3 Key Quarterly Releases To Watch Next Week

Image: Bigstock

The Q3 earnings cycle will shift into a higher gear next week, with several companies scheduled to reveal quarterly results leading up to ‘Big Bank Friday.’ It’ll be another critical cycle, particularly as the market tries to extend impressive year-to-date gains.

Outside of the big banks, notable companies scheduled to unveil quarterly releases next week include PepsiCo (PEP - Free Report), Delta Air Lines (DAL - Free Report), and UnitedHealth Group (UNH - Free Report). Let’s take a deeper dive into what’s expected out of each.

PepsiCo

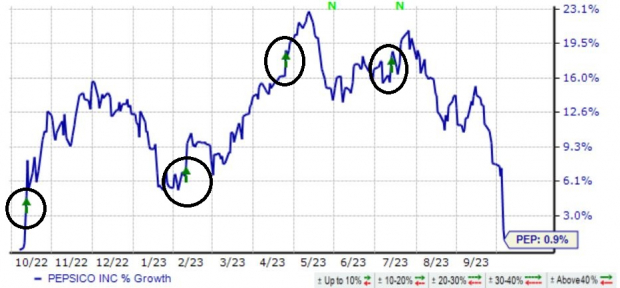

PEP shares have faced adverse price action over the last several months following an impressive start to 2023, down roughly 13% during the period. Analysts have primarily kept their earnings expectations unchanged for the upcoming release, with the $2.17 Zacks Consensus EPS Estimate down just a penny over the last several months.

The consumer staples giant regularly beats quarterly expectations, exceeding both Zacks Consensus earnings and revenue estimates in six consecutive releases. As shown below, shares have seen a boost post-earnings following several recent releases.

Image Source: Zacks Investment Research

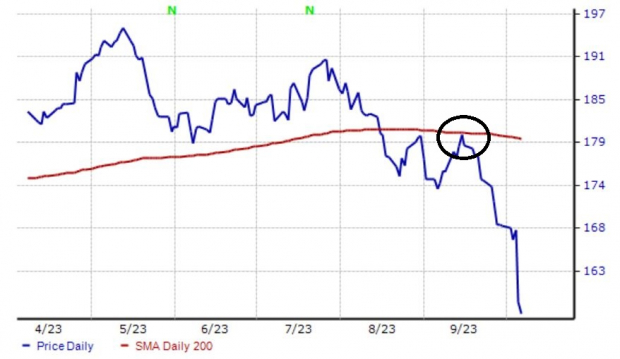

Still, negative sentiment has taken hold of near-term price action, with shares recently being rejected at the 200-day moving average and heading lower.

Image Source: Zacks Investment Research

It’s worth noting that the company upped its FY23 view following its latest quarterly print, citing continued strong business momentum. Our consensus quarterly revenue estimate for PEP stands at $23.4 billion, 6% higher than the year-ago figure.

Image Source: Zacks Investment Research

PepsiCo, a current Zacks Rank #4 (Sell), will report on Tuesday, Oct. 10, before the market’s open.

Delta Air Lines

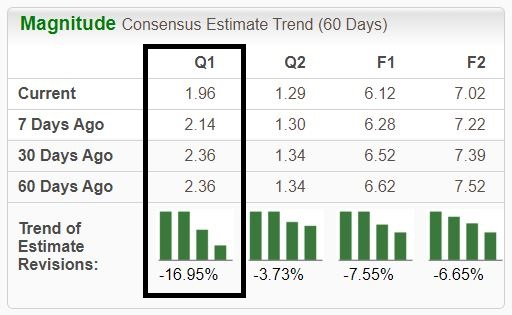

Delta Air Lines shares have traded somewhat similarly to PEP over the last three months, facing adverse price action following a melt-up during early summer. Analysts moved their expectations lower following a filing on Sept. 14, with the $1.96 Zacks Consensus EPS Estimate down 17% over the last several months.

