rank #2 (Buy).

Value-focused investors could be interested; CHKP shares currently trade at a 15.3X forward 12-month earnings multiple, below the 19.2X five-year median and the respective Zacks industry average. Over the last five years, shares have traded as high as 23.5X.

In addition, Check Point Software carries a solid growth profile, with earnings expected to expand more than 10% on 4% higher revenues in its current year. The company’s revenue has remained highly consistent, as we can see illustrated in the chart below.

Image Source: Zacks Investment Research

Bottom Line

Targeting low-beta stocks can help shield investors against volatility, as these stocks are less susceptible to the market’s movements.

For those who seek exposure to tech, all three low-beta stocks above – Dell Technologies, NetEase, and Check Point Software Technologies – fit the criteria.

In addition, all three have seen their earnings estimates drift higher as of late, indicating favorable optimism among analysts.

More By This Author:

Paypal Suffers A Larger Drop Than The General Market: Key InsightsBear Of The Day - Dollar General

5 Balanced Mutual Funds To Buy Amid Market Meltdown

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any specific ...

more