3 Highly Ranked Stocks With Robust Dividend Yields Perfect For Income Investors

Image: Shutterstock

The first half of 2022 was undoubtedly one we would all like to put behind us. Stocks tumbled, and investors felt the pain. The ongoing war in Ukraine, supply chain issues, and a hawkish Fed were all impactful forces driving the poor share performances.

Nobody has a crystal ball that tells us where the market heads next, and investors must react - not predict. During times of overall market weakness, it’s very beneficial for investors to have a stream of income that’ll help offset drawdowns. Investing for income is a popular strategy that many investors utilize.

Three stocks with high dividend yields paired with a strong Zacks Rank include Arbor Realty Trust (ABR - Free Report), Vale SA (VALE - Free Report), and Devon Energy (DVN - Free Report).

Let’s examine these stocks a little closer to see why they would be solid bets for investors looking to add an income stream into their portfolios.

Arbor Realty Trust

Arbor Realty Trust (ABR - Free Report) is a specialized real estate finance company investing in real estate-related bridge and mezzanine loans, preferred equity, mortgage-related securities, and other real estate-related assets.

ABR’s annual dividend yield sits pretty in the double-digits at 11.6%, with a payout ratio sitting at 75% of earnings. What sticks out to me is the company’s commitment to rewarding shareholders – the company has increased its dividend a jaw-dropping 16 times over the last five years and has a five-year annualized dividend growth rate in the double-digits of 15.5%. The yield is much higher than that of the S&P 500.

Image Source: Zacks Investment Research

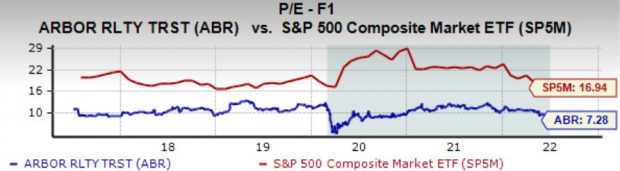

ABR has enticing valuation levels, further displayed by its Style Score of B for Value. Its forward earnings multiple sits nicely at 7.3X, well below highs of 13.3X in 2019 and well below the five-year median of 10.3X. In addition, shares trade at a steep 57% discount relative to the S&P 500.

Image Source: Zacks Investment Research

ABR is a Zacks Rank #2 (Buy).

Devon Energy

Devon Energy Corporation (DVN - Free Report) is an independent energy company primarily engaged in exploring, developing, and producing oil and natural gas. The company’s operations are mainly concentrated in the onshore areas of North America.

DVN thoroughly enjoys rewarding its shareholders; its dividend metrics are robust. The company’s dividend yield is 9.2%, with a payout ratio of 81% of earnings. What sticks out to me is its dividend growth – the company has increased its dividend a whopping ten times in the past five years, giving it a five-year annualized dividend growth rate of nearly 32%.

Image Source: Zacks Investment Research

Devon Energy sports a beautifully low 6.1X forward earnings multiple, nowhere near 2017 highs of 33.5X and well below 2021 highs of 33.5X. Additionally, the value reflects a resounding 64% discount relative to the S&P 500’s forward earnings multiple of 16.9X.

Devon Energy is a Zacks Rank #2 (Buy).

Vale SA

Vale SA (VALE - Free Report) is a mining company that extracts iron, nickel, gold, copper, aluminum, potash, and other precious metals.

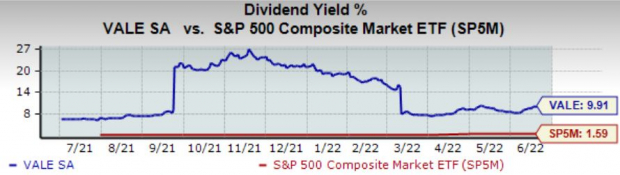

For those looking for an income stream, Vale’s got that covered with its annual dividend yielding 9.9% and its payout ratio sitting at 29% of earnings. Additionally, the miner has increased its dividend six times over the last five years, providing an annualized five-year dividend growth rate of nearly 75%.

Image Source: Zacks Investment Research

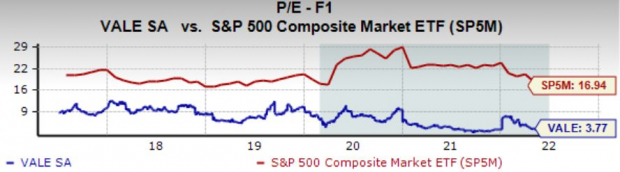

The company sports enticing valuation metrics. Its 3.8X forward earnings multiple is well below 2018 highs of 12.3X and nowhere near its five-year median value of 3.8X. Additionally, shares trade at a steep 78% discount relative to the S&P 500.

Image Source: Zacks Investment Research

Vale is a Zacks Rank #1 (Strong Buy).

Bottom Line

Investing for an income stream is a popular way for investors to balance a portfolio. During times of overall market weakness, income-related stocks provide a reliable cash flow, undoubtedly easing drawdowns.

All three companies above have robust dividend metrics, solid valuation levels, and all carry a high Zacks Rank. These three stocks would be great places to start for investors with an appetite for income.

Disclaimer: Neither Zacks Investment Research, Inc. nor its Information Providers can guarantee the accuracy, completeness, timeliness, or correct sequencing of any of the Information on the Web ...

more