Image Source: Zacks Investment Research

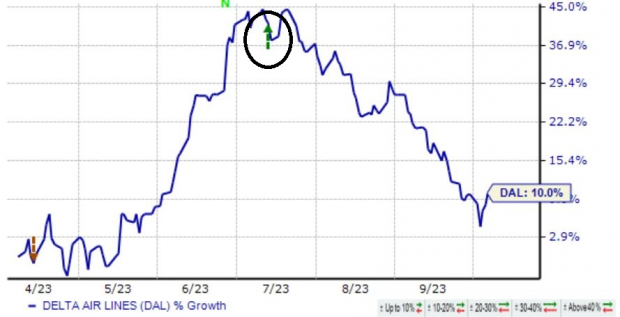

DAL shares sold off following its latest release despite posting record quarterly revenue and profitability, likely a reflection of profit-taking following the above-mentioned summer melt-up.

Image Source: Zacks Investment Research

Rising fuel costs throughout the period undoubtedly impacted DAL’s quarter to be released. As mentioned above, in September, the company updated previous guidance given in the latest earnings call, now expecting fuel prices of $2.75-$2.90 per gallon ($2.50-$2.70 per gallon previously). Our consensus estimate for average fuel price per gallon presently sits at $2.88, 14% higher than $2.52 per gallon in 2023 Q2.

Delta Air Lines, a current Zacks Rank #5 (Strong Sell), will report on Thursday, Oct. 12, before the market’s open.

UnitedHealth Group

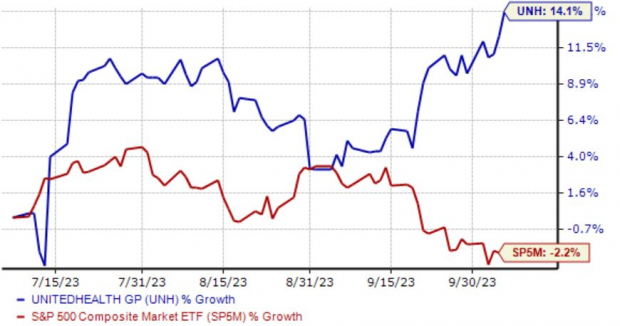

Unlike those above, UNH shares have seen favorable action over the last several months, tacking on 14% in value and outperforming the general market. Analysts have taken their expectations modestly lower for the quarter to be released, with the Zacks Consensus EPS Estimate down 2% since July.

Image Source: Zacks Investment Research

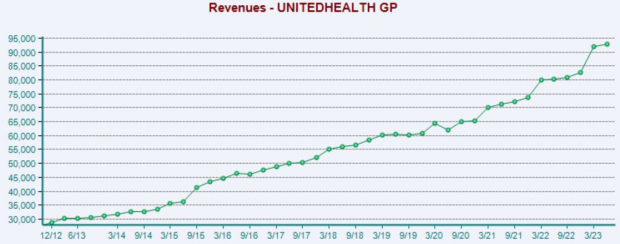

The company posted strong balanced growth in its latest release, with both segments posting double-digit percentage year-over-year growth rates. Regarding expectations, UNH exceeded both Zacks Consensus earnings and revenue forecasts, continuing its consistent nature. And given its first-half performance, UNH upped its full-year adjusted EPS outlook to $24.70-$25.00 per share.

Image Source: Zacks Investment Research

UnitedHealth, a current Zacks Rank #3 (Hold), will report on Friday, Oct. 13, before the market’s open.

Bottom Line

Earnings season is always an exciting time to be an investor, with companies pulling the curtain back and unveiling what’s transpired behind closed doors.

And next week, the quarterly reports will really start rolling in, including those from PepsiCo (PEP - Free Report), Delta Air Lines (DAL - Free Report), and UnitedHealth Group (UNH - Free Report).

More By This Author:

ETFs In Focus As Student Debt Curbs Consumer Spending3 Top-Ranked Stocks Shrugging Off Market Woes

Acquisition Watch: Time To Buy Exxon Mobil Or Pioneer Natural Resources Stock

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any specific ...

more