3 Key Quarterly Releases To Watch Next Week

Image Source: Pexels

Earnings season is always an exciting time for investors, with companies finally revealing what’s transpired behind closed doors.

As usual, the big banks shifted the cycle into a much higher gear, with many other companies scheduled to follow suit.

Concerning next week’s docket, three notable companies reporting quarterly results include PayPal (PYPL - Free Report), Amazon (AMZN - Free Report), and Advanced Micro Devices (AMD - Free Report).

But how do headline expectations stack up heading into the releases? Let’s take a closer look.

PayPal

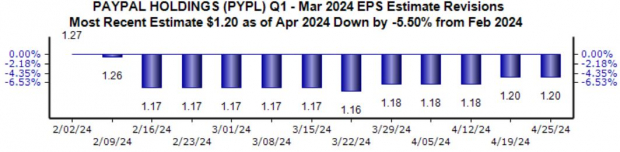

PayPal shares have primarily tracked the S&P 500 in 2024, gaining 7.2% compared to a 6.7% gain. Analysts' revisions for the upcoming release have moved higher over the last few weeks, with the current $1.20 Zacks Consensus EPS estimate suggesting a 2.5% climb year-over-year.

Image Source: Zacks Investment Research

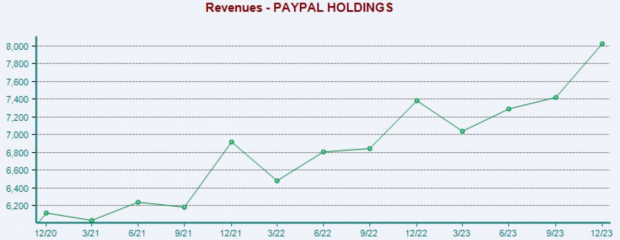

Top-line expectations haven’t budged much, with the $7.4 billion consensus estimate reflecting a 6.6% jump from the year-ago period. The company’s revenue has remained on a consistent trajectory, as we can see illustrated below.

Image Source: Zacks Investment Research

Amazon

Analysts have been notably bullish for Amazon’s upcoming release, with the $0.82 Zacks Consensus EPS estimate up 15% since February and suggesting 160% growth year-over-year. Operational efficiencies have aided the company’s profitability in a big way, helping explain the outsized growth.

Image Source: Zacks Investment Research

Revenue revisions have remained flat, with the $142.5 billion expected suggesting a 12% jump from the year-ago period. The company’s revenue has seen an acceleration over the last few quarters, further illustrated below.

Image Source: Zacks Investment Research

Advanced Micro Devices

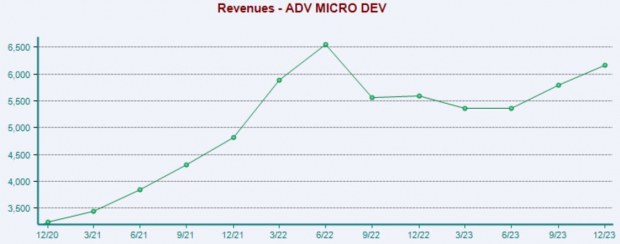

Analysts haven’t been bullish on AMD’s quarter to be reported, with the $0.60 Zacks Consensus EPS estimate down 9% since February and flat compared to the year-ago period.

Top-line revisions haven’t been as harsh, down a modest 1% to $5.4 billion over the same timeframe. Below is a chart illustrating the company’s revenue on a quarterly basis.

Image Source: Zacks Investment Research

Bottom Line

Earnings season is always an exciting time for investors, with companies finally telling us what’s transpired behind closed doors.

And next week, several notable companies -- PayPal, Amazon, and Advanced Micro Devices – are on the reporting docket.

Video Length: 00:01:02

More By This Author:

These 3 Companies Could Positively Surprise InvestorsAirliner Earnings: What Can Investors Expect?

3 Buy-Rated Stocks Fit For Value Investors