3 Hot Tech Stocks To Buy On The Dip: CRWD, MU, WDC

Image Source: Unsplash

The stock market is bouncing back swiftly in Monday morning’s trading session, with President Trump dialing back his threat to impose an additional 100% tariff on Chinese goods.

De-escalating fears of a reemergence in a U.S.-China trade war, President Trump stated that relations with China will be fine, as neither country wants a depression and wants to help the other.

Following the sharp selloff at the end of last week, this rhetoric has calmed investors' jitters, and it may be advantageous to scout the best buy-the-dip targets.

Companies with strategic positions in high-growth tech industries are among the most appealing in this regard, especially with the integration of AI promoting a high-demand environment.

Seeing as a pullback can also serve as a "healthy correction", here are three hot tech stocks that fit this scenario and currently hold spots on the coveted Zacks Rank #1 (Strong Buy) list.

CrowdStrike: An AI Cybersecurity Leader

An ever-evolving technological landscape has led to an increased need for enterprise cybersecurity, and as you can imagine, the ability to combat AI-enhanced hacks can’t be underestimated. On the other hand, AI is helping firms streamline their cybersecurity operations, and CrowdStrike (CRWD - Free Report) has continued to grow in popularity as a leader in next-generation endpoint protection, threat intelligence, and cyberattack response services.

Up nearly +50% year to date, CrowdStrike stock had nearly matched its all-time high of $518 a share in last Friday’s trading session before pulling back with the broader market as trade tensions set in.

Still, the optimism for CRWD shares comes as CrowdStrike’s growth prospects have been lifted by its Falcon platform. As an AI-powered cybersecurity platform, Falcon has become a leading all-in-one solution for enterprise security that allows companies to customize and scale their cybersecurity needs.

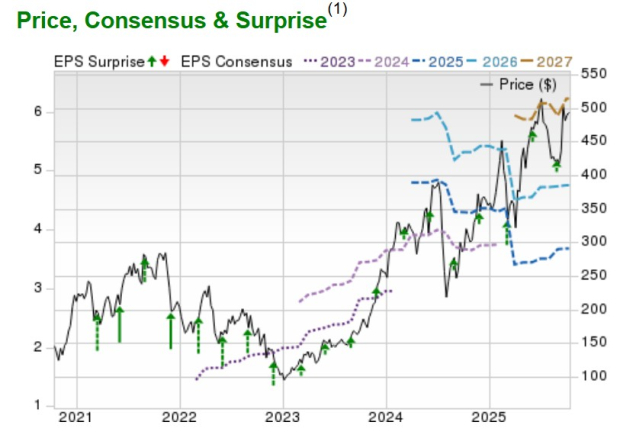

Consistency and strong financial results sum up the continued hype for CrowdStrike stock as the company has exceeded earnings expectations in every quarter since going public in 2019, as partly depicted by the green arrows in the price, consensus, and surprise chart below. Notably, CRWD is now sitting on captivating post IPO gains of more than +600%.

Image Source: Zacks Investment Research

Cloud Storage Leaders

AI data center demand has led to a crucial need for memory and data storage solutions, which has catapulted Micron Technology (MU - Free Report) and Western Digital’s (WDC - Free Report) stock over +100% in 2025.

As two of the top-performing stocks this year, massive growth in AI and cloud infrastructure for data centers has led to soaring demand for Western Digital’s nearline Hard Disk Drives (HDDs) and UltraSMR (Shingled Magnetic Recording) storage solutions, along with Micron’s High-Bandwidth Memory (HBM) chips.

While they don’t compete directly, both are among the top ten solid-state drive providers (SSDs), a type of data storage device that uses flash memory to store information. It’s noteworthy that Western Digital is thought to control the majority of the SSD market share at over 30%.

Furthermore, a fast-tracked leap in earnings estimate revisions (EPS) has been attributed to the blazing stock performances of MU and WDC, with Micron and Western Digital now expected to post double-digit EPS growth for the foreseeable future.

Regarding a buy-the-dip scenario, the trade tensions between the U.S. and China provided what could be a healthy breather with MU and WDC pulling further back from their recent all-time highs of $201 and $137 a share, respectively.

Image Source: Zacks Investment Research

Bottom Line

Investors may have been looking for a pullback in these three hot tech stocks, as CrowdStrike, Micron Technology, and Western Digital stock have rebounded more than +3% on Monday.

Further market volatility could lead to more lucrative buying opportunities as these companies have become crucial to the AI ecosystem. That said, their strong buy ratings are correlated with a positive trend of rising EPS revisions, which supports a bounce back.

More By This Author:

3 Medical Service Industry Stocks Poised To Counter Workforce Issues3 Defensive Stocks To Watch As Trade Tensions Resurface: GILD, JNJ, KR

3 Broadcast Radio & TV Stocks To Buy From A Prospering Industry

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any ...

more