3 Intriguing Stocks To Watch As Earnings Approach

Image: Bigstock

Many headline names have already reported this earnings season, but there are still some notable stocks that investors will want to watch next week. Here are three stocks that are worthy of consideration ahead of their quarterly reports which may become more attractive as we progress through 2023.

Ciena (CIEN - Free Report)

Ciena Corporation stands out before its fiscal second-quarter earnings on June 6 with a Zacks Rank #2 Buy. Ciena’s Fiber Optics Industry is also in the top 3% of over 250 Zacks industries.

Ciena is well positioned within its strong business industry as a leading optical networking equipment, software, and services provider. While Ciena’s growth hasn’t been overwhelming in recent years, its valuation has become more attractive.

Ciena stock has recently been seen trading at $48.13 a share and 16.7X forward earnings, which is roughly on par with the industry average and nicely beneath the S&P 500’s 19.6X. Plus, Ciena is a leader in its space and trades 71% below its five-year high of 58.3X earnings and at a 28% discount to the median of 23.2X.

Image Source: Zacks Investment Research

Ciena’s Q2 earnings could also start to reconfirm that better days are ahead in terms of growth. Second-quarter earnings are expected at $0.60 per share, which would be up 20% from Q2 2022. Even better, annual earnings are forecasted to climb 48% this year and jump another 28% in FY24 at $3.61 per share.

Casey’s General Stores (CASY - Free Report)

Set to report its fiscal fourth-quarter earnings on June 6, Casey’s General Stores is definitely a company worth watching next week. It currently lands a Zacks Rank #2 (Buy).

Casey’s stock has been on an incredible run over the last few years, as the company has continued its expansion as a retail convenience store leader across the Midwest. With it recently trading at $229.05 a share, there could be better buying opportunities ahead, but the company’s growth in recent years has been monumental.

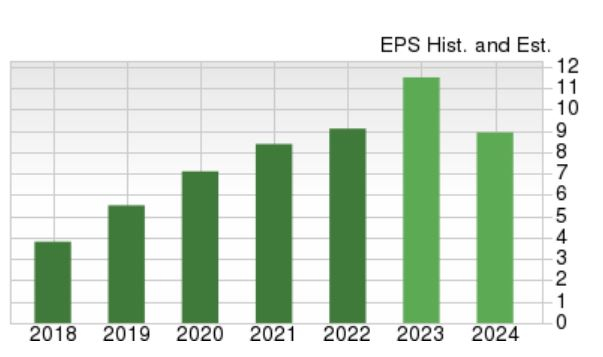

Fourth-quarter earnings are projected to dip -1% from the prior year quarter at $1.58 per share. Still, Casey’s would round out its fiscal 2023 with earnings climbing 28% year-over-year at $11.70 per share compared to EPS of $9.10 in 2022. Fiscal 2024 EPS is forecasted to dip -12% at $10.30 per share after what would be a tough year to follow, but Casey’s bottom line remains robust.

Image Source: Zacks Investment Research

Dave & Buster’s (PLAY - Free Report)

Lastly, set to report its fiscal first-quarter earnings on June 6, Dave & Buster’s results will give a broader look at how entertainment and hospitality companies are faring.

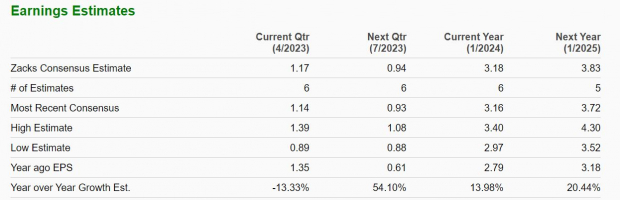

Dave & Buster’s currently lands a Zacks Rank #3 (Hold), with its Retail-Restaurants Industry in Zacks top 18%. The company’s growth remains attractive despite Q1 earnings expected to dip -13% year-over-year at $1.17 per share. With that being said, Dave & Buster’s current fiscal 2024 earnings are still forecasted to rise 14% and jump another 20% in FY25 at $3.83 per share.

With shares of PLAY recently seen trading at $33.42 and still 26% from 52-week highs, Dave & Buster’s anticipated growth is starting to make its stock much more attractive.

Image Source: Zacks Investment Research

Bottom Line

These stocks are very intriguing ahead of their quarterly reports next week, and reaching or exceeding earnings expectations could lead to more upside. This will be more likely if they can offer positive guidance as shares of Ciena, Casey’s, and Dave & Buster’s should continue to be viable investments going forward.

More By This Author:

Ciena To Post Q2 Earnings: Here's What To Expect4 Gold Stocks To Watch In A Promising Industry

Airline Stock Roundup: American Airlines' Bullish Q2 Forecast, Allegiant's Labor Deal & More

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any specific ...

more